Hannah Sayle checks out a stylin’ young lady on Madison Avenue.

Month: May 2012

Redneck Bar-B-Q Express

Susan Ellis profiles a BBQ team that’s been there from the beginning — the Redneck Bar-B-Q Express.

Redneck Bar-B-Q Express has been competing in the Memphis in May World Championship Barbecue Cooking Contest since the first year, 1978 (when the contest was held in a lot near the Orpheum), and they’ve been back every year since.

A few more Redneck Express facts and stats

• According to team bio: “Our entry form was the first to be into to Memphis in May.”

• The team name was inspired by Federal Express (now FedEx).

• The team was the first to prepare a whole hog, rather than just shoulders and ribs.

• Original team members: Pete Gross, Woody Coleman, Tommy Coleman, Mike Stals, Roy Nolen, and Mike Rivalto.

Redneck Express member Woody Coleman offers up more details on the team’s 3-plus decades in the Barbecue Fest trenches ….

I feel good about two things today: One, James Brown is alive and well on a Madison Avenue sidewalk.

And, two, people like Brittany are out and about, upping the cool factor and maintaining our city’s hip style profile. She was gracious enough to let me snap her pic (after I awkwardly called after her and chased her down), as she was on her way back to work.

What first caught my attention was the casual but professional mix of a blue jean shirt and a black pencil skirt, paired with nude patent flats (from Payless!)

But then I noticed her two-toned sunglasses (from Urban Outfitters) and smartly styled bun. Way cool.

Now who can tell me more about this James Brown graffiti?

