Tennessee Governor Bill Lee said last week he and others “fiercely” defended businesses from pandemic-related tax hikes ahead, but critics noted he has raised taxes on Tennessee’s online shoppers by about $377 million over the last two years.

Lee touted investment of $400 million into the state’s flagging unemployment insurance trust fund. The investment was a piece of $2.6 billion from the federal CARES Act fund.

Without the investment, Lee said tax premiums paid by Tennessee employers would have increased by 300 percent next year, according to figures from the University of Tennessee Boyd Center. Tennessee businesses would have seen their unemployment taxes raised by $837 million.

Sycamore Institute

Sycamore Institute

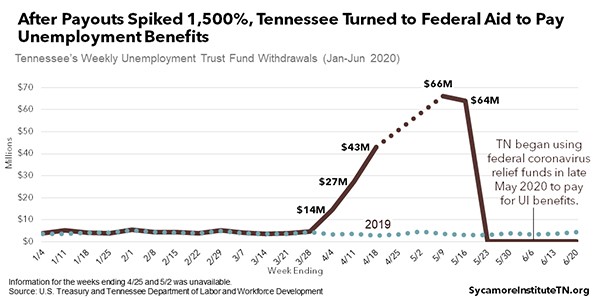

Without federal funds, Tennessee’s unemployment fund would have been dry within 14 weeks.

Tennessee has some of the lowest unemployment tax rates in the country, according to the Sycamore Institute. Tennessee businesses pay taxes on $7,000 of an employee’s annual pay for the unemployment fund. In contrast, Washington state business owners pay such taxes on $52,700 of an employee’s annual pay. The average tax on all wages in Tennessee was 0.2 percent, the third-lowest in the country.

Employee unemployment benefits are also among the lowest in the country. Lawmakers here raised the maximum weekly benefit last year to $275, the fourth-lowest weekly payout in the country. The average weekly payout is $242, the fourth-lowest nationally. These benefits replace about 37 percent of an average worker’s lost wages in Tennessee, the fifth-lowest percent in the country, according to the Sycamore Institute.

Tennessee has also kept a relatively low fund balance in its unemployment trust fund. In March, the fund was $1.3 billion, the highest balance ever in the fund’s history. But even that amount fell short of federal standards in the fund’s ability to weather a typical recession.

The coronavirus began to quickly squeeze the fund in April. By May, withdrawals were 15 times higher than normal, draining $64 million from the fund in mid-May. Without help, the fund would have been dry in 14 weeks. So Lee and the state’s Financial Stimulus Accountability Group have invested $400 million into the fund.

Tennessee House Speaker Cameron Sexton (R-Crossville) said the move “is one of many ways we are continuing to support businesses during these difficult times by ensuring they aren’t penalized by burdensome tax increases.”

But Lee and Tennessee Republicans have increased tax burdens for another group — online shoppers. The online tax rate here is now the highest allowed by federal law.

“Gov. Lee says he wanted to save businesses from a tax hike, but what about our families who shop online?” read a statement last week from Tennessee Senate Democrats. “The tax increases didn’t have to happen right now, especially with so many everyday families shopping online for essential goods.”

The email points to three bills with sales tax expansions passed on Lee’s watch. The first simply allowed for the collection of online sales taxes. Two later bills made sure taxes here weren’t just for retail behemoths like Amazon or Walmart, lowering sales thresholds to $100,000. Taken together, the laws increased the sales tax burdens on Tennessee’s online shoppers by $377 million.