Cryptocurrencies have a massive environmental impact and Memphis’ low-cost energy could make it attractive for crypto mining operations – possibly driving up energy costs here.

Powering only the Bitcoin and Ethereum cryptocurrencies last year produced 78.8 million tons of carbon last year, the equivalent of tailpipe emissions from 15.1 million gas-powered cars, according to the U.S. Environmental Protection Agency (EPA). Environmental impacts like these from cryptocurrencies were the centerpiece of a Thursday hearing by the U.S. House Committee on Energy and Commerce.

Committee chairman Frank Pallone (D-New Jersey) said cryptocurrencies bring “enormous promise” and that the committee was not attempting to stifle innovation. Instead, the hearing was to put the environmental impacts out in the open.

“One estimate found that the energy required to process transactions on the Bitcoin network could power a home for more than 70 days,” Pallone said. “Last year, there were hundreds of thousands of transactions on this network. Just imagine the climate implications.”

Most of crypto’s environmental impact — energy consumption, carbon production, and electronic waste — is from crypto mining operations, according to Digiconimist, a website dedicated to tracking unintended consequences of digital trends. Miners are constantly working (largely through trial and error) to prepare a new set of transactions for the blockchain, a shared database that stores information digitally. To find new and valuable transactions, crypto miners employ massive amounts of computer power.

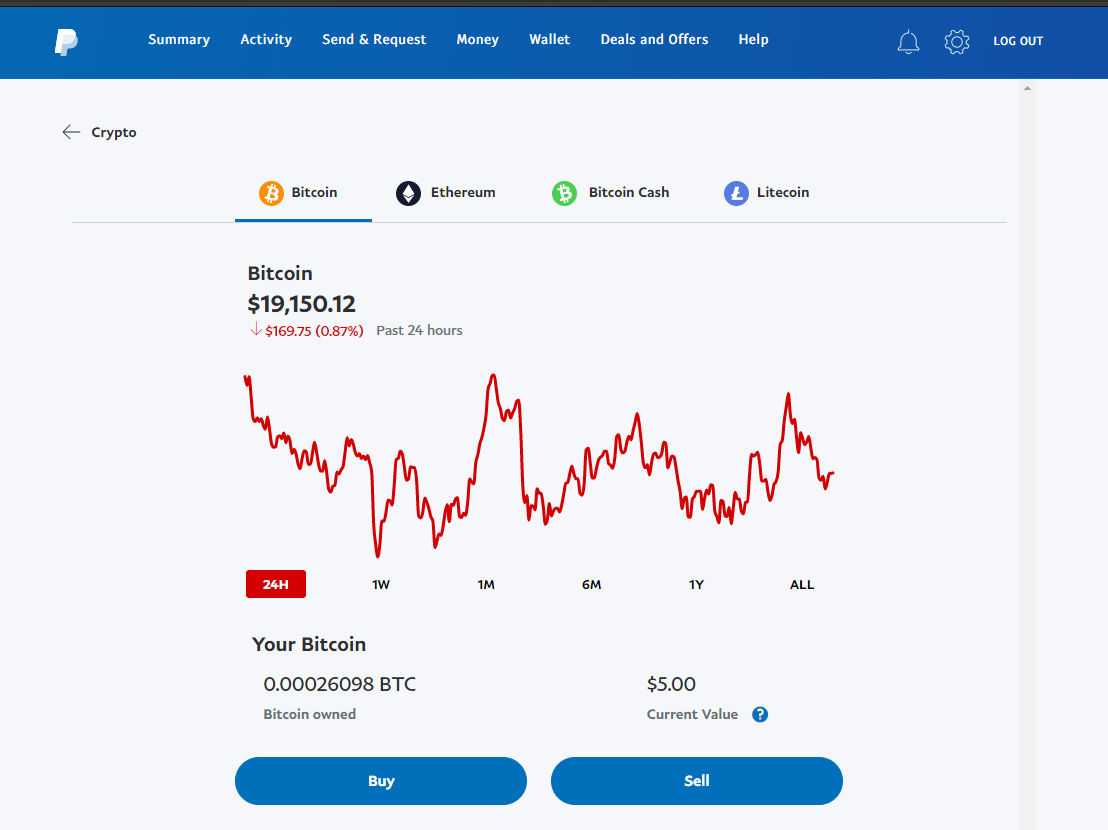

How much power? If Bitcoin was a country, it would rank between Thailand and Vietnam for annual energy usage, according to Digiconomist; and Ethereum energy use matches that of the Netherlands, per the website.

This need for power has some crypto investors looking to set up their mining operations in areas with low-cost energy to maximize profits. QuoteColo, a company that matches companies to an array of services like Bitcoin mining and miner hosting, said Memphis is a good place for a Bitcoin mining operation. For this, it cited the city’s low price of electricity.

Last week, the Tennessee Valley Authority (TVA) claimed Tennessee energy costs are lower than 80 percent of other utilities across the country. Should crypto miners rush to Memphis for low-cost energy, that could increase demand and increase prices. A University of Berkeley Business School study estimated crypto mining operations in upstate New York increased electric bills for small businesses by $165 million and by $79 million for individuals.

Four years ago in the Memphis subreddit, a user asked if others mined crypto here and the conversation went quickly to the cheap cost of electricity. One commenter noted that “university dorms are the best place for crypto mining. All the free electricity your rigs can guzzle down.” Another commenter said the energy prices in Memphis were so low, “it honestly doesn’t even matter where you run it from in this city.”

The crypto mining conversation does not seem to have made any public appearances in Memphis as of yet. No major announcements here from TVA or Memphis Light, Gas and Water. Though, QuoteColo listed some crypto data centers in Memphis, but no information could be immediately found to verify any of them.

However, the topic was top of mind in East Tennessee’s Claiborne County, also a TVA customer, this week. A company called ANKR wants to establish a “controversial” mining center there and the local power utility just signed a $9 million annual contract to supply it electricity. That move came after TVA approval.

The local utility would supply the facility with nearly 20 megawatts of power per month, according to the newspaper, at a cost of about $750,000 each month. The operation is not expected to raise rates in Claiborne County.

In Thursday’s House hearing, BitFury Group CEO Brian Brooks said a crypto mining operation should not be judged on how much energy it uses, but where that energy comes from. Digiconomist said most mining operations are in regions (like China) that rely on coal for power.

Brooks said people must prioritize energy needs based on value. For example, if crypto mining produces more value than gold mining, crypto should be prioritized. Digiconimist data say gold mining takes less energy than Bitcoin mining and produced about $189 billion more value last year.

Barbara Helgason | Dreamstime.com

Barbara Helgason | Dreamstime.com  Photo by Bitcoin BCH

Photo by Bitcoin BCH