Tennessee Republicans maimed (and likely killed) bills this session that would have allowed state taxpayers to know which corporations pay no state corporate income taxes.

The bills were carried by Nashville Democrats Sen. Heidi Campbell and Rep. John Ray Clemmons. Each bill got brief hearings this month. Both passed committee votes and both got negative recommendations from a majority of lawmakers on those committees.

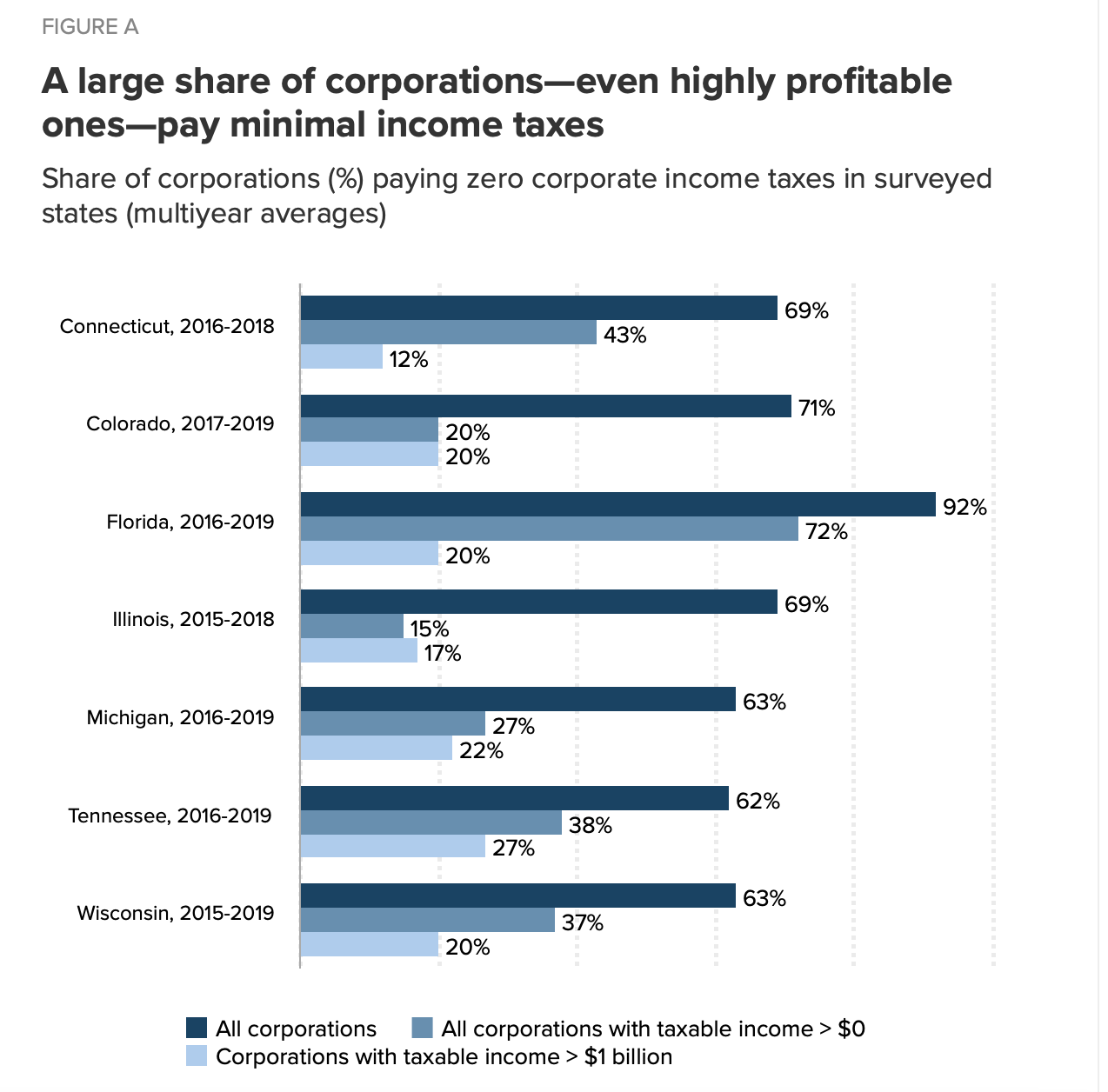

Campbell and Clemmons said the Tennessee Department of Revenue (TDOR) told them more than 60 percent of corporations here pay no state income tax, and “that is jarring to hear,” Campbell said. About 27 percent of Tennessee companies that report more than $1 billion in taxable income to the federal government paid zero Tennessee income taxes, she said.

“We don’t know which companies are paying nothing because the state law shields that information from public view.”

Sen. Heidi Campbell

“We don’t know which companies are paying nothing because the state law shields that information from public view,” Campbell said. “This bill will require publicly traded companies to report what they pay or don’t pay to the public. So, we can better understand how our current tax code is working.”

