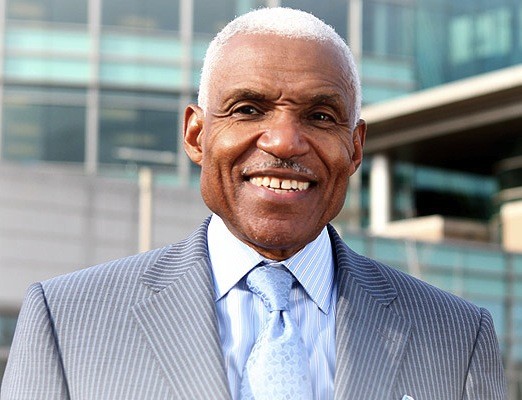

Shelby County Mayor Lee Harris took aim at city and county tax breaks last week and pulled no punches, calling components of it “made up” and “laughable.”

Harris spoke candidly about the issue during a panel convened last week by The Beacon Center, a Nashville-based free-market think tank. The panel included Mark Cunningham, the center’s vice president of strategy and communications, and was moderated by Otis Sanford, Memphis journalism professor, columnist, and television commentator.

The conversation followed an online viewing of a documentary called “Corporate Welfare: Where’s the Outrage?” (below). The film features The $9.5 million tax break given by Memphis and Shelby County in 2015 to lure Swedish retailer Ikea to Germantown Parkway. (The company returned some of the money in 2019 after failing to meet job numbers set out in the original agreement.)

Harris has been publicly against tax breaks for some time and said (as he did again last week) that investing in infrastructure like schools, roads, and law enforcement would do more to lure companies to Shelby County.

Here are some of Harris’ hardest-hitting quotes from Thursday’s discussion:

• “I am generally against tax breaks for corporations. One of the main reasons is because it sets up government to pick winners and losers, to decide which companies should get a government subsidy and which companies should not.”

It sets up government to pick winners and losers.

“Those kinds of things should be determined by the market, by what consumers demand, and by entrepreneurship, and what kinds of companies are good at their craft, not by government.

“This idea that government somehow steers a company one way or another doesn’t sound believable to me.”

On the prestige of having an Ikea and the competitive pressure to woo the company here:

• “This stuff is just made up from the start of it to the end of it.”

This stuff is just made up from the start of it to the end of it.

“A few weeks after [Ikea] got the millions in tax breaks from Memphis and Shelby County, they announced that we’re going to also open something in Nashville and they continue to open stores all across the country.

“It’s just made up stuff. It’s a made-up theory about how the economy works. It’s a made-up theory about ‘if we do this, they’ll go somewhere.’

“Businesses want to achieve profitability. That is what drives their decision-making. Government’s getting in the middle of it actually hurts and hinders all of us. It doesn’t help them to make their businesses better. It hurts us all.”

• “That’s what I’d say about the repetitional effects: They just weren’t there. [Ikea was] announcing these openings all over the place. So, those things are just made up to get the tax breaks and they tell you what’s really happening.”

On why politicians support tax breaks:

• “I think it’s just the idea among politicians is still — that for the last 50 years or more — jobs has been such a high-polling issue. So, if you want to attach yourself to that high-polling issue, this is one way to attach yourself to it.”

You just got to understand that the businesses create jobs, not government elected officials.

“But … if you go back to the fundamentals of the economy, government officials don’t create jobs except jobs in government, right? You just got to understand that the businesses create jobs, not government elected officials. That just doesn’t really happen. They come, but it doesn’t really work that way.”

On why tax breaks continue:

• “The system [for tax breaks] already exists. The consultants are already out there.

“[Consultants] produce the reports, which are generally not worth a lot. They come with these packages to say, ‘Hey, we can get you a little extra.’

“So, from the business perspective, they start to feel like suckers. If they say, ‘No, no, no, I’m all about the free markets.’ They’re almost boxed into saying, ‘Okay, you’ve got a package of incentives and subsidies that you can bring from a municipality or from a state. I’ll take it.’”

So, from the business perspective, they start to feel like suckers.

“So, the businesses are boxed in, too, even if they agree that it would be better to not have this practice at all.”

Sanford: What if Memphis and Shelby County decided to get out to the tax break game? Wouldn’t that depress the economy here?

• “I don’t think it has an effect on these kinds of decisions. Governments are in charge of some things. They’re in charge of infrastructure in schools, and crime, a lot of quality-of-life-kinds of issues.

“At the margins, executives are making decisions based on those issues. Can I recruit other executives [to the city]? Is it a place families want to live?

“So, if we shifted from economic incentives to quality of life [improvements], we all know, or we all should know, that we would get a lot more benefit. If you have high-quality schools, and low crime, and great roads, and bicycle lanes, we all know that that’s a thriving community and that’ll be very appealing.”

Tax cuts for all:

• “There are alternatives; just give everybody a tax cut, right? Everyone agrees that any level of tax cut across the board, is going to stimulate the economy. There may be some disagreement about how much a tax cut stimulates the economy, but every tax cut helps the economy.”

• “If you do shift away from this winners-and-losers mode into a general tax cut mode, then you can stimulate a whole bunch of additional economic activity.”

We don’t even know how much money we’re giving away, right?

“First, you’ve got to quantify where the incentives are, which no one does a good job at, right? We don’t even know how much money we’re giving away, right?

“But if you were to quantify it and know what you were giving away and then shift as much as possible to just the general-tax-cut mode, then you can create a whole lot of additional economic activity, the same way that some of these other things like infrastructure, schools, law enforcement, and crime reduction create.”

On companies living up to their promises and clawback protections if they don’t:

• “They definitely don’t [have to live up to promises].”

We were told for years, “we’ve got these clawbacks” and “there are these clawbacks coming.” I mean, it’s laughable.

“We were told for years, ‘We’ve got these clawbacks’ and ‘There are these clawbacks coming.’ I mean, it’s laughable.

“I’m not trying to belittle anybody. But it’s just the truth of the matter. We don’t have clawbacks. We didn’t get anything back. It doesn’t happen.

“I’m not trying to belittle anyone because I understand the need to talk about jobs and it’s a really, really high-priority issue, but I’m just saying when these deals are done and put together with the customer, they just don’t happen the way they are advertised to happen.”

Beacon Center of Tennessee

Beacon Center of Tennessee  LRK/FedEx Logistics

LRK/FedEx Logistics  Jake Giles Netter/NBC

Jake Giles Netter/NBC

Wiseacre Brewing Co.

Wiseacre Brewing Co.

Tennessee Arts Commission

Tennessee Arts Commission  Shelby County Commission

Shelby County Commission  Raymond James

Raymond James  Belz

Belz