JB

JB

Shelby County Commissioner Mike Ritz

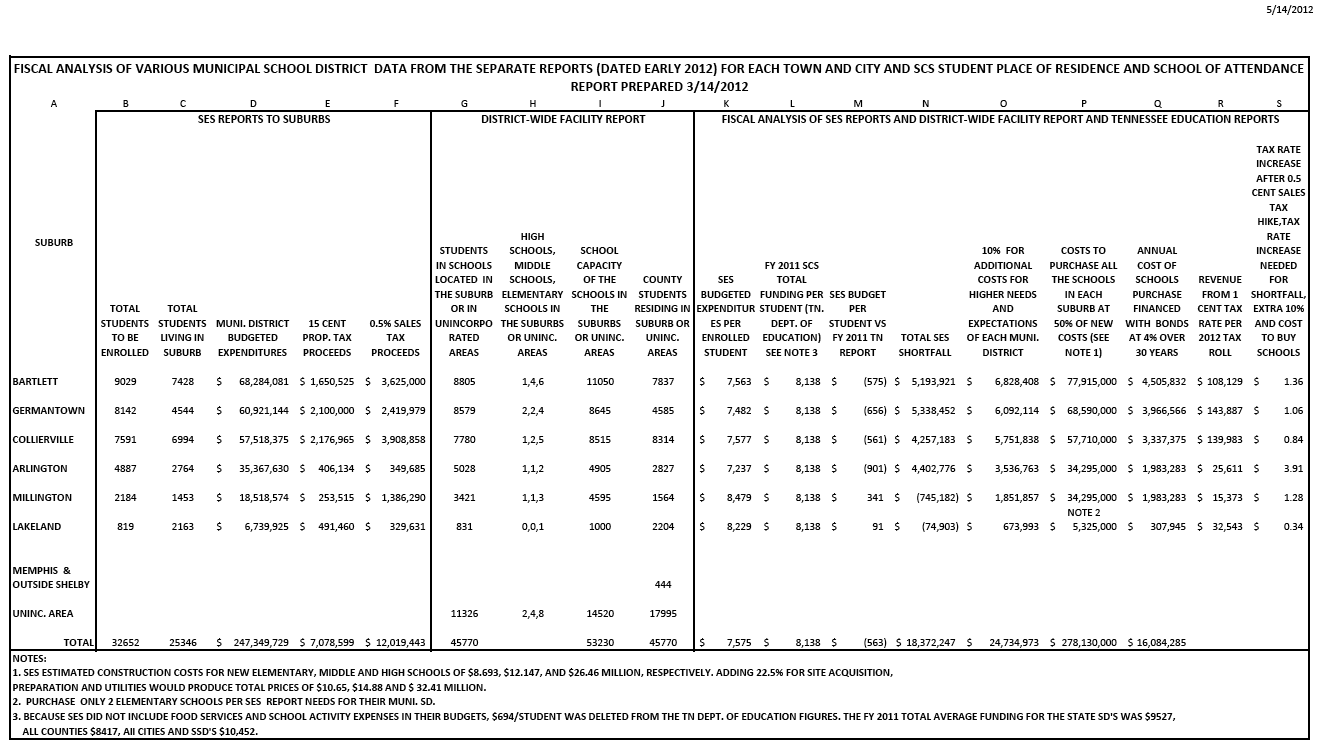

In a study prepared for presentation to the Shelby County Commission’s education committee on Wednesday, District 1 Commissioner Mike Ritz, a Germantown Republican, offered some sobering fiscal warnings to suburbanites considering the establishment of municipal school districts for their communities.

Applying what he termed a “brutally conservative” approach, Ritz, whose background is in investment banking, essentially found fault with what he regards as over-rosy financial projections from Southern Educational Strategies, the local consulting group which has offered advice to six Shelby County suburban cities – Germantown, Collierville, Bartlett, Lakeland, and Arlington.

All these communities intend to hold referenda in August to gain voter approval for municipal schol districts.

Among Ritz’s findings:

*Significant employee expenses – notably OPEBs (Other Post-Employment Benefits) – were overlooked in the SES estimates. Should the six suburban communities establish independent school districts, those expenses would cease to be obligations of the Shelby County Unified System and become liabilities for the suburban communities.

*The prospect of having to ”level up” on teacher salaries, so as to make those in the suburban systems comparable to the pay-scale of the Unified System, was also overlooked in the SES estimates.

*Also overlooked by SES were costs associated with providing for students with special education needs. Says Ritz: At a cost-per-student of up to $100,000 annually, these costs must be borne by the municipalities. “There are no BEP or County funds for these purposes.”

*Expenses associated with the acquisition of school buildings from the Unified District and with add-on per-pupil expenditures for students living outside the municipalities’ limits will be significantly in excess of the SES estimates, especially factoring in inflationary costs. In the case of some of the suburban communities, e.g., Arlington and Lakeland, these unanticipated expenses could be prohibitive – requiring, in the case of Arlington, a four-fold increase in that city’s property tax rate.

*Moreover, contends Ritz, the establishment of municipal school districts could necessitate the construction of new facilities “to educate students from an unincorporated area,’ and the capital cost of these buildings “will fall on all Shelby County taxpayers.”

Ritz’s complete survey reads as follows:

FISCAL ISSUES CONCERNING PROPOSED MUNICIPAL SCHOOL DISTRICTS

May 14, 2012

-Mike Ritz, Budget Committee Chairman, Shelby County Commission

My observations and findings concerning the fiscal issues facing the proposed municipal school districts are based on my reading and understanding of (a) the separate reports presented by Southern Educational Strategies, LLC (SES) to each suburban government in early 2012 and (b) the ‘District-Wide Facility Usage and the Student Enrollment Within Unincorporated Shelby County’ report and ‘Student Place of Residence and School of Attendance’ spreadsheet presented to the Shelby County Board of Education March 20, 2012. Upon completion of the attached spreadsheet, ‘Fiscal Analysis of Various Municipal School District Data from the Separate Reports (Dated Early 2012) and The Student Place of Residence and School of Attendance spreadsheet prepared by Shelby County School Planning Department Revised 3-14-2012’, I prepared this report. Please note that I used the Shelby County School System average per student expenditure in my spreadsheet as a minimum expectation of expenditures per student. If I had used the State-wide, All County, or City and SSD average per student funding, the potential fiscal impact on each of the suburbs would have been considerably more. While some observations are common for several of the suburbs, very few apply to all suburbs. My findings are presented for each suburb.

