State Capitol building

Tennessee lawmakers may have an extra $3 billion to budget this year, according to a new policy report from the Sycamore Institute.

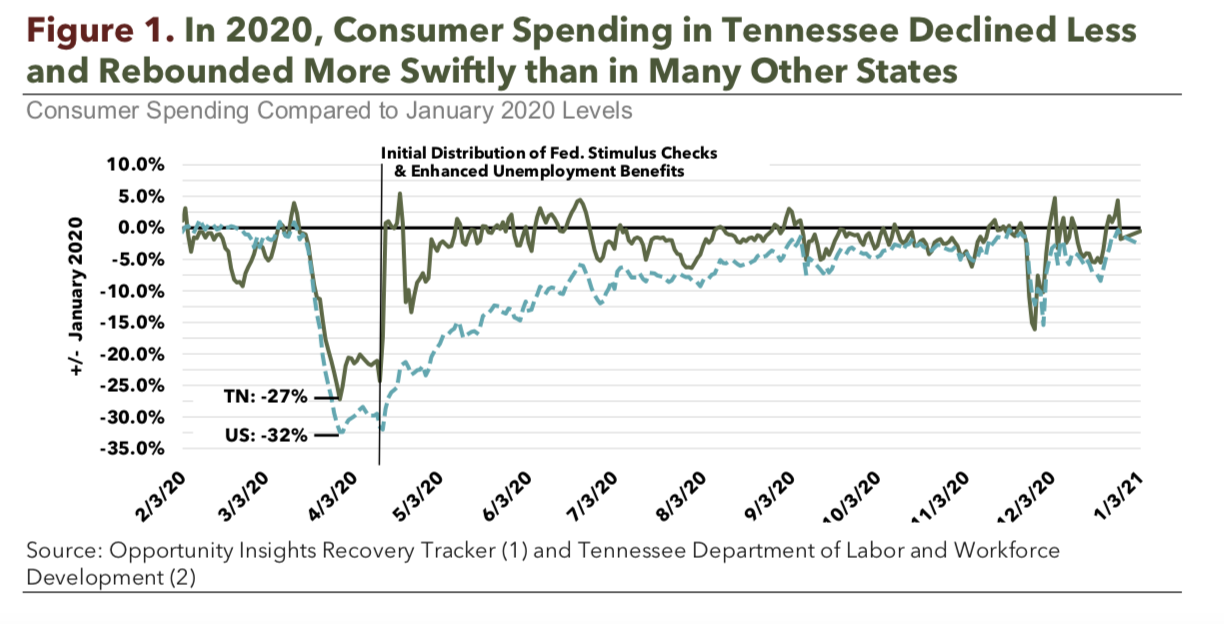

State coffers declined less and rebounded faster than in other states, according to the nonpartisan think tank based in Nashville. Consumer spending fell dramatically in March 2020 (27 percent lower than in January 2020). But spending here returned to near pre-pandemic levels soon after Tennessee received billions of dollars in federal CARES Act funding.

