Tennessee lawmakers are making things harder on the poor and easier on the rich, and those old-timey class frictions are heating up in the rifts.

Republicans blame technical glitches and piles of red tape they created as obstacles to get millions of dollars to help low-income families here. Meanwhile, they cut taxes for the business class last year, plan to cut even more this year, and hope to free up more of everyone’s tax dollars to help everyone — no matter how much money they have — pay for private schools.

Gun violence dominated debate and headlines around the Tennessee General Assembly in 2023. Many vow to keep the issue in front of lawmakers in 2024. But if a school shooting in Nashville during last year’s regular session and an entire special session on gun violence last summer won’t move GOP lawmakers to act, rays of hope on the issue seem faint.

It’s way too early to predict what issue(s) may dominate discussions at the State Capitol in the coming weeks. But money seems an early leader, especially as news came late last year that once-hot state revenues are cooling thanks in large part to those 2023 GOP tax cuts.

Money matters have not seen center stage in Tennessee for awhile. The state’s budget has been pushed up and up in recent years with nary a cut in sight. That’s partly due to the new-ish ability to collect online sales taxes and a major surge in revenues from those business taxes in the past. But that won’t likely be the case this year.

Tennessee Gov. Bill Lee is expected to unveil his new budget for Tennessee on Monday, during the annual State of the State address. Projected revenues — how much money officials think we’ll have to spend in the next year — will likely flatten.

This could present some difficult decisions for lawmakers, especially some on the House side, who may have not yet dealt budget cuts. If cuts come, it will be especially interesting to see where the state’s GOP-dominated purse-string-holders will make them (especially since they made the cuts necessary). This could also likely flatten the state’s ability to fund any new initiatives. (Think of it like this, if you quit a job, you might not have the money to pay for your existing car and you damn sure can’t buy a new one.)

Budgets are more than numbers. Budgets are priorities. For a household, that could mean the difference in saving for college later or going on vacation now. For local governments, that could mean the difference in more police or better parks. With its tax cuts last year, the Tennessee GOP prioritized at least one thing: more long-term money in the bank for the state’s businesses.

Now, as money matters begin to creep into the state spotlight once again, some old, tense questions are rising. Who pays for the government? Who does the government work for? Who wins? Who struggles?

So many of these questions have root in Tennessee’s overarching economic development model. That is, basically, how do we organize our economy? How do we build it?

Republicans here love to tout Tennessee as one of the most “business-friendly” states in the union. But don’t just take their word for it. Yahoo! Finance put the state in its top 10 for business friendliness last year and MSNBC ranked it in the top 3, both using different methodologies.

Tennessee’s economy, like many other Southern states, works on the basic trickle-down theory that lower business taxes will attract more businesses, which will hire more people and create more wealth that will “trickle down” to the lower classes.

Except it doesn’t, according to a new report from the Economic Policy Institute (EPI). The high tide promised by this economic theory does not lift all boats, it said. For a more in-depth look at how this plays out in Tennessee and across the South, see below (Economic Policy Institute Report).

Here, we’ll look at some issues and opinions on money and class that might shape debates as the legislature heads back to Nashville.

The poor and hungry

Back in 2019, The Beacon Center, a free market think tank in Nashville, discovered the Lee administration quietly sat on a stockpile of $730 million meant to help working poor families in Tennessee. For years, Tennessee got $190 million from the federal government to help these families get on their feet with monthly checks for childcare, transportation, and more.

Instead of finding ways to getting all of the money to needy families, Lee just did not. The initial discovery of the funds in 2019 led some on social media to decry Lee’s money management. Others saw GOP disdain for the poor.

“This is why [I march for universal basic income] today, because of villainous shit-holes like the governor of Tennessee who is hoarding $732 M in TANF [Temporary Assistance for Needy Families] money instead of spending it on reducing poverty,” reads a tweet from the time from Scott Santens, founder of the Income to Support All Foundation.

By 2021, the fund ballooned to nearly $800 million. Thanks to Beacon, a plan is now in place to spend that money down.

However, Lee’s plan puts a hurdle between those needy families and the money. Rather than go directly to families in need, the funds will in large part go to organizations or health departments that will give them temporary aid.