My approach was to be ‘brutally conservative.’ It will be very difficult politically to turn back the creation of a municipal school district once it is in place. Any error in the SES calculations that misses or understates the actual and necessary costs for a municipal school district will fall 100% on the taxpayers of the municipal school district. Thus a very careful approach is necessary.

SES did not project the cost of the “Other Post-Employment Benefits” (OPEB) for their teachers and other staff. OPEB includes the school system’s costs of health and life insurance for retirees. The OPEB benefits are not part of the retirement pay from the state retirement system that Shelby County teachers expect. These OPEB costs have until recently been ignored and unfunded by both of the local school boards. Recent changes in governmental accounting standards require their annual financial reports or audits to calculate these unfunded liabilities. The unfunded OPEB liabilities of the two school systems as of June 30, 2011 was $1,503,097,723. The ultimate funding responsibility of the two system’s unfunded OPEB liabilities lies with Shelby County Government. Any reduction of teachers and staff employed by the Unified Shelby County School System will cause a reduction in the Unified System’s unfunded OPEB liabilities. Teachers and staff hired by the municipal school systems will expect some health and life insurance benefits in retirement. The ultimate fiscal responsibility of OPEB for their retired teachers and staff will be the respective suburban government. These costs were not included in the SES reports.

Another cost not included in the SES reports was the cost of ‘leveling up’ the teacher compensation of Shelby County School System to the salaries of the Memphis City Schools. State law requires ‘leveling up’ when 2 systems are merged. If the municipal school systems have to match a Shelby County teachers’ salary to recruit them, the FY 2014 or later salaries for the municipal district’s teachers will be higher than noted in the SES reports.

A third cost not included is the cost of special education needs students. It is not unusual to have a school age child who needs special assistance or equipment to learn which cost $100,000 annually. Each municipal school district will have to pay for those needs. There are no BEP or County funds for those purposes.

BARTLETT. Bartlett has the largest number,11, of the Shelby County Schools (SCS) buildings and

7837 Bartlett residing students now attend SCS schools. 6178 of the 8805 students attending SCS schools in Bartlett live in Bartlett. The remaining 1659 Bartlett residing students attend Arlington HS (466), and Bolton HS (1118), and other SCS schools. SES proposed the largest municipal school district for Bartlett with 9029 students, a system 15% larger than the number of Bartlett residing students. While the minimum state requirement of 15 cents of local property tax support for their municipal school system would produce the budgeted $1,650,525, the proposed 0.5 percent sales tax increase would produce $3,625,000 which is more than twice the minimal amount needed. However, if Bartlett (a) spends the average of FY 2011 SCS funding for their municipal system to start up in FY 2013 or later, (b) pays 50% of the cost of new schools for the 11 schools in their city, and (c) increase school operation costs 10% for inflation, greater expectations or needs than SES budgeted, then they will need a $1.36 property tax increase, a 91% increase over their current tax rate of $1.49. The annual cost to buy their 11 schools is 27% of the total of the three defined cost of this analysis (the Total SES Shortfall plus 10% Cost of Higher Needs and Expectations plus Annual cost of Schools Purchase). It might be expected that Bartlett municipal school district would want to build a new high school (or expand Bartlett HS) for the 1584 Bartlett residing students attending high schools outside Bartlett which would be an additional capital expense. Added to these potential additional property taxes can be some amount for OPEB benefits for their initial 886 teachers and staff, special education needs children, and the costs of matching the ‘leveled up’ teacher compensation.

