Mayor A C Wharton and the Memphis City Council held a retreat Saturday morning to step back and take a look at the big picture of city finances.

The good news: Memphis has a AA bond rating and some untapped or lightly tapped financing sources I’ll get to in a minute. The bad news: Population and property tax assessments are both going in the wrong direction at the same time Memphis is growing in land area, which stretches the cost of providing services.

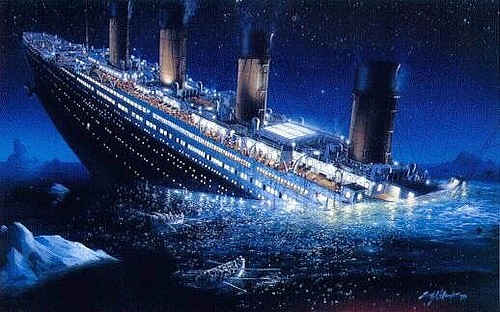

In what was either the most apt or alarming symbolic moment of the three-hour session at the FedEx Family House across from Methodist LeBonheur Hospital, city development czar Robert Lipscomb displayed a slide with a graphic of the Titanic going down amidst a field of icebergs. It was meant as a metaphor for various financial perils on the horizon or not yet seen. While the order to abandon ship has not been given, lifeboats have been sighted in Germantown, Collierville, and DeSoto County and other safe harbors.

Because of its declining tax base, “Memphis has no margin for error,” Lipscomb said. “I would suggest that you have a business model which is not sustainable.”

Wharton decried the need to provide city services to untaxed nonprofits and businesses within Memphis and citizens of Shelby County outside of Memphis. Because of tax breaks, about 30 percent of the property in Memphis is exempt from standard city property taxes. Left unsaid was the fact that those tax breaks were given and are still being given with the approval of the people at the retreat or by agencies such as the Industrial Development Board of Center City Commission. On top of that, Tourism Development Zones and Tax Increment Financing districts have dedicated revenue streams that keep money out of the general fund. How to put all that together in one picture?

“That is the crux,” said Wharton.

City finance officials are forecasting a deficit of about $17 million this year. Sharp-eyed observers, however, will see different figures depending on which year or city fund is under discussion. The general trend is this: Local property tax revenues continue to decline, sales tax revenues is recovering slowly, and fines and fees have fallen short of expectations. A property tax increase of 18 cents that was approved but not imposed last year is one possibility.

Council members had a few gripes.

“Where was the big picture” last year when the city supposedly had a $6 million surplus, wondered Myron Lowery.

“There are people in this room who were here five years ago,” said Wanda Halbert, adding “I’m seeing some of my colleagues get major money and my district is not getting anything.”

Janis Fullilove inquired about a payroll tax on non-residents who work in Memphis or a state income tax. Those prospects, history has shown, are unlikely. She noted that while the players on the Memphis Grizzlies and the Nashville Predators hockey team pay a privilege tax, the Tennessee Titans do not. In the current shortened NBA season, the Grizz tax only nets a bit less than $1 million, finance officials said.

Finance director Roland McElrath said bond debt payments will get priority over other expenses, and the administration will present the council with a balanced budget in April. Wharton said “there will be some pressure regardless of what we do” on the city’s bond rating because of the ripple effect from a big bond default in Jefferson County (Birmingham) Alabama.

Retreats are a near-annual event, and this one was more focused — and shorter — than several I have witnessed. A low point came one year in the Herenton administration when the gang traveled all the way to Jackson, Tennessee for such a session. Finishing the job in under three hours is progress of a sort. And so was the setting, on a stretch of Poplar Avenue between Midtown and downtown that used to be lined with public housing projects and now has a hospital tower and attractive housing.

To belabor the metaphor one more time, it takes time to turn around a big ship in the water, especially in a field of icebergs.

.