Lee administration officials said it has found a home for $717 million of the TANF reserve. But state Sen. Heidi Campbell (D-Nashville) wants more in the hands of actual needy families. Introduced last week, her bill would increase TANF payments to cover rising inflation costs each year.

Meanwhile, thousands of families in Tennessee have less literal food on the table thanks to Lee administration computer problems. Last summer the Tennessee Department of Human Services (TDHS) updated some computer software. A glitch in the system resulted in a backlog of benefits for 35,000 recipients of the federal Supplemental Nutrition Assistance Program (SNAP), sometimes called food stamps.

TDHS Commissioner Clarence Carter said his team hopes to have the backlog cleared by March. He also said he’s not dragging his feet, telling state lawmakers last week that his team has “an almost desperate sense of urgency to get this right.” Tennessee Lookout editor Holly McCall pointed out this “kicker” from their story on the matter: “DHS officials noted that the staff brought in to help are keenly aware of the importance of the work: some department staff rely on food stamps themselves.”

Who pays?

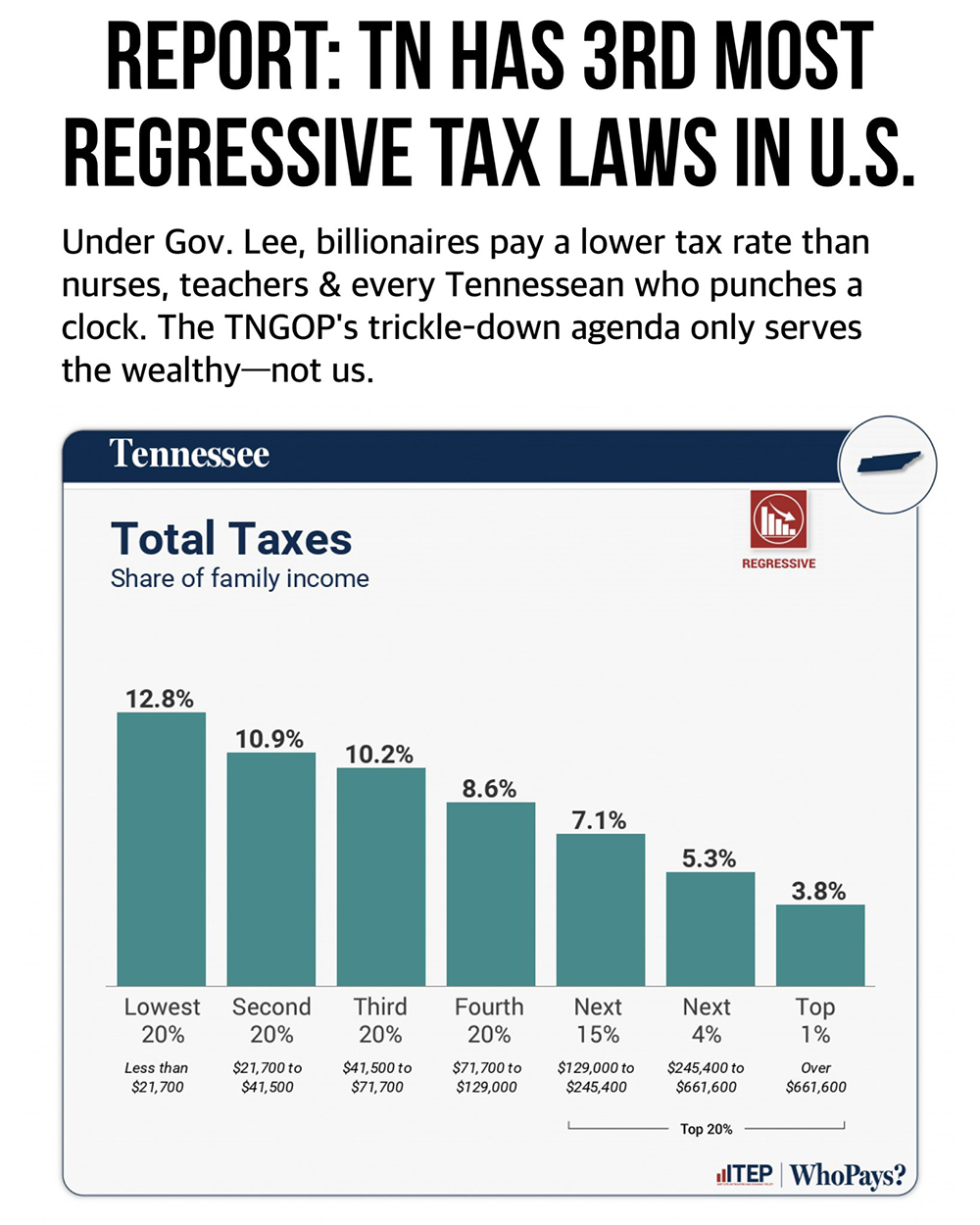

Tennessee has the third-most regressive tax system in the country, according to the seventh annual “Who Pays?” report from the Institute on Taxation and Economic Policy (ITEP). Regressive taxes are those paid equally by all, no matter how much money they make. These, of course, hit lower-income taxpayers the hardest.

In Tennessee, this means the lowest 20 percent of earners (those making less than $21,000 each year) spend 12.8 percent of their total annual household income on taxes. The top 1 percent (those making over $661,600 each year) spend just 3.8 percent of their total income on taxes here. The poorest pay more than three times as much as the wealthy.

“States such as Florida, Tennessee, and Texas are often described as ‘low tax’ due to their lack of personal income taxes,” reads the report. “While this characterization holds true for high-income families, these states levy some of the nation’s highest tax rates on the poor.”

A tale of two tax cuts

State Sen. London Lamar (D-Memphis) can go back to 2011 and rattle off a list of GOP-sponsored policies “that have truly benefited the wealthy and big corporations.” The repeal of the millionaire estate tax. The repeal of the luxury gift tax. A repeal of income tax on stocks and bonds. A reduction of the jet fuel tax. Corporate exemptions to the sales tax. Exemptions for corporate income taxes.

“Our tax policy is incentivizing businesses for keeping people poor,” Lamar said. “I say that because since 2011 and when the Republicans got in office, the main tax reform and benefits have truly benefited the wealthy and big corporations.