GERMANTOWN. Germantown has 8 of the Shelby County Schools (SCS) buildings and 4585 Germantown residing students now attend SCS schools. 8579 students attend SCS schools in Germantown. Only 38 Germantown residing students attend schools outside Germantown. Of the 4032 non-resident students attending the 8 schools in Germantown, 2799 live in unincorporated Shelby County and 1067 live in Collierville. SES proposed a municipal school district for Germantown with 8142 students, a system 76% larger than the number of Germantown residing students. While the minimum state requirement of 15 cents of local property tax support for their municipal school system would produce the budgeted $2,100,000, the proposed 0.5 percent sales tax increase would produce $2,419,979 or $319,979 more than minimally needed. However, if Germantown (a) spends the average of FY 2011 SCS funding for their municipal system to start up in FY 2013 or later, (b) pays 50% of the cost of new schools for the 8 schools in their city, and (c) increase school operation costs 10% for inflation, greater expectations or needs than SES budgeted, then they will need a $1.06 property tax increase, a 71% increase over their current tax rate of $1.485. The annual cost to buy their 8 schools is 26% of the total of the three defined cost of this analysis (the Total SES Shortfall plus 10% Cost of Higher Needs and Expectations plus Annual cost of Schools Purchase). Obviously if Germantown would propose a system more aligned to the number of students residing in Germantown, the fiscal impact on their residents could be substantially lessened. Germantown has annexed all of its annexation reserve areas. Taking greater fiscal risk for students who don’t and won’t live in Germantown does not appear to be a conservative fiscal policy. Added to these potential additional property taxes can be some amount for OPEB benefits for their initial 777 teachers and staff, special education needs children, and the costs of matching the ‘leveled up’ teacher compensation.

COLLIERVILLE. Collierville has 8 of the Shelby County Schools (SCS) buildings and 8314

Collierville residing students now attend SCS schools. 7780 students attend SCS schools in Collierville. 1072 Collierville residing students attend schools outside Collierville with 1067 attending schools in Germantown with 754 and 204 at Houston High and Middle, respectively. Of the 7780 students attending schools in Collierville, 7229 live in Collierville and 456 live in unincorporated Shelby County. SES proposed a municipal school district for Collierville with 7591 students, a system for 91% of Collierville residing students. While the minimum state requirement of 15 cents of local property tax support for their municipal school system would produce the budgeted $2,100,000, the proposed 0.5 percent sales tax increase would produce $3,908,858 or $1,731,893 more than minimally needed. However, if Collierville (a) spends the average of FY 2011 SCS funding for their municipal system to start up in FY 2013 or later, (b) pays 50% of the cost of new schools for the 8 schools in their city, and (c) increase school operation costs 10% for inflation, greater expectations or needs than SES budgeted, then they will need a $0.84 property tax increase, a 59% increase over their current tax rate of $1.43. The annual cost to buy their 8 schools is 25% of the total of the three defined cost of this analysis (the Total SES Shortfall plus 10% Cost of Higher Needs and Expectations plus Annual cost of Schools Purchase). Added to these potential additional property taxes can be some amount for OPEB benefits for their initial 745 teachers and staff, special education needs children, and the costs of matching the ‘leveled up’ teacher compensation.

ARLINGTON. Arlington has 4 of the Shelby County Schools (SCS) buildings and 2827 Arlington residing students now attend SCS schools. 5028 students attend SCS schools in Arlington. Only 22 Arlington residing students attend schools outside Arlington. Of the 5028 students in Arlington schools, 2787 live in Arlington, 484 live in Bartlett, 1111 live in Lakeland, and 559 live in unincorporated Shelby County. SES proposed a municipal school district for Arlington with 4887 students, a system 73% larger than the number of Arlington residing students. While the minimum state requirement of 15 cents of local property tax support for their municipal school system would produce $406,134, the proposed 0.5 percent sales tax increase would produce only $349,685 or $56,449 less than minimally needed amount. Arlington and Lakeland are the only two suburbs where the proposed 0.5 percent sales tax increase produces less than the minimum 15 cent property tax increase. Moreover, if Arlington (a) spends the average of FY 2011 SCS funding for their municipal system to start up in FY 2013 or later, (b) pays 50% of the cost of new schools for the 4 schools in their city, and (c) increase school operation costs 10% for inflation, greater expectations or needs than SES budgeted, then they will need a $3.91 property tax increase, a 391% increase over their current tax rate of $1.00. The annual cost to buy their 4 schools is 20% of the total of the three defined cost of this analysis (the Total SES Shortfall plus 10% Cost of Higher Needs and Expectations plus Annual cost of Schools Purchase).Obviously if Arlington would propose a system more aligned to the number of students residing in Arlington, the fiscal impact on their residents could be substantially lessened. It may be a very long time before Arlington annexes the areas of unincorporated Shelby County where some of their students may reside. It does not make conservative fiscal sense to take the greater fiscal risk for those children or the students from Bartlett and/or Lakeland. Added to these potential additional property taxes can be some amount for OPEB benefits for their initial 456 teachers and staff, special education needs children, and the costs of matching the ‘leveled up’ teacher compensation.

