Who made the best bid for Memphis Networx? Was it the well-funded seven-month-old holding company from Colorado — Communications Infrastructure Investments (CII)? What about New York’s proven infrastructure firm American Fiber Systems (AFS)? Or was it BTi Corporate (BTi), the darkhorse candidate that wants to turn Memphis into the bio-tech research hub of the Americas?

MLGW’s board says CII won the bid fair and square. The other bidders say the fix was in from day one.

It might be helpful for the City Council to hear all three companies explain why they think they made the best bid. But given the long, strange saga of Memphis Networx, such an occasion might distract from the unspoken question that loomed like a family curse over last Thursday’s vote by the MLGW board to sell Networx for a cash return on its $29 million investment of just $994,000: Namely, how in the world did Memphis Networx become lodged so inextricably between the frying pan and the fire?

Networx representatives made the case that delaying the company’s sale any longer will send it into a tailspin of irreversible loss. “It’s now or never” has been a reoccurring theme in the Networx debate. But when “now” is a paltry return of $994,000, “never” isn’t much of a threat.

The MLGW board meeting did reveal several apparent flaws in the bidding process. A presentation delivered by the McLean Group — the consulting firm hired to assist Networx through the sale — may have done more damage to the credibility of the consultants’ ultimate findings than anything brought to the podium by angry representatives of AFS and BTi.

McLean Group chairman Dennis Roberts and junior consultant Tom Swanson made the losing bidders sound so bad it became impossible to imagine how such nonserious bidders could have made it to the final three in the first place.

As the deal was explained to the media by Nick Clark — who sits on the boards of both MLGW and Memphis Networx — the bidding process was managed quietly through the McLean Group to weed out frivolous bidders and to avoid conflicts of interest. In a sneering assault on BTi’s credibility, one McLean Group consultant announced that a BTi principal had been making his living installing stereo equipment. (BTi founder and CEO Paul Allen has since stated that nobody in his telecom company has ever installed stereo equipment.)

The McLean consultants also said Allen’s company didn’t follow the rules and that its bank letters were unconvincing. They said BTi representatives didn’t show up for a scheduled due diligence meeting. (BTi has given the Flyer a letter from Thomas Murray of Fifth Third Bank reconfirming its interest in financing the Networx purchase based on a thorough process of due diligence.)

AFS’ problem, as identified by the McLean Group, was basically that they couldn’t show anybody the money. AFS has filed a declaratory action suit to prove their seriousness.

No BTi representatives were present when McLean consultants trashed their company’s bid, but AFS CEO Dave Rusin was visibly disturbed by the McLean Group’s findings. He shook with anger at times while explaining in measured words how his company survived the dot-com crash in 1999, weathered the telecom meltdown of 2001, and is a serious and reputable company.

He convincingly answered charges that his company wasn’t good for the cash by asking what was wrong with the $60 billion available to AFS’ historically cooperative financiers: Sierra Venture Partners, Lucent Venture Partners, North Atlantic Capital, and Hamilton Lane.

Dave Danchak, AFS senior vice president of corporate development, angrily said that the McLean Group’s figures didn’t look like anything he’d ever seen before.

Germantown resident David McCabe, a representative of BTi Corporate, arrived for the second half of the marathon meeting.

“They’re hiding something,” he insisted, accusing the McLean Group of spinning the facts.

McCabe also challenged the McLean Group’s assertion that BTi missed its due diligence meeting. He said that Networx representatives called unexpectedly on a Wednesday afternoon and asked if BTi could assemble its team and be in Memphis the next morning. According to McCabe, doubts were expressed on the front end as to whether or not his people could make it on such short notice, but they said that they would be in Memphis as soon as possible.

McLean consultant Swanson admitted that the due diligence process had been “accelerated,” a fact conveniently left out of the McLean Group’s original narrative, which alleged that the stereo-installing bunglers of BTi just couldn’t follow the rules. “Their story keeps changing,” McCabe declared.

After listening to McCabe’s indignant rebuttal of the McLean’s Group’s analysis, the MLGW board concluded that the McLean Group and BTi had had “a miscommunication.”

Although Rusin and Danchak of AFS had initially refused to comment on BTi’s proposal, the AFS reps returned to the podium and expressed sympathy for their competitor.

