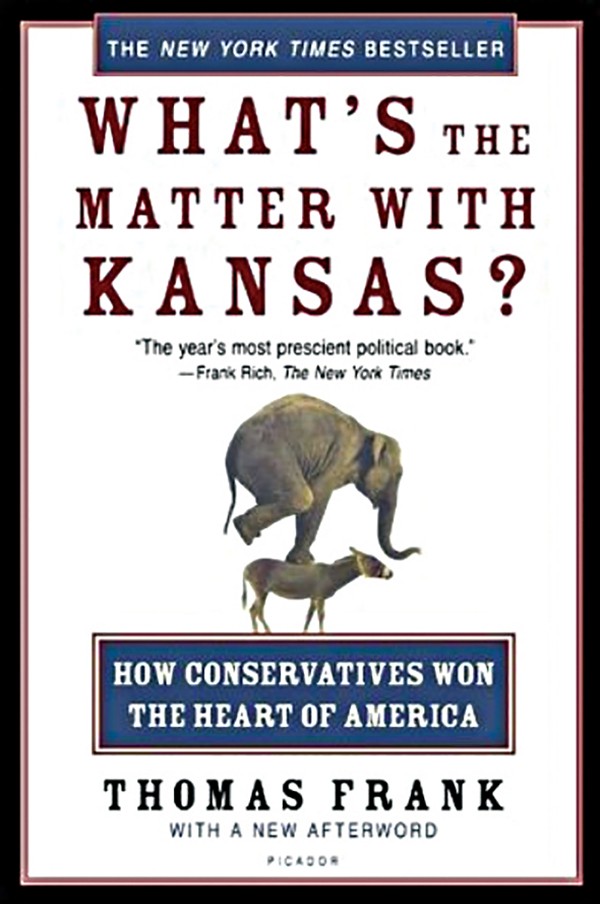

Parts of Thomas Frank’s What’s the Matter with Kansas?, a cheeky exploration of voters’ tendency to undermine their own self-interests, hold up better than others. Especially in this political era, I’m not sure if latté liberals’ fancy vocabularies drove working-class “values voters” into the arms of tax-spurning billionaire deregulators as much as Frank believed. And by using Kansas, a state whose population is 5 percent African-American, to illustrate his “backlash” phenomenon, Frank was able to conveniently ignore the large and growing segment of working-class Americans who still vote blue.

Whether by intention or not, the book’s enduring message comes in a critique of neoliberal policies — deregulation, union-busting, and the practice of luring businesses with economic incentives in the name of “job creation” — that are largely tolerated, despite their toxicity. It’s as if people stop listening when they hear “job creation” — just don’t tell them how much they’ll pay or who’s footing the bill for this “investment.”

I’ve been thinking about that critique a lot since Electrolux announced it would be shuttering its plant, well before the expiration of its PILOT agreement. Why was such a risky deal pushed through so quickly? Where was the outrage over the lack of of a clawback provision? The sub-optimal salaries? The $40 million commitment from the city and county? Were we so drunk on job juice that no one spoke up?

I’m no economist, but it was one-sided from the start. It’s a deal bad enough to make even Chris Wallace cringe. Sure, there was skepticism in 2011, after the deal was done and the shovels-and-hard-hats photo op had already taken place. But the jobs were the lede. The ugly details weren’t in the press release.

When the deal was announced, the unemployment rate in Shelby County was about 10 percent. For context, it was 3.6 percent in December. The hope, no doubt, was that a well-known brand and 3,000 new jobs would accelerate recovery from the recession. If the city, county, and state didn’t make the commitment, someone else would. That was the cost of doing business. Incentives are a necessary evil.

If that’s so, how do we prevent this from happening again? And who else is preparing to weigh anchor before the tax bill comes due? How much of the momentum I keep hearing about is fueled by property taxes?

Back to Kansas for a moment: Kansas City, Missouri, and Kansas City, Kansas, were engaged for years in a race to the bottom for taxpayer-funded business investment. Companies would take short-term leases to leverage a sweeter incentive package across the river. Over a five-year period, according to a Hall Family Foundation study, Kansas and Missouri gave up $200 million in tax revenue for 400 jobs. Kansas had paid $340,000 per job. In 2011, an alliance of Kansas City businesses petitioned both states’ governors to figure out a better way.

Yes, this was happening as Memphis, Shelby County, and Tennessee were filling a vault with coins for Electrolux to dive into, Scrooge McDuck-style. Set that aside for a moment. It was the businesses who said, “This isn’t really helping us as much as you think.” The so-called border war became so costly, both states — Missouri in 2014, and Kansas in 2016 — have proposed truces.

It’s an extreme example, but Memphis, as a neighbor to Arkansas and Mississippi, is in a position similar to the Kansas Cities. Memphis is in a financial position that necessitates creativity and restraint, and with a lot of in-state competition in Nashville. I get it. But if incentives are necessary, so is transparency. So is equitable pay.

Basically, we’re told, we can’t get by on our charm and good looks alone; to get the big boys to notice us, we’ve got to put out. Fine. There’s a difference between flirting and begging for a date, though. It’s nice to see local and state officials working to recoup Electrolux’s tax backlog and prevent such a swindle from happening again, but it never should have happened the first time. Not without public input. Not without taxpayer protections in place, should the company decide to bail on Memphis the way it bailed on its facility in Canada (spoiler alert). There were signs.

We should be angry that Memphis is, yet again, starring in a cautionary tale. That money ain’t coming back. However, there may be a hidden opportunity to reshape the definition of “business-friendly.” Communities in every state are dealing with this. Maybe we can be the ones to say, “We make the rules now.” If there’s any positive takeaway from this debacle, it’s that more people are paying attention. I hope our leaders are prepared to start answering more questions.

Jen Clarke is a digital marketing specialist and an unabashed Memphian.