MILLINGTON. Millington has 5 of the Shelby County Schools (SCS) buildings and 1564 Millington residing students now attend SCS schools. 3421 students attend SCS schools in Millington. Only 6 Millington residing students attend schools outside Millington. Of the 3421 students in Millington schools, 1437 live in unincorporated Shelby County. SES proposed a municipal school Millington residing students. SES recommended Millington annex the Lucy community annexation reserve area to reach the minimum state requirement for new municipal school districts to assure 1500 students in the schools or at least 2000 students presently enrolled. While the minimum state requirement of 15 cents of local property tax support for their municipal school system would produce $253,515, the proposed 0.5 percent sales tax increase would produce $1,386,290 or $1,132,775 more than minimally needed. However, if Millington only spends the average of FY 2011 SCS funding for their municipal system to start up in FY 2013 or later, but however (a) pays 50% of the cost of new schools for 4 of the 5 schools in their city, and (b) needs to increase school operation costs 10% for inflation, greater expectations or needs than SES budgeted, then they will need a $1.28 property tax increase, a 104% increase over their current tax rate of $1.23. The annual cost to buy 4 of their 5 schools is 64% of the total of the three defined cost of this analysis (the Total SES Shortfall plus 10% Cost of Higher Needs and Expectations plus Annual cost of Schools Purchase). If Millington would propose a municipal school system size closer to the minimum state requirement, the fiscal impact on their residents could be substantially lessened. Added to these potential additional property taxes can be some amount for OPEB benefits for their initial 246.5 teachers and staff, special education needs children, and the costs of matching the ‘leveled up’ teacher compensation.

LAKELAND. Lakeland has only 1 of the Shelby County Schools (SCS) buildings and 2204 Lakeland residing students now attend SCS schools. Only 831 students attend the SCS school in Lakeland. Of the 2204 Lakeland residing students, 111 attend Arlington located schools, 240 attend Bartlett schools, and 788 attend the single Arlington school. Of the 831 students in Lakeland ES, 19 live in Bartlett and 10 live in unincorporated Shelby County. SES proposed a single school municipal school district for Lakeland with 819 students, a system big enough for only 37% of Lakeland residing students. While the minimum state requirement of 15 cents of local property tax support for their municipal school system would produce $491,460, the proposed 0.5 percent sales tax increase would produce only $329,631 or $161,829 less than minimally needed. Lakeland and Arlington are the only two suburbs where the proposed 0.5 percent sales tax increase produces less than the minimum 15 cent property tax increase. Moreover, if Lakeland only spends only the average of FY 2011 SCS funding for their municipal system to start up in FY 2013 or later, but however pays (a) 50% of the cost of new schools for the single school in their city, and (b) needs to increase school operation costs 10% for inflation, greater expectations or needs than SES budgeted, then they will need a $0.34 property tax. Lakeland currently does not have a property tax. The annual cost to buy their 1 school is 34% of the total of the three defined cost of this analysis (the Total SES Shortfall plus 10% Cost of Higher Needs and Expectations plus Annual cost of Schools Purchase). If Lakeland decides to also have a property taxes over and above the 34 cent increase noted above. Added to these potential additional property taxes can be some amount for OPEB benefits for their initial 94 teachers and staff, special education needs children, and the costs of matching the ‘leveled up’ teacher compensation.

FISCAL IMPACT ON SHELBY COUNTY GOVERNMENT OF THE MUNICIPAL SCHOOL DISTRICTS.

There are several observation, albeit general and non specific, that should be noted.

1.If the Shelby County School Board does not allow a municipal school district to educate students from an unincorporated area, those students will stay in the Shelby County system and will need school buildings to house them. Many of the unincorporated students now attend schools in a suburb. If a municipal district acquires (buy, lease, or gift) the schools in their respective suburb, then the capital cost of new buildings for the unincorporated children will fall on all Shelby County taxpayers via Shelby County’s obligation to provide the capital funds for the Shelby County Schools.

2.Per 1 above and If the municipal districts have to pay to buy or lease the public schools in the suburbs, then that consideration could be used by Shelby County Schools to build the schools they may need for the unincorporated students. These funds would offset a requirement for Shelby County taxpayers to pay debt service on new bonds to replace the schools in the suburbs.

3. Creation of municipal school districts will reduce the teachers and staff of the Shelby County Schools which will in turn reduce the unfunded OPEB obligations of the Shelby County Schools.

Ritz spreadsheet

Grizzlies-Clippers: Game Seven Thoughts

Chris Herrington takes a look at Game 7 between the Griz and Clips and points out where things went wrong.

Who Gets the Organs?

Face it, Memphis doesn’t get statewide bragging rights that often — FedEx, the river, Elvis, St. Jude, the Grizzlies, a few others. So when I heard in 2009 that Apple founder Steve Jobs came to Methodist University Hospital for a life-saving liver transplant, I thought it was pretty cool.

It was an example of the positive effect that universities and hospitals — eds and meds — have on a community. And it was a good story, with a rich celebrity, a dynamic company (Apple’s stock market value increased $300 billion between the surgery and Jobs’ death last year), a skillful surgeon, a mystery about Jobs’ whereabouts, and an underlying ethical question about who gets a liver when there is a waiting list for donors.

I could imagine John Grisham writing about it in a novel called The Transplant or a movie with Ryan Gosling as Jobs. But that didn’t happen. Instead, the back story is about turf wars, and the scriptwriters are federal bureaucrats. Methodist University Hospital is at odds with Vanderbilt, and, in an odd twist, a Memphis nonprofit that procures organs for transplants is criticizing Methodist University, while a similar nonprofit in Nashville is sympathetic. In condensed form, here’s the deal:

In 2008, a contractor that runs the federal organ procurement and transplant network revisited the 20-year-old organ-sharing agreement, resulting in a change in the area from which organs are drawn for local transplants. It doesn’t take effect until the end of this year, which is an indication of the sensitivity and complexity of this issue. Presently, Memphis is part of a donor area that includes all of Tennessee. The change, upheld by the Department of Health and Human Services, puts Memphis in a Mid-South region that includes West Tennessee, plus part of Arkansas and Mississippi.

“There are basically two major transplant programs in Tennessee, one in Memphis and one in Nashville,” said James Eason, medical director of the Methodist University Transplant Institute and the surgeon who performed the liver transplant on Steve Jobs. “Starting in 2008, Vanderbilt did not agree to the sharing agreement. Under the new plan, we will only have access to our area and Nashville has access to their area, which has 75 percent of the donors. At the end of the year, we will be looking at a 75 percent reduction in transplant access.

“A liver in Jackson, Tennessee, can go to the least sick person in Nashville while our sickest person with a few days to live on life support won’t be able to access that. This also affects kidneys. We have the largest African-American population in the state, and 80 percent of our kidney recipients are African-American.”

Failing to get HHS to reconsider, Methodist University went to Plan B, which was to recommend a merger of donor nonprofit organizations in Memphis and Nashville. No sale.

“The statement that more patients will die, we just don’t believe to be true,” said Kim Van Frank, executive director of the Mid-South Transplant Foundation in Memphis, which has a $11.7 million budget and recovers some 220 organs a year. “The current system gives Methodist an advantage, and their patients don’t have to wait as long, which is why individuals outside the Mid-South are coming here. They are cutting in line, make no mistake.”

Nashville-based Tennessee Donor Services, with a $41.7 million budget, is pro-merger.

“We would not object at all,” said executive director Jill Grandas. “Many states already have organ procurement organizations that cover the entire state.”

To an outsider, this is where the story gets baffling. Both organizations are well funded. Public documents show that Van Frank made $169,000 in 2010 and Grandas $264,000. Can’t nonprofits with a similar mission merge? No. Martin Croce is director of the Elvis Presley Trauma Center at the Med. He used to be chairman of the board at Mid-South Transplant Foundation.

