JB

JB

Shelby County Commissioner Mike Ritz

In a study prepared for presentation to the Shelby County Commission’s education committee on Wednesday, District 1 Commissioner Mike Ritz, a Germantown Republican, offered some sobering fiscal warnings to suburbanites considering the establishment of municipal school districts for their communities.

Applying what he termed a “brutally conservative” approach, Ritz, whose background is in investment banking, essentially found fault with what he regards as over-rosy financial projections from Southern Educational Strategies, the local consulting group which has offered advice to six Shelby County suburban cities – Germantown, Collierville, Bartlett, Lakeland, and Arlington.

All these communities intend to hold referenda in August to gain voter approval for municipal schol districts.

Among Ritz’s findings:

*Significant employee expenses – notably OPEBs (Other Post-Employment Benefits) – were overlooked in the SES estimates. Should the six suburban communities establish independent school districts, those expenses would cease to be obligations of the Shelby County Unified System and become liabilities for the suburban communities.

*The prospect of having to ”level up” on teacher salaries, so as to make those in the suburban systems comparable to the pay-scale of the Unified System, was also overlooked in the SES estimates.

*Also overlooked by SES were costs associated with providing for students with special education needs. Says Ritz: At a cost-per-student of up to $100,000 annually, these costs must be borne by the municipalities. “There are no BEP or County funds for these purposes.”

*Expenses associated with the acquisition of school buildings from the Unified District and with add-on per-pupil expenditures for students living outside the municipalities’ limits will be significantly in excess of the SES estimates, especially factoring in inflationary costs. In the case of some of the suburban communities, e.g., Arlington and Lakeland, these unanticipated expenses could be prohibitive – requiring, in the case of Arlington, a four-fold increase in that city’s property tax rate.

*Moreover, contends Ritz, the establishment of municipal school districts could necessitate the construction of new facilities “to educate students from an unincorporated area,’ and the capital cost of these buildings “will fall on all Shelby County taxpayers.”

Ritz’s complete survey reads as follows:

FISCAL ISSUES CONCERNING PROPOSED MUNICIPAL SCHOOL DISTRICTS

May 14, 2012

-Mike Ritz, Budget Committee Chairman, Shelby County Commission

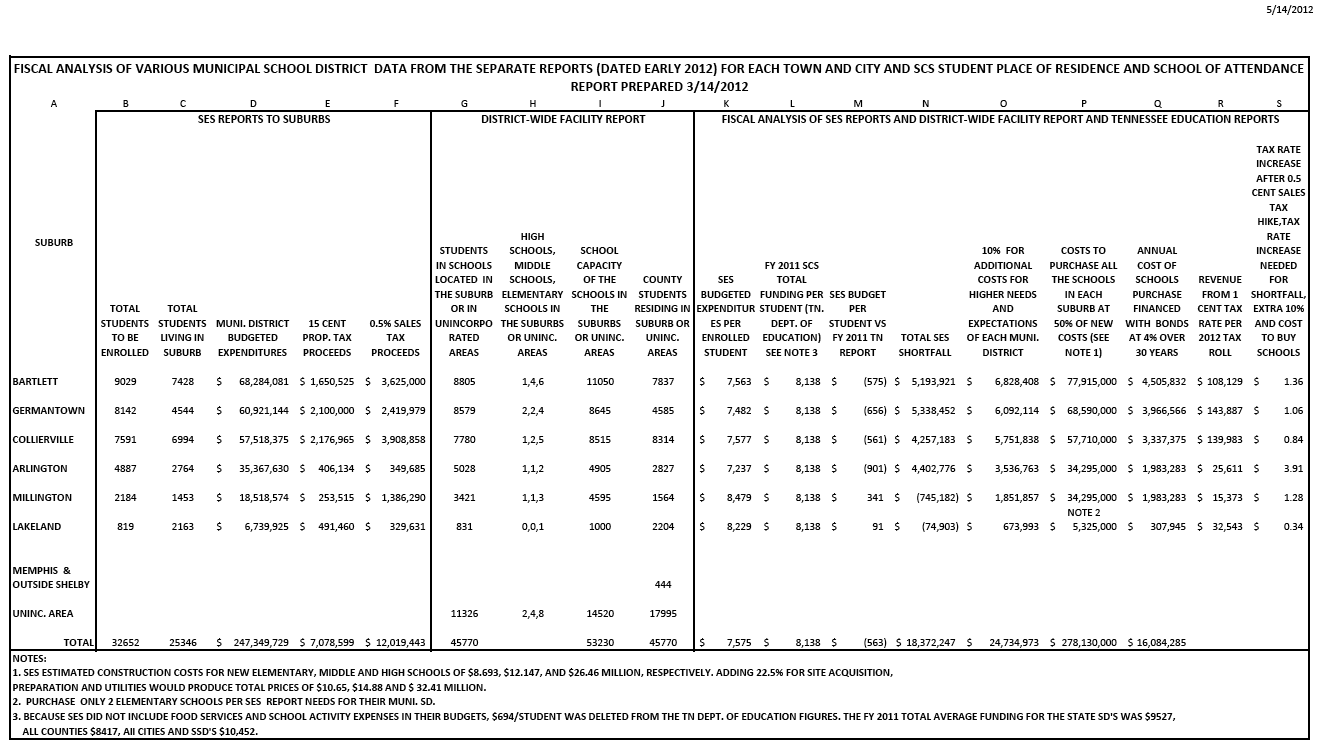

My observations and findings concerning the fiscal issues facing the proposed municipal school districts are based on my reading and understanding of (a) the separate reports presented by Southern Educational Strategies, LLC (SES) to each suburban government in early 2012 and (b) the ‘District-Wide Facility Usage and the Student Enrollment Within Unincorporated Shelby County’ report and ‘Student Place of Residence and School of Attendance’ spreadsheet presented to the Shelby County Board of Education March 20, 2012. Upon completion of the attached spreadsheet, ‘Fiscal Analysis of Various Municipal School District Data from the Separate Reports (Dated Early 2012) and The Student Place of Residence and School of Attendance spreadsheet prepared by Shelby County School Planning Department Revised 3-14-2012’, I prepared this report. Please note that I used the Shelby County School System average per student expenditure in my spreadsheet as a minimum expectation of expenditures per student. If I had used the State-wide, All County, or City and SSD average per student funding, the potential fiscal impact on each of the suburbs would have been considerably more. While some observations are common for several of the suburbs, very few apply to all suburbs. My findings are presented for each suburb.

My approach was to be ‘brutally conservative.’ It will be very difficult politically to turn back the creation of a municipal school district once it is in place. Any error in the SES calculations that misses or understates the actual and necessary costs for a municipal school district will fall 100% on the taxpayers of the municipal school district. Thus a very careful approach is necessary.

SES did not project the cost of the “Other Post-Employment Benefits” (OPEB) for their teachers and other staff. OPEB includes the school system’s costs of health and life insurance for retirees. The OPEB benefits are not part of the retirement pay from the state retirement system that Shelby County teachers expect. These OPEB costs have until recently been ignored and unfunded by both of the local school boards. Recent changes in governmental accounting standards require their annual financial reports or audits to calculate these unfunded liabilities. The unfunded OPEB liabilities of the two school systems as of June 30, 2011 was $1,503,097,723. The ultimate funding responsibility of the two system’s unfunded OPEB liabilities lies with Shelby County Government. Any reduction of teachers and staff employed by the Unified Shelby County School System will cause a reduction in the Unified System’s unfunded OPEB liabilities. Teachers and staff hired by the municipal school systems will expect some health and life insurance benefits in retirement. The ultimate fiscal responsibility of OPEB for their retired teachers and staff will be the respective suburban government. These costs were not included in the SES reports.