Clemmons said that, according to a report from the D.C.-based Institute on Taxation and Economic Policy, three Tennessee companies paid no federal taxes in 2020: FedEx Corporation, Franklin-based hospital operator Community Health Systems, and Chattanooga-based insurance company Unum Group. However, current state law does not allow the public to know if these companies paid any Tennessee taxes.

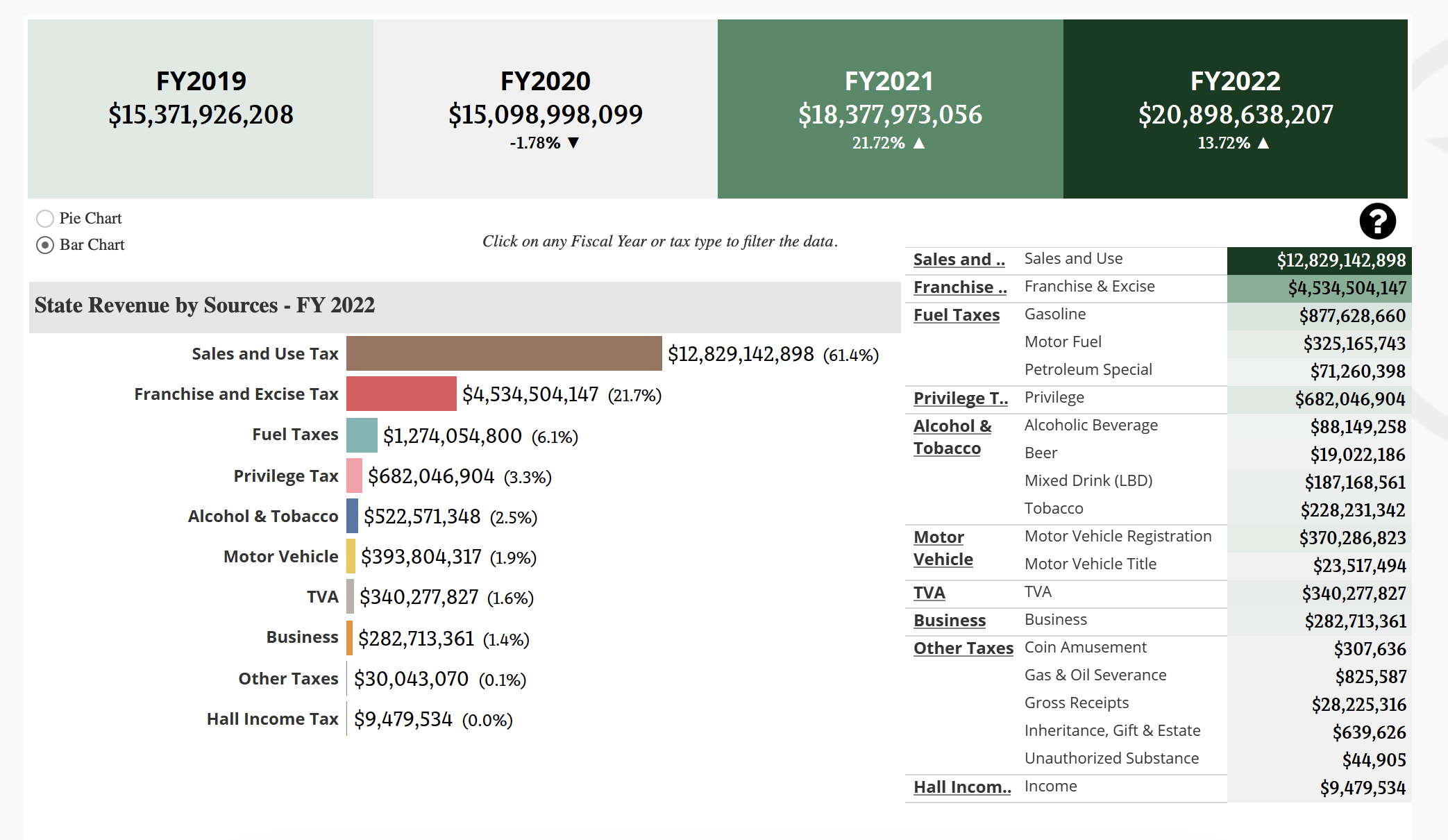

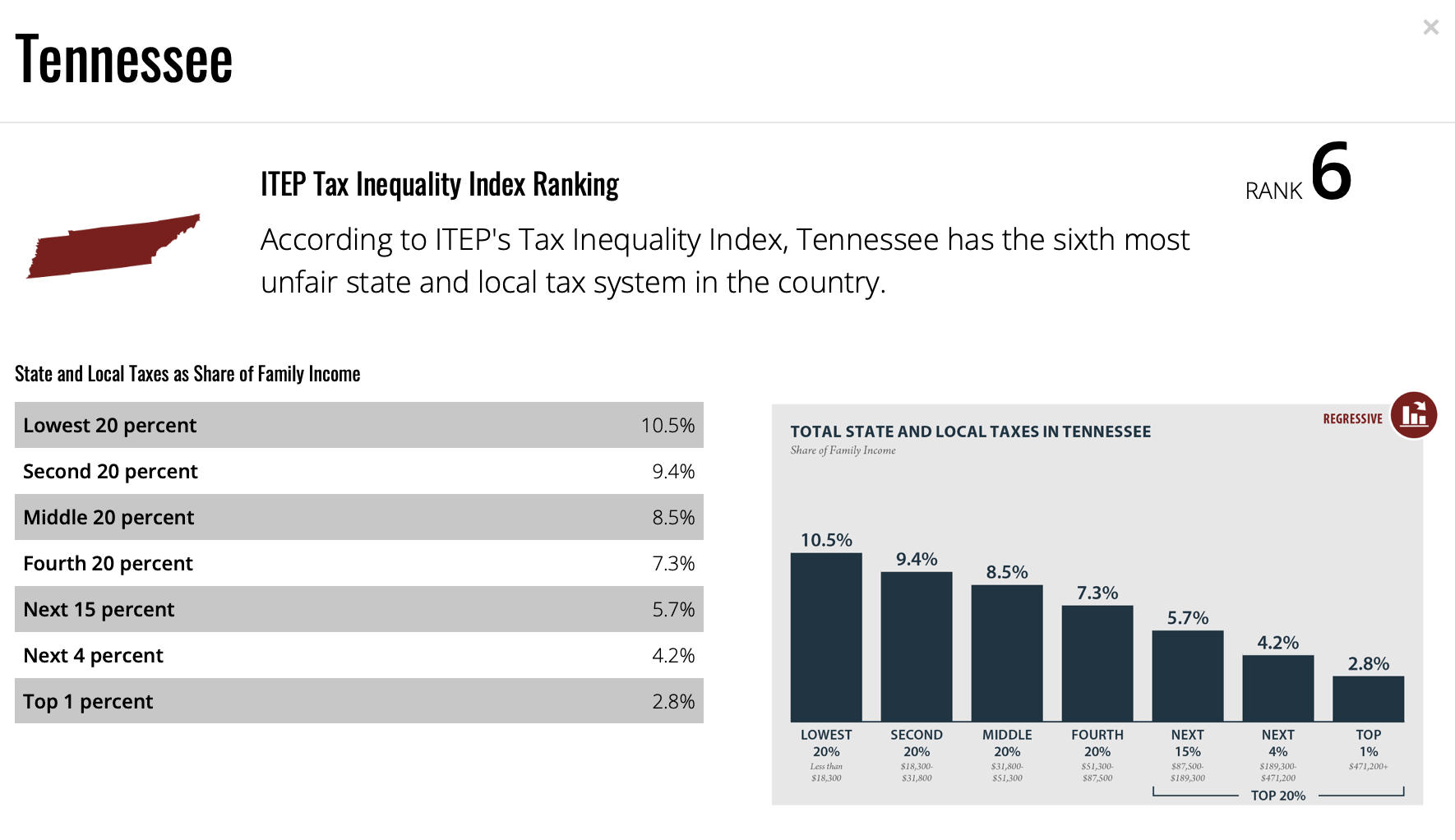

Clemmons said Tennessee has the second-highest sales tax in the country and is one of only a few states that taxes groceries. Sales and use taxes were the biggest chunk of the state’s 2022 budget, comprising more than 61 percent ($12.8 billion) of the budget, according to the TDOR. Clemmons called these “regressive taxes paid by working families.” Franchise and excise taxes (corporate income taxes) were second, making up more than 21 percent ($4.5 billion) of the budget.

“There are no loopholes for families buying groceries,” Clemmons said. “There are no loopholes for parents buying back-to-school clothes. There are no loopholes for property owners paying higher rates to make up for corporations [that are] not paying a dime.

“This bill does not raise taxes on anyone. It simply provides some transparency so the hardworking people of Tennessee, who pay their taxes, will know which big corporations are paying what they owe and which are not.”

Rep. Sabi Kumar (R-Springfield) said, “The implication that those who don’t pay taxes are not paying their fair share is a rather subjective matter.” He said a corporation’s responsibility is to “pay as little tax as they can following the law.” With this, Kumar said, “The problem is with the law, not with the fact that just because somebody does not pay taxes are doing something wrong.”

A corporation’s responsibility is to “pay as little tax as they can following the law.”

Rep. Sabi Kumar

“So, I would like to say that as a pro-business state, we need to realize it is okay to pay the legal share [of taxes], not the fair share as defined by somebody and that interpretation differs with everybody.”

The information sought by the bills is disclosed on the federal level, required by the U.S. Securities and Exchange Commission (SEC), according to a 2022 report from the D.C.-based Economic Policy Institute. But the SEC does not require the data on state taxes.

“The failure to require corporations to disclose their taxes allows them to unfairly avoid public scrutiny when they avoid paying billions in taxes,” reads the report. “Without information on how much corporations actually pay at the state and local levels, there is no way to determine whether or not they are paying their fair share.”

State and local governments are missing out on a range of $43 billion-$57 billion in taxes from these companies, the report said.