After the Shelby County Commission’s marathon 7 ½-hour special called meeting

JB

JB

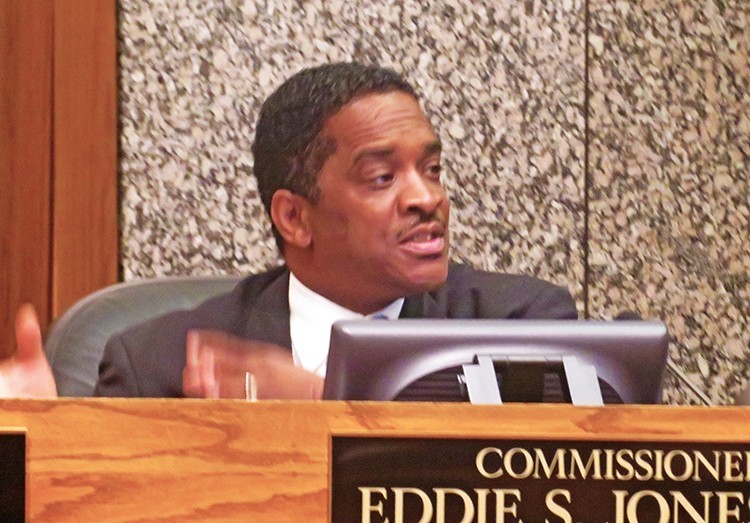

Key voter Eddie Jones

on the budget Monday night seemed to produce a consensus in favor of a $4.10-cent tax rate (with the final vote pending), Commissioners engaged in a much briefer discussion in committee on Wednesday.

They recapitulated the opposing positions in the far briefer span of 40 minutes, and this time reversed course with a 5-4 party-line vote in favor of a $4.13 rate — one that maintains a revenue base that the administration of Mayor Mark Luttrell regards as stable and that eschews the prospective tax cut that dominated discussion on Monday.

Wednesday’s vote was a pure party-line affair, with the Democrats present voting for the higher rate and the Republicans on hand going for the lower rate. To be sure, the regular Commission meeting scheduled for next Monday, when more Commissioners (probably all 13) will be present, could swing momentum back toward the tax-cut rate, but one fact argues against that.

The fact is that the Commission’s Republicans, at full strength and unified, add up to only 6 out of 13 members and usually need to peel away one Democrat or perhaps two to vote their way — in this case for the $4.10 rate and for a tax cut.

There are two inner-city Democratic Commissioners whose tendency to vote along with the GOP members is almost proverbial. They are Eddie Jones and Justin Ford, both of whom were being counted on by some key Republicans to cross over one more time. Ford was absent on Wednesday, but Jones was there, and he voted along with the other Democrats for the $4.13 tax rate.

Jones was one of the final speakers on the issue in Wednesday’s opening budget committee. His remarks — including a comment that Wednesday’s vote was “not the end of the road, just a fork in the road” — hinted at some residual flexibility on the issue. But, should he stick with the rest of the Democrats on Monday, and should Ford also hew to the party line, both the $4.10 rate and the suburban GOP dream of a tax cut are dead in the water

That outcome would suit the administration just fine. Harvey Kennedy, Luttrell’s CAO, began the tax-rate discussion Wednesday by commenting that, while the administration could make $4.10 work “if it’s the will of the body,” it continued to be opposed to the lower rate as too restrictive. And County finance director Wanda Richards added a warning that the $4.10 rate “down the road will increase our dependence on debt.

From that point on, a mini-version of Monday night’s lengthy debate ensued.

“Giving back to taxpayers” vs. “”a false narrative”

Millington Republican Terry Roland insisted that, during the seven years so far of his tenure, “this is the first chance we’ve had to give something back.” Germantown Commissioner Mark Billingsley argued in like manner: “I’d like to see us put a few dollars back in our citizens’ hands.”

Democrat Reginald Milton, whose special concern these days is public health, particularly the financial needs of Region One Hospital (formerly The Med), said he was “sympathetic” to taxpayers’ desire for some relief, but that, in view of the ongoing medical crisis, it would be “practical to maintain our dollars until we can see what happens.”

George Chism of Collierville would tilt back the other way. Focusing on the need for business and industrial expansion, he said that, for the sake of all citizens, “We gotta have some victories,” meaning a tax rate that would attract, rather than discourage, new investment.

Veteran Democrat Walter Bailey would have none of that, calling the idea of “giving back” a “false narrative:.” He put it baldly: “Rich people don’t need government. The working class and the poor need government services.” And service, he said, was “where we fail.”

After Roland and Republican Heidi Shafer weighed in again for the $4.10 rate (Shafer making a familiar argument that tax cuts spur growth), Bailey called for a vote, which ended with the aforesaid 5-4 outcome.

Van Turner, who as vice chair was presiding over the discussion, substituting for absent budget chair Steve Basar, then pointed out that, for procedural reasons, another vote had to be taken in order to complete the second reading of what was now an amended tax rate.

But first the Commissioners on hand then went through their appointed motions a second time. Roland began by seeming to suggest that, if necessary to support the lower tax rate, he would favor holding up on a prior vote to add 24 Sheriff’s deputies. Billingsley, who chairs the Commission’s law and order committee, said he, too, could “back away” on the new deputies and went on to interject an unexpected and potentially controversial argument.

Heat Over Community Grants and PILOTS

He turned the subject to something that had generated some unexpected heat during Monday’s prolonged debate — the matter of grants to putatively deserving local community causes and organizations. Mayor Luttrell professed hmself “troubled” and “gravely concerned” about how and whether the grants, administered by individual Commissioners from their own designated funds, were being accounted for.

“If you screw it up, you can go to the pokey,” Luttrell said, in support of adding a mechanism to monitor the grant process.

The process of allowing each of the 13 Commissioners to have a de facto fund for designating such outlays — called “community enhancement grants” — had been an innovation during this past fiscal year, one sponsored by Commissioner Milton, and on Monday he and the Mayor engaged in some intense sparring over the issue, with the Commissioner defending the purpose and accountability of the process.

Both Luttrell and Milton had grown hot under the collar, at various points each accusing the other of questioning his integrity.

Re-igniting the argument on Wednesday, Billingsley declared that, if necessary to create the possibility of a tax cut, “we cannot support the fluff,” and he spelled that out to mean the prospect of deleting the Commissioners’ individual community grants. (An amendment to that end by Bartlett Commissioner David Reaves had failed on Monday.)

Suddenly the Germantown Republican adopted a surprising and paradoxical-sounding rhetorical position. “I spend every day fighting for the poor,” he said, characterizing the proposed tax-cut rate as a question of “3 cents for the poor in Shelby County.” Roland chimed in that he, too, could be brought to support a “scorched-earth” policy.

Bailey pointed out what he regarded as the obvious, that cutting taxes was not a concern of the poor but that access to services was.

Both Jones and Roland continued in a populist vein and managed somehow to get on the same rhetorical page, though arguing for different tax-rate outcomes, with Jones denouncing the tax giveaways of the county’s PILOT (payment-in-lieu-of-taxes) arrangements and Roland thundering against the joint city/county EDGE board for its ability, independent of Commission oversight, to approve tax abatements.

Brief as that part of the discussion was, it augured a different, perhaps unifying theme that could potentially be picked up on Monday when, as Turner had said, either the $4.13 tax rate or the $4.10 rate could win out, in whichever case a final reading would be called for in a special called meeting for later next week.