My wife and I are one kid away from being empty nesters. Roman is a high school senior at White Station and looking at colleges, applying for aid, checking out scholarships, visiting schools, etc. Every day’s mail brings at least a dozen glossy pamphlets from schools all over the U.S. Amazingly, they are all challenging and inspirational places to learn, and absolutely life-changing for the students who go there. Every campus is beautiful; the students pictured are a careful blend of ethnicities; all the professors are top-notch.

And the cost to attend any of them is staggering.

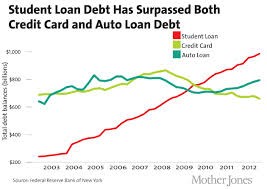

Families of college-bound students are playing the biggest lottery in America. The winners get their tuition paid or maybe land a scholarship that covers most college expenses. The losers’ families — and/or the students themselves — take out loans they’ll be repaying for decades. In 2015, American students and former students owe an incredible $1.2 trillion in student loan debt.

It wasn’t always this way. Tuition at my university back in the 1970s was $700 a semester. Room and board was $1,100 a year. My parents were not wealthy and they had four kids. We were basically on our own to get through college. And you know what? It wasn’t that hard. I got a job at a fast-food joint; later, I drove a school bus. I worked summers in construction. When I graduated, I even had a little money in the bank.

Students can’t do that in 2015, not when tuition at many schools is higher than the average American’s yearly income. Higher education has become yet another contributor to income inequality in the U.S. There are the haves, who can afford (or have the income to secure loans) to go to “good” schools with $50,000 yearly tuition. And there are the have nots, who, unless they’re one of the talented and/or lucky ones who get a scholarship, go to community colleges or in-state schools where scholarship money is available.

I hasten to say that there is absolutely nothing wrong with going to an in-state public school or community college. I went to a state university. The point is that the options are limited for far too many bright and ambitious U.S. kids.

In October, Germany joined many other countries in Europe and eliminated university tuition, even for foreign students. If you live in one of these countries and are smart enough, you can go to college for free. Doesn’t matter how much your daddy makes.

President Obama’s proposal to make community college tuition free is a step in the right direction, though getting it through Congress will be a battle. In Europe, governments are ensuring that their best and brightest can get an education. They know that an educated citizenry benefits the economy. In the U.S., meanwhile, our students are mortgaging their futures, and borrowing money from the government — at this point, more than $1 trillion and counting — for the privilege of going to college.

Somebody’s doing it wrong.