“So, the question is, where are the priorities for those citizens who are working the hardest to contribute to our economy?”

Well, the GOP cut taxes for working-class families just last year. Well, kinda sorta. And it wasn’t much. And it wasn’t forever. But …

Remember that odd, three-month cut on the state’s grocery tax last year? It was a $273 million part of the $400 million Tennessee Works Tax Act, “the largest single tax cut in Tennessee history.” It cut the 4 percent tax for everyone from August to October. Then, the tax went straight back onto receipts.

It was a head-scratcher to many and seemed a solution to a problem that didn’t exist (except, y’know, that Tennessee is one of only 13 states that still tax groceries). Why? Where did this cut come from? Even folks on Reddit couldn’t pin the motivation on some coarse design to win votes because there was no upcoming election.

But it was the remaining cuts in the Tax Act that smarted some working-class taxpayers. While they got a one-time deal that put about $100 in their pockets, the state’s business class got a permanent tax cut worth about $127 million that would put thousands of dollars in their bank accounts each and every year.

The Tax Act seemed to prove Lamar’s notion. Meaningful, permanent cuts for those with means; shallow, temporary cuts for everyone else. (Though, legislation has been filed for this year’s session to permanently cut Tennessee’s grocery tax.)

This might all come into sharper focus later, especially if revenues continue to fall. Because it’s lost revenues from those business tax cuts knocking multi-million-dollar holes in the state budget.

So, should lawmakers indeed need to make cuts to programs it offers Tennessee’s taxpayers, it won’t be because the majority of them got a brief respite from grocery taxes.

#VoucherScam

Capitol-watchers have said Lee’s controversial plan to expand his school voucher program could be the biggest fight in Nashville this year. Lee eventually wants to expand the program to every student for any kind of school — public, private, charter, or home.

But the program would allow the vouchers, worth about $7,075 per student each year, for all students, with no income requirements. This means wealthy parents — who now pay taxes for public schools and tuition at private schools — could divert funds from the public school system.

The fight over the legislation may prove to be another class battle that could heat up in Nashville this year. For proof, dig around X for #LeesVoucherScam.

“The voucher scam takes tax dollars from our neighborhood public schools to pay for the private school education of the wealthy,” tweeted Teri Mai, a Democratic candidate running for a House seat in Middle Tennessee. “Simply put, the school voucher scam defunds public schools by funneling your tax dollars to private and religious schools.”

