In the end, it was no contest — in either of the ballot matters that were before Memphis voters and were concluded on Thursday.

Proposed City Ordinance 5495, the referendum for a half-cent increase in the optional local sales tax in order, primarily, to support a citywide pre-Kindergarten program and,, secondarily, to allow for the reduction of the city’s current property tax, was defeated: 60 percent no, 40 percent yes.

And, despite expressed misgivings by Democratic activists that a projected low turnout might endanger the margin of Democratic nominee Raumesh Akbari, she handily defeated Libertarian candidate Jim Tomasik by an almost 9 to 1 ratio to become the successor to the late Democratic state Rep. Lois DeBerry.

Given that —as City Councilman Shea Flinn, a referendum co-sponsor, had acknowledged — the default result for a tax-increase referendum is no, the outcome of the sales-tax referendum was not surprising. Nor was the victory of Akbari in District 91, a Democratic stronghold in which there was no Republican opposition.

The difference in the two outcomes was that Akbari’s victory margin was roughly the same in early and absentee voting and in election-day voting, while there was a perceptible diminishing in the support for the sales-tax referendum in the transition from early and absentee voting to election day.

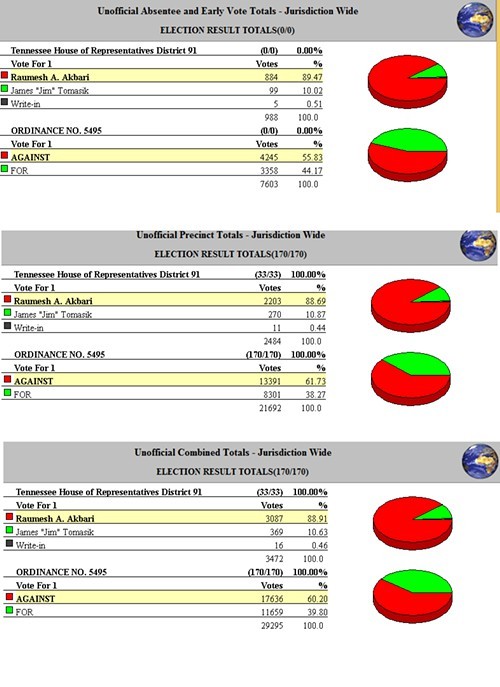

As the totals shown below, from the Shelby County Election Commission, indicate, Akbari led by 89.47 percent to Tomasik’s 10.01 percent in early and absentee voting, and she closed out on election day with a 88.69 percent to 10.87 percent margin. Her ultimate winning percentage was 88.91 to Tomasik’s 10.63. All these ratios are roughly the same.

In the referendum contest, however, the yes vote, 44.17 percent, was somewhat competitive with the no vote of 55.83 percent in early and absentee voting. But it was no contest on election day, when three times as many votes were case, , with opposition to the referendum registering at 61.73 percent and the vote for the sales-tax increase dropping to 38.27 percent.

With 29, 295 votes case overall — or something like 6 percent of the eligible voters — the cumulative no vote was 60.20 percent, the cumulative yes vote was 39.80.

The bottom line was that, in the last week, sentiment seemed to have shifted perceptibly away from favoring the sales-tax add-on, which was already in the losing, or default, position. It is hard to evaluate the effect of intermittent rain son Thursday, election day, except to note that bad election-day weather tends to depress the working-class vote somewhat disproportionately.

Rather than blunting the prospects of a yes vote for the sales-tax increase, it seems more likely that the rain might have kept the margin or rejection from being even larger than it was. On the admittedly anecdotal evidence of yard signs, response from attendees at public forums, and other indications of campaign activity, support for the referendum seemed to be greater among higher-income voters and in upscale neighborhoods than elsewhere.

Certainly proponents of a yes vote were able to mount a big-budget advertising campaign, backed significantly by the Greater Memphis Area Chamber of Commerce and industrialist/philanthropist J.R. “Pitt” Hyde, primary contributors to a Memphis Pre-K Initiative list that seemed top-heavy with names prominent in the city’s civic and business establishment.

Economic issues rather than educational ones were the focus of opposition leaders, like the Rev. Kenneth Whalum Jr. (whose musician brother Kirk Whalum, ironically, was a member of an advisory pre-K commission appointed by Mayor A C Wharton).

Whalum harped upon the regressive aspects of the sales-tax vis-à-vis the property tax and, in a climactic last-week debate with Flinn sponsored by the Memphis Rotary Club, commented, “In what by any standard is the poorest big city in the United States, with one of the highest illiteracy rates, we must not further burden the children of our city and their parents.”

In the end, opposition to paying an incrementally higher sales tax seemed to loom larger in the minds of voters at large than argumemts for the efficacy of a taxpayer-subsidized pre-K program in raising educational standards and student prospects.

On the heels of an even more lopsided defeat for a 2012 Shelby County referendum for a sales-tax increase that would have included funding for pre-K, Thursday’s result may have aborted the likelihood of similar referenda for some time to come.

The following totals are from the website of the Shelby County Election Commission: