It’s a simple question, really, one I’ve heard numerous times in recent months: “Who’s going to live in all these new apartment buildings in Midtown?”

New complexes have sprouted all along Madison — across from Minglewood, next to Cash Saver, at the corner of McLean. There are new apartments at McLean and Union and more going up at Sam Cooper and East Parkway. There is no doubt that there is an apartment-building boom.

So, who’s going to live in all these new apartments? The question got even more interesting on the heels of just-released U.S. Census data that show Midtown and Downtown (where another apartment-building boom has occurred) both actually lost a little population between 2010 and 2020. There seems to be a disconnect.

I asked two developers (both of whom asked to comment anonymously) and a former president of the Memphis Area Association of Realtors. Interestingly, all pointed to the recession of 2008 as a major turning point in the housing market.

“After 2008, it was the same all over the country,” said one of the developers. “The single-family home building business got decimated, so the supply of new housing was constrained for a number of years. There was a demand shift to less owner-occupied housing, more rental housing. Some of that is still playing out.”

“Midtown is really hot,” said the other developer I talked to. “Houses go on the market and sell within hours. There’s not much new housing stock, really — nowhere to build. Developers develop what the market demands, and right now, that’s apartments. And these apartments are getting leased.”

Kathryn Garland, immediate past president of the Memphis Area Association of Realtors agreed that the Midtown market is tight. “It’s gotten to where some people might want to sell, but they’re afraid they won’t be able to get another house in the area, and they can’t afford to close on a new house before selling their old one, so they stay put, which keeps the market tight. And many landlords lost a lot of money during the pandemic because of the eviction freeze. I know some who are turning rental units into BnBs, just to try to recoup. And that also tightens the available housing.”

So how do we reconcile population loss with an apartment-building boom? There are several possibilities, not all mutually exclusive. It’s possible, for example, that Midtown’s population fell lower at some point, say 2015, and started to pick back up in the past couple of years, which looks like a boom. It’s also possible that the demand for Midtown housing and the attendant rental increases have driven the less-affluent to other neighborhoods, countering the population growth of new people moving in.

“I’m still not convinced the data has caught up with any of what’s happened in the past couple of years,” said one of the developers. “The pandemic has impacted housing in ways we’re still not completely understanding. People whose company headquarters are in New York or Chicago are now letting their employees work from anywhere. Some of those people are moving to markets like Memphis because they can afford nicer apartments and homes. We haven’t been able to quantify that yet, but it’s happening.”

“The pandemic is affecting the commercial market, as well,” said Garland. “Commercial realtors will tell you that the office space market has changed entirely. Companies are downsizing their space, moving to Zoom meetings, letting employees work wherever they like. Things are in flux.”

But what happens when all the young people moving in get older, have children, want a yard and a dog? Does the apartment bubble burst?

“Of course, the apartment bubble could burst,” said one developer. “You’re always trying to figure out your next move. Sometimes, you just pull in your wings and see where the demand goes.”

“Often, apartment buildings become condo buildings as demand changes,” said Garland. “There are lots of older folks, retirees, who are moving into apartments and condos in Downtown and Midtown when they downsize. Their homes out east get bought by young families. It’s all a cycle.”

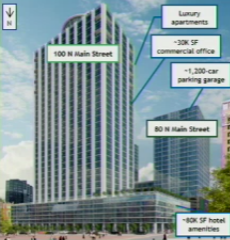

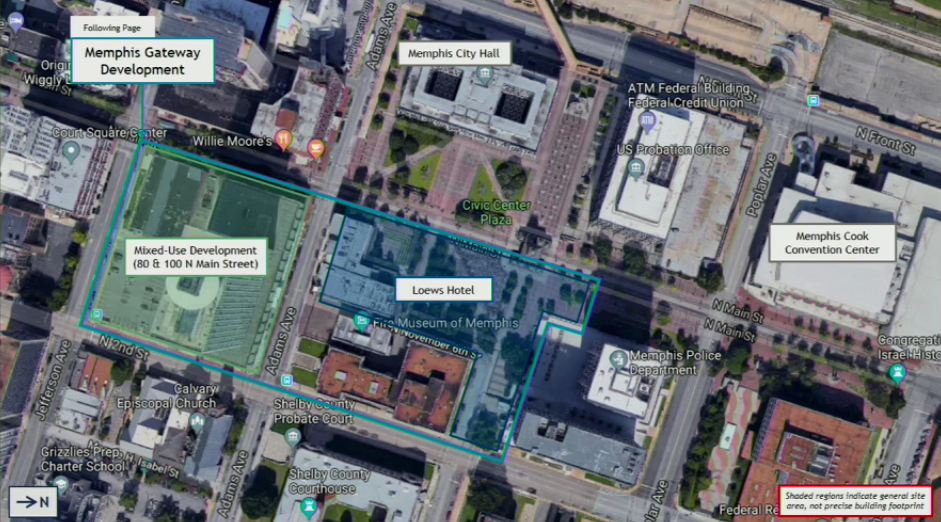

Townhouse Management Company/Lowes Hotel & Co

Townhouse Management Company/Lowes Hotel & Co  Townhouse Management Company/Lowes Hotel & Co

Townhouse Management Company/Lowes Hotel & Co

Courtesy of the Lofts

Courtesy of the Lofts  Courtesy of the Lofts

Courtesy of the Lofts  Courtesy of the Lofts

Courtesy of the Lofts  Courtesy of the Lofts

Courtesy of the Lofts