Another cost not included in the SES reports was the cost of ‘leveling up’ the teacher compensation of Shelby County School System to the salaries of the Memphis City Schools. State law requires ‘leveling up’ when 2 systems are merged. If the municipal school systems have to match a Shelby County teachers’ salary to recruit them, the FY 2014 or later salaries for the municipal district’s teachers will be higher than noted in the SES reports.

A third cost not included is the cost of special education needs students. It is not unusual to have a school age child who needs special assistance or equipment to learn which cost $100,000 annually. Each municipal school district will have to pay for those needs. There are no BEP or County funds for those purposes.

BARTLETT. Bartlett has the largest number,11, of the Shelby County Schools (SCS) buildings and

7837 Bartlett residing students now attend SCS schools. 6178 of the 8805 students attending SCS schools in Bartlett live in Bartlett. The remaining 1659 Bartlett residing students attend Arlington HS (466), and Bolton HS (1118), and other SCS schools. SES proposed the largest municipal school district for Bartlett with 9029 students, a system 15% larger than the number of Bartlett residing students. While the minimum state requirement of 15 cents of local property tax support for their municipal school system would produce the budgeted $1,650,525, the proposed 0.5 percent sales tax increase would produce $3,625,000 which is more than twice the minimal amount needed. However, if Bartlett (a) spends the average of FY 2011 SCS funding for their municipal system to start up in FY 2013 or later, (b) pays 50% of the cost of new schools for the 11 schools in their city, and (c) increase school operation costs 10% for inflation, greater expectations or needs than SES budgeted, then they will need a $1.36 property tax increase, a 91% increase over their current tax rate of $1.49. The annual cost to buy their 11 schools is 27% of the total of the three defined cost of this analysis (the Total SES Shortfall plus 10% Cost of Higher Needs and Expectations plus Annual cost of Schools Purchase). It might be expected that Bartlett municipal school district would want to build a new high school (or expand Bartlett HS) for the 1584 Bartlett residing students attending high schools outside Bartlett which would be an additional capital expense. Added to these potential additional property taxes can be some amount for OPEB benefits for their initial 886 teachers and staff, special education needs children, and the costs of matching the ‘leveled up’ teacher compensation.

GERMANTOWN. Germantown has 8 of the Shelby County Schools (SCS) buildings and 4585 Germantown residing students now attend SCS schools. 8579 students attend SCS schools in Germantown. Only 38 Germantown residing students attend schools outside Germantown. Of the 4032 non-resident students attending the 8 schools in Germantown, 2799 live in unincorporated Shelby County and 1067 live in Collierville. SES proposed a municipal school district for Germantown with 8142 students, a system 76% larger than the number of Germantown residing students. While the minimum state requirement of 15 cents of local property tax support for their municipal school system would produce the budgeted $2,100,000, the proposed 0.5 percent sales tax increase would produce $2,419,979 or $319,979 more than minimally needed. However, if Germantown (a) spends the average of FY 2011 SCS funding for their municipal system to start up in FY 2013 or later, (b) pays 50% of the cost of new schools for the 8 schools in their city, and (c) increase school operation costs 10% for inflation, greater expectations or needs than SES budgeted, then they will need a $1.06 property tax increase, a 71% increase over their current tax rate of $1.485. The annual cost to buy their 8 schools is 26% of the total of the three defined cost of this analysis (the Total SES Shortfall plus 10% Cost of Higher Needs and Expectations plus Annual cost of Schools Purchase). Obviously if Germantown would propose a system more aligned to the number of students residing in Germantown, the fiscal impact on their residents could be substantially lessened. Germantown has annexed all of its annexation reserve areas. Taking greater fiscal risk for students who don’t and won’t live in Germantown does not appear to be a conservative fiscal policy. Added to these potential additional property taxes can be some amount for OPEB benefits for their initial 777 teachers and staff, special education needs children, and the costs of matching the ‘leveled up’ teacher compensation.