Economic Policy Institute Report

Southern politicians tout the region’s “business-friendly” economic development policies, but a new study finds those policies are rooted in racism and have failed most people who live here.

The October study is from Washington, D.C.-based Economic Policy Institute (EPI), a nonpartisan think tank focused on “the needs of low-and-middle-income workers in economic policy discussions.” The study looks at job growth, wages, poverty, and state GDP. The data, EPI said, “show a grim reality.”

The group characterized the Southern economic development model as one with “low wages, low taxes, few regulations on businesses, few labor protections, a weak safety net, and vicious opposition to unions.”

The state of Tennessee basically agrees with this and shouts it in all caps (literally) on its website under the “business climate” section.

“We believe in high expectations, low debt, and a pro-business regulatory environment,” reads the page from the Tennessee Department of Economic and Community Development. “Tennessee is proud to be a right-to-work state [also noting Tennessee’s low union participation] with no personal income tax. Our state and local tax burdens are among the lowest in the country, and our state budget operates with a healthy surplus, rather than a deficit.”

The EPI study said this does not work for everyone.

“While this economic model has garnered vast amounts of riches for the wealthiest people across the region, it is leaving most Southerners with low wages, underfunded public services, a weak safety net in times of economic downturns, deep racial divisions, and high rates of poverty,” said report author Chandra Childers, a senior policy and economic analyst for EPI’s Economic Analysis and Research Network.

Here are a few key takeaways from the report:

• Job growth across the South has failed to keep up with population growth. The share of prime-age workers (ages 25–54) who have a job is lower than the national average in most Southern states.

• Workers in Southern states tend to have lower earnings. Median earnings in nine Southern states are among the lowest in the nation, even after adjusting for lower cost of living in the South.

• Poverty rates are above the national average in most Southern states. Louisiana and Mississippi have the highest poverty rates in the nation, with nearly one in five residents living in poverty.

• Child poverty is highest in the South compared to any other region. At 20.9 percent, child poverty rates in the South are 3.7 percentage points higher than the region with the next-highest child poverty rate — the Midwest (17.2 percent).

• Southern states are among the lowest-GDP states. Nine of the 15 states with the lowest per-worker GDP are in the South.

The racist remnant of the Southern economic development model, according to EPI, is that business owners in the South continue to rely on “large pools of cheap labor,” particularly Black and brown people. The study points back to slavery in the South when Black people were not paid at all and then to Pullman porters who were “forced to rely on tips” after slavery ended. Now, incarcerated individuals can be required to work with no pay at all, the study said.

“The racist roots of this model have been obscured and have been replaced by a more acceptable ‘pro-business’ narrative,” reads the study. “The pro-business narrative suggests that low wages, low taxes, anti-union policies, a weak safety net, and limited regulation on businesses creates a rising tide that ‘lifts all boats.’”

Tennessee policies fit into this model, the study said, as the state has no minimum wage, no income tax, a high sales-tax burden for all residents, no expanded Medicaid program, a low per-worker GDP, and more.

Poverty is higher in Tennessee than in other parts of the country. This is especially true for people of color and particularly women of color, according to the data. The highest rates of poverty across the South are experienced by Black women. One in five lives in poverty, but it’s not due to an unwillingness to work, the study says. Black women have a higher employment-to-population (EPOP) ratio than women from any other racial or ethnic group in the South.

“One reason Black women’s poverty rates remain high in the South — despite a relatively high EPOP — is that they are disproportionately employed in jobs consistent with the occupations they were largely limited to during and after the end of slavery: care work, cleaning, and food production, including agricultural and animal slaughter work,” reads the study. “Because this work is largely done by Black, brown, and immigrant workers, consistent with the Southern economic development model, these jobs pay very low wages.”

Wages are lower in Tennessee than in other parts of the country, and again it’s especially true for people of color and particularly women of color, according to the report.

“On average, Black women in the South are paid $35,884 at the median and Hispanic women just $30,984, compared with $58,008 for white men,” reads the report.

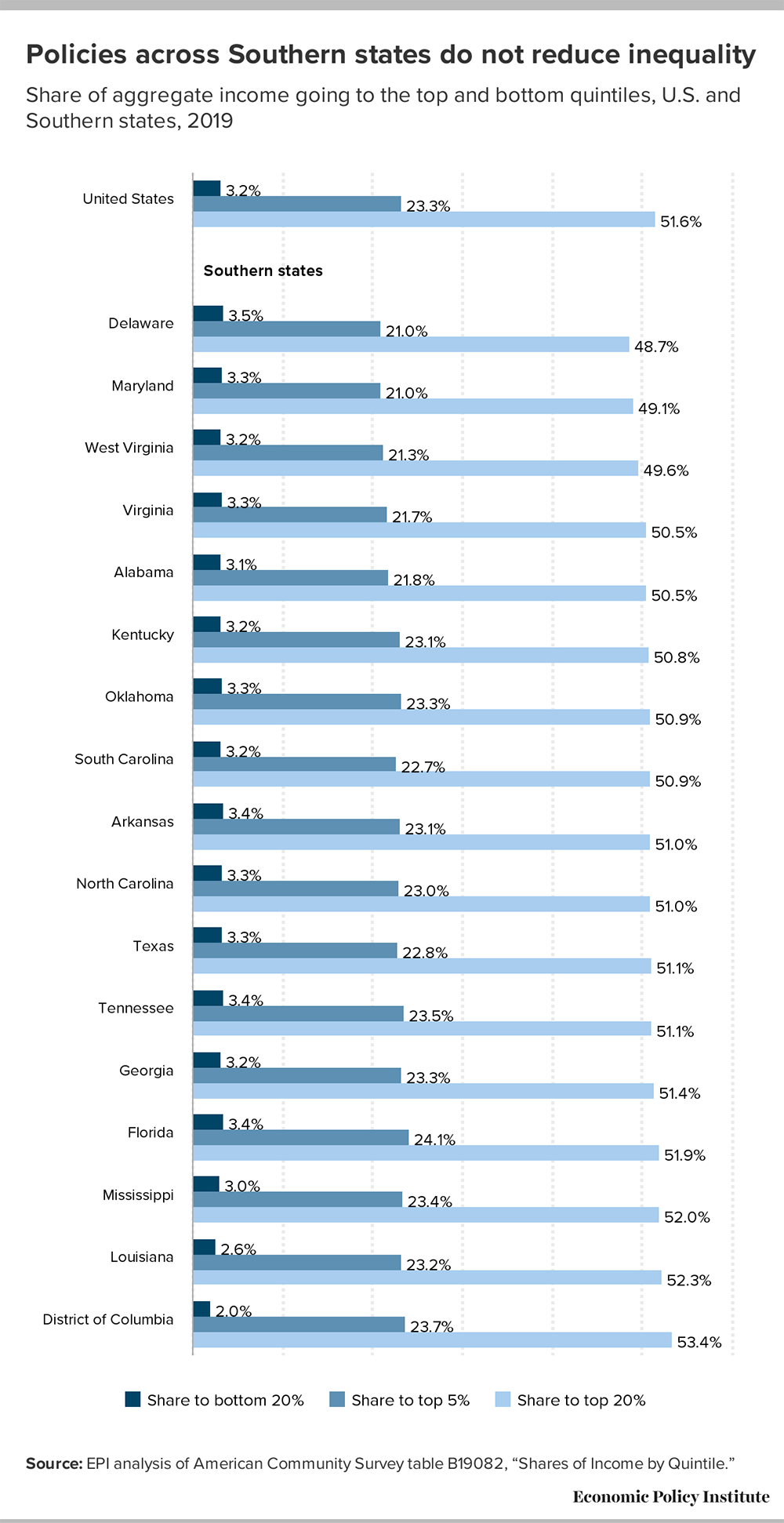

If the Tennessee economic model is working like politicians claim, where does the money go? The study says it goes to the wealthiest Tennesseans. The top 20 percent richest Tennesseans share more than half (51 percent) of the state’s total income. The top 5 percent share 23 percent of the state’s aggregate income. The bottom 20 percent share just 3.4 percent.

“Many Southerners may believe their politician’s arguments that the Southern economic development model will deliver good, well-paying jobs,” reads the report. “However, the data presented here show clearly and emphatically that this model has failed those living in Southern states.”