Sycamore Institute

Sycamore Institute

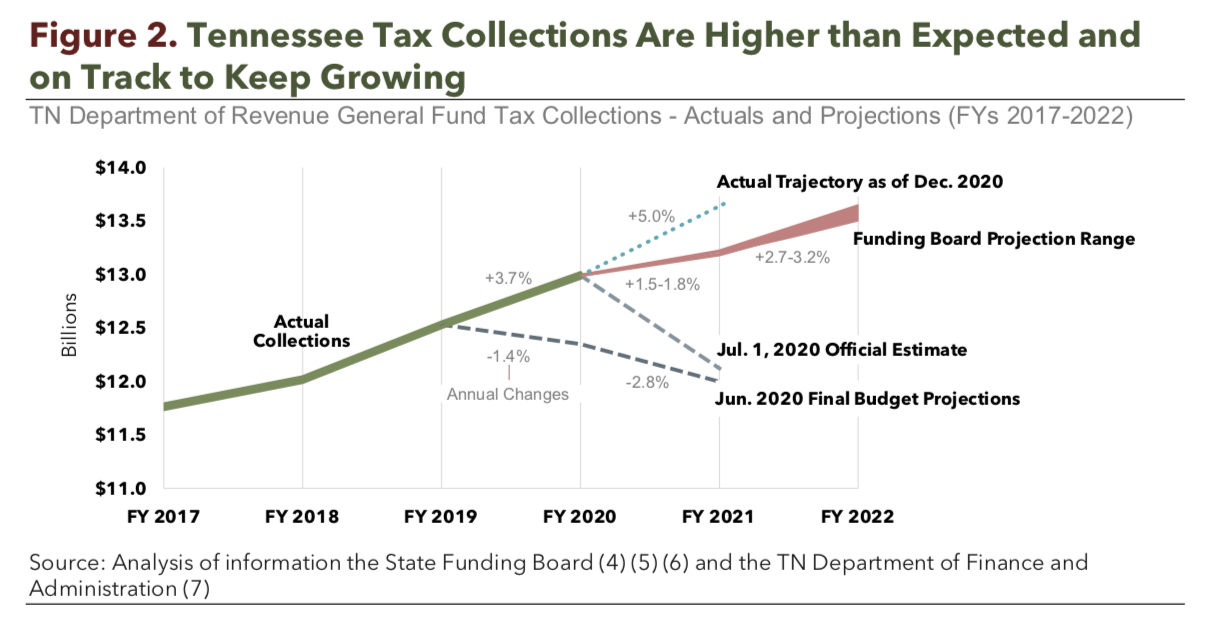

With this, tax revenue in Tennessee has “far exceeded expectations,” the report says. Last summer, policymakers projected dips (1.4 percent in 2020 and 2.8 percent for 2021) in Tennessee’s general fund. But the fund was up 3.7 percent at the end of the 2020 fiscal year. Five months into the new fiscal year, the fund has already beaten year-to-date estimates by $716 million. If the trend continues, the state’s general fund could end up 5 percent over the 2020 fiscal year.

Sycamore Institute

Sycamore Institute

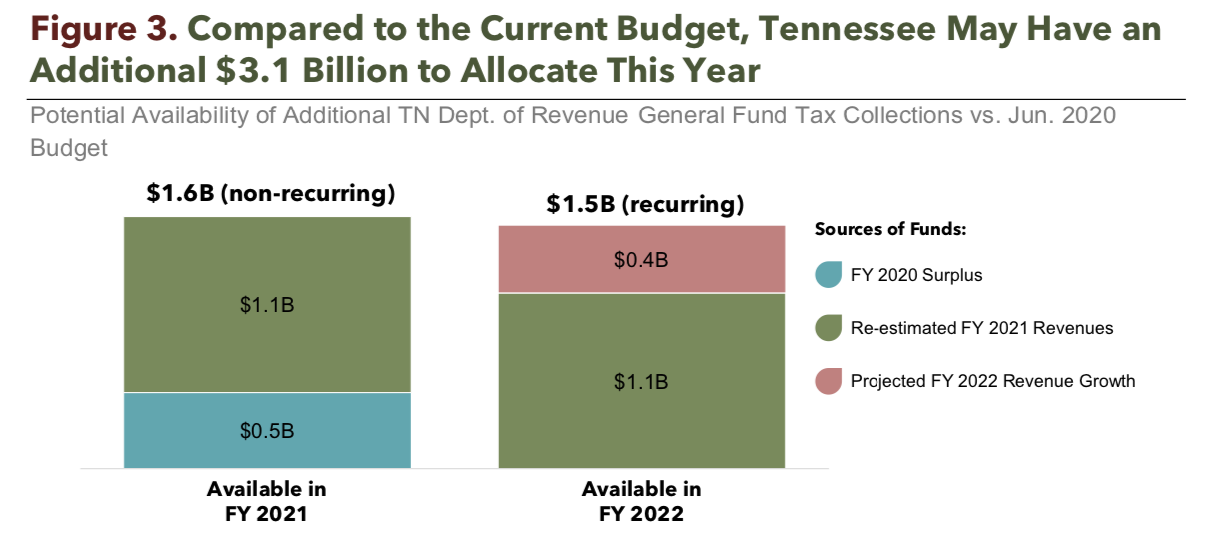

Here’s where the additional $3 billion will come from:

• $476 million (non-recurring) from the 2020 surplus.

• $1.1 billion (non-recurring) from projected 2021 collections above official budgeted estimates.

• $1.5 billion from the increased 2021 base plus projected 2022 growth.

Sycamore Institute

Sycamore Institute

“Some of this money has already been appropriated, but most remains available for the governor and [Tennessee General Assembly] to allocate,” reads the report. “During the recent special legislative session on education, for example, lawmakers appropriated $110 million of non-recurring funds for the current fiscal year. That money will increase the state’s share of the school funding formula for teacher salaries and for other activities to mitigate pandemic-related learning loss.

“A portion of recurring funds will also be needed to offset decisions made in June to ensure the budget was balanced in the face of uncertain revenues. The June 2020 budget was balanced but used some non-recurring actions to offset a projected $1 billion recurring revenue shortfall.

“Policymakers will likely first apply re-estimated recurring revenues to bring recurring revenues and spending into balance.”