COLLIERVILLE. Collierville has 8 of the Shelby County Schools (SCS) buildings and 8314

Collierville residing students now attend SCS schools. 7780 students attend SCS schools in Collierville. 1072 Collierville residing students attend schools outside Collierville with 1067 attending schools in Germantown with 754 and 204 at Houston High and Middle, respectively. Of the 7780 students attending schools in Collierville, 7229 live in Collierville and 456 live in unincorporated Shelby County. SES proposed a municipal school district for Collierville with 7591 students, a system for 91% of Collierville residing students. While the minimum state requirement of 15 cents of local property tax support for their municipal school system would produce the budgeted $2,100,000, the proposed 0.5 percent sales tax increase would produce $3,908,858 or $1,731,893 more than minimally needed. However, if Collierville (a) spends the average of FY 2011 SCS funding for their municipal system to start up in FY 2013 or later, (b) pays 50% of the cost of new schools for the 8 schools in their city, and (c) increase school operation costs 10% for inflation, greater expectations or needs than SES budgeted, then they will need a $0.84 property tax increase, a 59% increase over their current tax rate of $1.43. The annual cost to buy their 8 schools is 25% of the total of the three defined cost of this analysis (the Total SES Shortfall plus 10% Cost of Higher Needs and Expectations plus Annual cost of Schools Purchase). Added to these potential additional property taxes can be some amount for OPEB benefits for their initial 745 teachers and staff, special education needs children, and the costs of matching the ‘leveled up’ teacher compensation.

ARLINGTON. Arlington has 4 of the Shelby County Schools (SCS) buildings and 2827 Arlington residing students now attend SCS schools. 5028 students attend SCS schools in Arlington. Only 22 Arlington residing students attend schools outside Arlington. Of the 5028 students in Arlington schools, 2787 live in Arlington, 484 live in Bartlett, 1111 live in Lakeland, and 559 live in unincorporated Shelby County. SES proposed a municipal school district for Arlington with 4887 students, a system 73% larger than the number of Arlington residing students. While the minimum state requirement of 15 cents of local property tax support for their municipal school system would produce $406,134, the proposed 0.5 percent sales tax increase would produce only $349,685 or $56,449 less than minimally needed amount. Arlington and Lakeland are the only two suburbs where the proposed 0.5 percent sales tax increase produces less than the minimum 15 cent property tax increase. Moreover, if Arlington (a) spends the average of FY 2011 SCS funding for their municipal system to start up in FY 2013 or later, (b) pays 50% of the cost of new schools for the 4 schools in their city, and (c) increase school operation costs 10% for inflation, greater expectations or needs than SES budgeted, then they will need a $3.91 property tax increase, a 391% increase over their current tax rate of $1.00. The annual cost to buy their 4 schools is 20% of the total of the three defined cost of this analysis (the Total SES Shortfall plus 10% Cost of Higher Needs and Expectations plus Annual cost of Schools Purchase).Obviously if Arlington would propose a system more aligned to the number of students residing in Arlington, the fiscal impact on their residents could be substantially lessened. It may be a very long time before Arlington annexes the areas of unincorporated Shelby County where some of their students may reside. It does not make conservative fiscal sense to take the greater fiscal risk for those children or the students from Bartlett and/or Lakeland. Added to these potential additional property taxes can be some amount for OPEB benefits for their initial 456 teachers and staff, special education needs children, and the costs of matching the ‘leveled up’ teacher compensation.