“Mr. McCabe talks about how the story keeps changing,” Rusin said. “Well, guess what? We come here today and find that the numbers have changed.”

Rusin and Danchak then unveiled their company’s lawsuit. MLGW board chairman Rick Masson expressed concern that the suit was part of an intentional ploy to further devalue Networx, which has only enough operating capital to survive for a month to 45 days.

CEO Dan Platko then delivered a grim assessment of Networx’ financial condition, and Clark described what might happen if the sale was delayed. Staff cuts would be necessary, he said, service would then decline, and customers would flee. According to Platko and Clark, it was doomsday eve for Networx, and the clock was ticking.

In spite of potential conflicts of interest, Clark maneuvered back and forth between his dual roles as MLGW governor and Networx board member. He spoke of the need for a transparent process and occasionally played the role of devil’s advocate, despite the fact that the Networx board had approved the sale to CII and had signed a binding agreement with the company.

Clark cited a Flyer story and asked a series of questions supposedly based on this newspaper’s ongoing coverage of the Networx sale. But Clark’s Flyer-based line of questioning left out the same embarrassing facts about possible conflicts of interest that were raised in the article that he’d omitted in a previous report to City Council chairman Tom Marshall.

After confirming that Platko had once been employed by Intira, a company co-founded by former Networx CEO Mark Ivie, Clark moved to another subject, without mentioning the fact that Swanson — the McLean Group’s allegedly unbiased third party — had also been a vice president at Intira. Nor did Clark mention that Swanson, prior to assuming his McLean Group duties, may have accepted a lucrative, paid consulting gig with Networx via his personal firm, TJSwansonCo.

After Clark’s omissions were noted, Platko and Swanson admitted that they’d worked together at Intira. Swanson later said that prior to the Networx deal, he and Platko hadn’t done business together since leaving Intira. However, a contract signed by Platko on October 5, 2006, suggests that Networx’ chief executive offered Swanson $2,000 a day for consulting with Networx’ sales division, a month before the McLean Group was called in to assist in Networx’ eventual sale.

The information becomes doubly troubling in light of Networx officials’ repeated failure to identify Swanson as having any duties above and beyond the work he was doing through the McLean Group. (Detailed questions submitted by the Flyer to Swanson and Platko have yet to be answered.)

“It was an imperfect process, but it’s an imperfect world.” This, more or less, was the opinion MLGW board members unanimously expressed prior to finally signing off on the sale of Networx to CII.

In a two-to-one vote with one abstention, the board passed a resolution to go forward with the sale of Memphis Networx to CII. In light of AFS’ lawsuit and mounting concerns within the City Council, it’s unclear what that resolution ultimately means.

Documents dating from 2004 show that Networx executives and at least one board member were actively negotiating to sell Memphis Networx to AFS in an unpublicized all-stock deal.

Although sources conflict on the details, it appears that Networx officials’ enthusiasm for closing the original deal may have faded when it was discovered that the offer would be small and paid in stocks, especially in light of the fact that MLGW, as a publicly held company, is prohibited from owning stock in a private company.

When asked last Thursday, Networx board member Andrew Seamons said it was highly unlikely that any of the private investors would have an interest in absorbing the AFS stock into their share of the sale. Seamons is professionally affiliated with Pitt Hyde’s Pittco investments. Hyde, who recently stepped down from his position as AutoZone chairman, is one of the original private investors in Memphis Networx.

Over the weekend, one highly placed proponent of the Networx sale to CII circulated news items intended to prove BTi was in over its head on the Networx deal.

Considering the board’s vote to sell Networx to CII, it’s hard to imagine what anyone stands to gain by further discrediting BTi. Unless it’s the fact that continuing the debate over who placed the best bid shifts focus away from the only questions that matter: When did Networx’ executives know the company was in a tailspin; and how were the company’s finances managed from that point on?

If the McLean Group was contacted to assist with the sale of Networx in December, as reported, serious concern over the company’s finances had to be growing by the time Platko offered Swanson $2,000 a day for services that have yet to be sufficiently explained.

Networx’ history of questionable decision-making ranges from disastrous technology purchases to a miscalculated deal with ServiceMaster that cost the telecom thousands of dollars a month for nearly a year. How did that history change when new CEO Platko found out that his company was in serious trouble? Did he tighten up the company’s belt or did he enable spending that further exacerbated Networx’ dire situation?