“I made it clear I thought the best thing for our organization was to merge,” he said. “I wanted everyone on the board to know my position, and, after that, I was not reelected or reappointed to the board. Mid-South Transplant is a well-performing organization, but they just don’t have the numbers.”

The decision to change Tennessee’s transplant territory predates it, but the Jobs transplant has had a lingering impact. Van Frank said “it brought forth a lot of those myths we try to dispel.” Eason said Jobs and Methodist went strictly by the rules.

They agree that any publicity that encourages more donors is good. If you are so inclined, consult the nonprofits for the how-tos.

Final Thoughts on Game 7

- LARRY KUZNIEWSKI

- Zach Randolph and Marc Gasol probably didn’t share the floor enough in the season’s final quarter.

After posting my Game 7 story early Sunday evening, I had to put it all away — absent a reluctant trip to Monday’s final media session — until we wrapped on this week’s paper yesterday afternoon.

But, with that out of the way, I sat down Tuesday afternoon, before my weekly appearance on The Chris Vernon Show, and went through the last 15 minutes of the game again. This gave me not only a different look at the action than I got from my upstairs media seat, but the ability to pause, rewind, re-watch, etc. And four things jumped out to me as major factors in the Grizzlies’ struggles, particularly on the offensive end, where the team mustered only 16 points on 4-18 shooting in the final quarter:

1. The Arenas/Haddadi Substitutions: The Grizzlies used lineups at the end of the third quarter and at the beginning of the fourth quarter that they hadn’t used in the series to that point, with Marc Gasol and Hamed Haddadi paired at the end of the third and Haddadi and Gilbert Arenas paired to start the fourth. And re-watching confirms that the Haddadi and Arenas substitutions really hurt the team.

Arenas hadn’t been effective in his limited minutes all series, of course. But, in fairness, Lionel Hollins had played Haddadi important second-half minutes in two other games — 4 and 6, I think — and gotten good results from this move. But it didn’t work in Game 7, and I think it had a lot to do with the situations in which Haddadi was placed. Haddadi is a quality backup center when he sticks to within five feet of the hoop, but in this game he was routinely forced to handle the ball on the perimeter — usually after running a pick-and-roll with O.J. Mayo, in which Mayo was trapped — which, unsurprisingly, resulted in turnovers and low-percentage shots.

2. Fatigue was Real: In his post-game press conference, Hollins cited fatigue as a factor in his late-game substitutions, and that certainly seems legitimate. On the game, the four players who logged the most minutes — Rudy Gay (40), Mike Conley (40), Zach Randolph (39), and Marc Gasol (37) — were all Grizzlies. Chris Paul (35) was the only Clipper to top 30 minutes. The Clippers’ superior bench play was one of the stories of the series and it was definitive in Game 7. There are a couple of times in the fourth quarter where Conley, playing with flu-like symptoms, looks like he’s going to collapse. The play before Randolph controversial trip to the bench in the middle of the quarter, he was jogging back on defense while Kenyon Martin was streaking past him for a dunk. On the crucial play late when O.J. Mayo got a steal and had a chance to cut the Clippers lead from six to four, both Chris Paul and Reggie Evans tracked him down to contest his shot. Not a single other Grizzlies player even crossed half court.

Overton Park Conservancy Gets Major Grant

The Assisi Foundation has granted $500,000 to the Overton Park Conservancy. Bianca Phillips has the story.

PFLAG Donates Major Gift to MGLCC

The Memphis Gay & Lesbian Community Center (MGLCC) may soon be amping up it counseling services, thanks to a $5,000 gift from Parents, Families & Friends of Lesbians and Gays (PFLAG). The gift comes with a challenge match of up to $15,000.

The $5,000 gift is to be used specifically for MGLCC’s counseling referral program, which connects LGBT Memphians with LGBT-friendly counselors.

Additionally, PFLAG has vowed to match every donation MGLCC receives from now until July 31st, up to $15,000.

PFLAG’s Memphis chapter was founded in 1986. It meets on the first Thursday of every month at 6 pm at the Benjamin Hooks Central Library on Poplar. For more information, see www.pflag.org.