MILLINGTON. Millington has 5 of the Shelby County Schools (SCS) buildings and 1564 Millington residing students now attend SCS schools. 3421 students attend SCS schools in Millington. Only 6 Millington residing students attend schools outside Millington. Of the 3421 students in Millington schools, 1437 live in unincorporated Shelby County. SES proposed a municipal school Millington residing students. SES recommended Millington annex the Lucy community annexation reserve area to reach the minimum state requirement for new municipal school districts to assure 1500 students in the schools or at least 2000 students presently enrolled. While the minimum state requirement of 15 cents of local property tax support for their municipal school system would produce $253,515, the proposed 0.5 percent sales tax increase would produce $1,386,290 or $1,132,775 more than minimally needed. However, if Millington only spends the average of FY 2011 SCS funding for their municipal system to start up in FY 2013 or later, but however (a) pays 50% of the cost of new schools for 4 of the 5 schools in their city, and (b) needs to increase school operation costs 10% for inflation, greater expectations or needs than SES budgeted, then they will need a $1.28 property tax increase, a 104% increase over their current tax rate of $1.23. The annual cost to buy 4 of their 5 schools is 64% of the total of the three defined cost of this analysis (the Total SES Shortfall plus 10% Cost of Higher Needs and Expectations plus Annual cost of Schools Purchase). If Millington would propose a municipal school system size closer to the minimum state requirement, the fiscal impact on their residents could be substantially lessened. Added to these potential additional property taxes can be some amount for OPEB benefits for their initial 246.5 teachers and staff, special education needs children, and the costs of matching the ‘leveled up’ teacher compensation.

LAKELAND. Lakeland has only 1 of the Shelby County Schools (SCS) buildings and 2204 Lakeland residing students now attend SCS schools. Only 831 students attend the SCS school in Lakeland. Of the 2204 Lakeland residing students, 111 attend Arlington located schools, 240 attend Bartlett schools, and 788 attend the single Arlington school. Of the 831 students in Lakeland ES, 19 live in Bartlett and 10 live in unincorporated Shelby County. SES proposed a single school municipal school district for Lakeland with 819 students, a system big enough for only 37% of Lakeland residing students. While the minimum state requirement of 15 cents of local property tax support for their municipal school system would produce $491,460, the proposed 0.5 percent sales tax increase would produce only $329,631 or $161,829 less than minimally needed. Lakeland and Arlington are the only two suburbs where the proposed 0.5 percent sales tax increase produces less than the minimum 15 cent property tax increase. Moreover, if Lakeland only spends only the average of FY 2011 SCS funding for their municipal system to start up in FY 2013 or later, but however pays (a) 50% of the cost of new schools for the single school in their city, and (b) needs to increase school operation costs 10% for inflation, greater expectations or needs than SES budgeted, then they will need a $0.34 property tax. Lakeland currently does not have a property tax. The annual cost to buy their 1 school is 34% of the total of the three defined cost of this analysis (the Total SES Shortfall plus 10% Cost of Higher Needs and Expectations plus Annual cost of Schools Purchase). If Lakeland decides to also have a property taxes over and above the 34 cent increase noted above. Added to these potential additional property taxes can be some amount for OPEB benefits for their initial 94 teachers and staff, special education needs children, and the costs of matching the ‘leveled up’ teacher compensation.

FISCAL IMPACT ON SHELBY COUNTY GOVERNMENT OF THE MUNICIPAL SCHOOL DISTRICTS.

There are several observation, albeit general and non specific, that should be noted.

1.If the Shelby County School Board does not allow a municipal school district to educate students from an unincorporated area, those students will stay in the Shelby County system and will need school buildings to house them. Many of the unincorporated students now attend schools in a suburb. If a municipal district acquires (buy, lease, or gift) the schools in their respective suburb, then the capital cost of new buildings for the unincorporated children will fall on all Shelby County taxpayers via Shelby County’s obligation to provide the capital funds for the Shelby County Schools.

2.Per 1 above and If the municipal districts have to pay to buy or lease the public schools in the suburbs, then that consideration could be used by Shelby County Schools to build the schools they may need for the unincorporated students. These funds would offset a requirement for Shelby County taxpayers to pay debt service on new bonds to replace the schools in the suburbs.

3. Creation of municipal school districts will reduce the teachers and staff of the Shelby County Schools which will in turn reduce the unfunded OPEB obligations of the Shelby County Schools.

Ritz spreadsheet