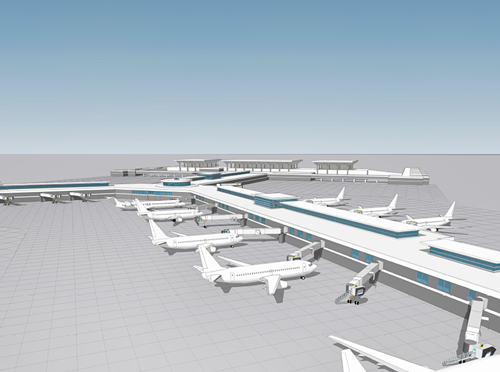

On Thursday, the Memphis Airport Authority board announced their plans to downsize the airport by demolishing the south end of the A and C concourses and consolidating airline flight operations into an enhanced and expanded B concourse.

Walkways in the B concourse will be nearly doubled in size to give passengers more room as they move to and from gates, and moving walkways will be installed. The ceilings will be raised, and more windows will be added to provide natural light. During construction, the airport will see seismic upgrades as well.

The project is slated to cost $114 million, much of which will be funded through federal and state grants. Forrest Artz, vice-president of finance for the Memphis Airport Authority, provides a breakdown of the numbers.

Flyer: Can you provide an overview of the grants that will be funding this project?

Artz: Because there are federal grants and state grants, we are required to have a matching portion to receive those grants. For the federal grant, that matching portion is 25 percent, and they give us 75 percent. For the state grant, it is 10 percent, and they give us 90 percent.

The federal grant is the AIP, the Airport Improvement Program. Those monies are generated each time a person buys an [airline] ticket. There’s a tax on everybody’s airline ticket. That money is collected by the federal government, and it’s intended use is for airport capital improvement projects across the country. Every airport is entitled to a certain amount of AIP dollars to be used for their capital programs. We make an application on those monies on an annual basis, but we have to provide them a five-year program of what our program is going to be.

So we may put in the first year of our modernization program for the request for those monies this year, but over the next four or five years, the Federal Aviation Administration (FAA) will know exactly what our funds requirement will be for the full program.

On the state side, it’s quite similar. The state dollars are derived every time an airline pays for jet fuel, they’re required to pay a tax to the state. That tax is collected and distributed back out to the airports within the state of Tennessee for capital purposes. We receive an annual entitlement of those dollars, and we put our financing program together so they know what we’re doing over the next five years as well.

Where will the matching portion come from?

Our matching portion will come from, in 2017, we have a reduction in debt service that the airlines have to pay to us of about $12 million. We anticipate giving them a reduction in the rates and charges but collecting some of it, so we can use that as our matching portion for our state and federal grants. That way we’ll fund the entire program using the monies from the reduced debt service, the federal portion of the grant, and the state portion of the grant.

At this point, we’re still working on what the different percentages will be of the federal and state portions, so I don’t have any concrete numbers at this point. But we’ll need to have that completed to send a schedule to the FAA on April 1st.

The Airport Authority has stated that it does not anticipate that this project will require the issuance of any additional general airport revenue bonds. Can you explain what that means?

For a lot of big projects, and we did this in the past, we have on our books general airport revenue bonds that we issued in prior years for capital projects. So what that means is, if we had a $200 million program that we want to do, some sort of capital improvement at the airport, we would go out and issue general airport revenue bonds in the market. We would promise to pay those bonds over a 25 or 30 year period, but we would receive the $200 million from the bonds immediately. Then we would use that $200 million to pay for the project for construction costs.

But then we would have debt service payments over the next 25 or 30 years. With that, you have not just the principle but interest, just like a note on your house. When you pay the interest over that 25 or 30 year period, just like your house payment, you pay a whole lot more money than if you were able to pay it with just the principle amount all at one time. But we’re not anticipating issuing any general airport revenue bonds.

I think most people want to know how this will affect their wallets.

As a result of the way that we’re structuring, it won’t have any impact on the rates and charges that are associated with the airlines. There will be no impact on what the airlines have to pay us.

But what about the debt service the airlines have to pay?

The debt service money, they wouldn’t have to pay us, but we have had discussions with them that, because of the reduction in debt service, we can do this program without having to issue any new general airport revenue bonds. They’re very much on board for that, because, the interest savings in 25 years is huge.