Platko and his predecessors had the advantage of using Networx’ private status to withhold information whenever anyone attempted to delve too deeply into the specifics of the company’s spending practices. The choice Networx executives have given its public owners — nothing or next to nothing — demands answers not available in the financial postmortems Clark has delivered to the press.

Epilogue: When Platko replaced his former colleague Mark Ivie as head of Memphis Networx in 2006, MLGW’s ratepayer/owners were not notified of the change. Clark, an appointed steward of the public’s interest in Networx, has described the lack of attention given to such changes at a company funded (in part) by public dollars as “fortunate.” To interpret his comment as “the less the public knows about what’s being done with its money, the better” may be unfair, but it’s also unavoidable.

Clark says he recognized that Networx was experiencing trouble when he joined the board in 2005. Ironically, given the final outcome, he says he kept quiet for fear of scaring off potential customers.

MLGW has fully enabled this disaster. Its board members have harbored concerns about Networx’ financial well-being for at least two years but allowed Networx to keep a low profile while the telecom was clearly wasting away. Silence and complicity in the name of maintaining Networx’ “competitive edge” precipitated MLGW’s recent “damned if you do, damned if you don’t” decision, wherein the only thing worse than selling its valuable telecom asset for a $28 million loss is not selling it right now … for a $28 million loss.

On Tuesday the Memphis City Council voted to discuss Networx-related issues at a meeting of the MLGW committee. Details of that committee meeting were not available at press time.

See MemphisFlyer.com for updates on the Networx story.

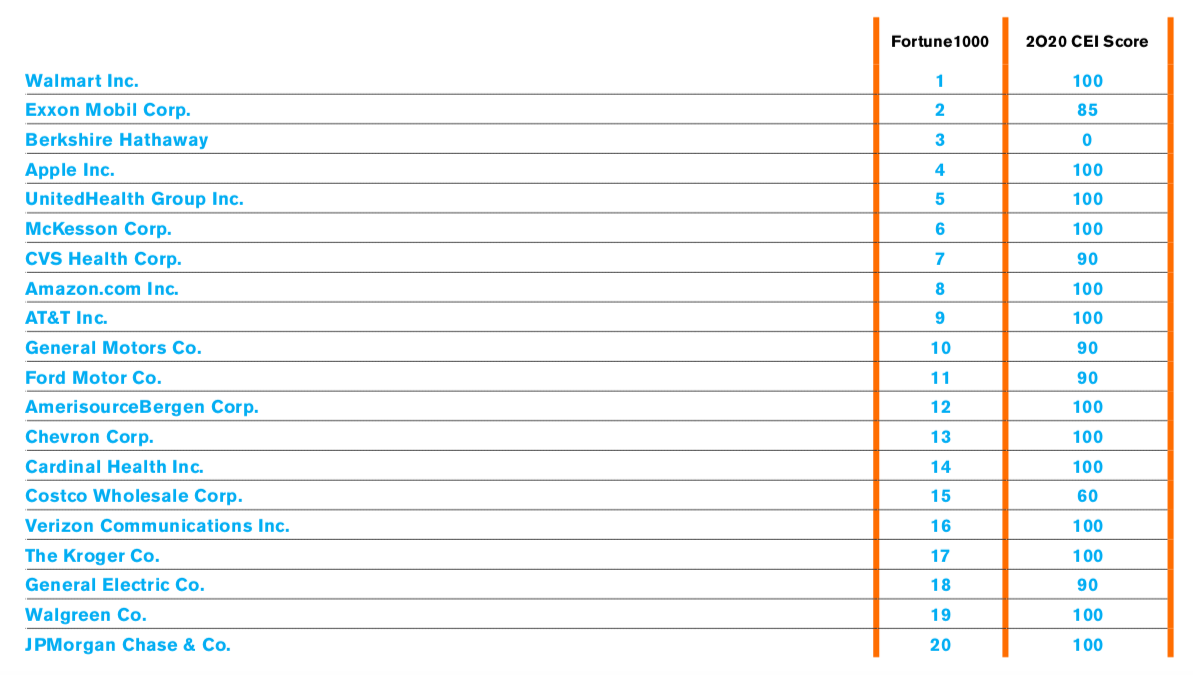

Human Rights Campaign

Human Rights Campaign