TVA

TVA

TVA’s new natural-gas-fueled Combined Cycle Plant.

A report released Wednesday by Friends of the Earth (FOE) anticipates Tennessee Valley Authority (TVA) “substantially” raising rates for customers over the next ten years.

Memphis Light, Gas, and Water (MGLW) is currently in the process of doing an Integrated Resource Plan to determine if it should consider getting power from an alternative source (other than TVA) in the future. The utility formed an advisory committee in April to weigh the option of alternative power sources.

Earlier this year, a study ordered by FOE and completed by the Brattle Group concluded that switching from TVA could save MLGW $240 million to $333 million each year.

The new report issued Wednesday, conducted by Synapse Energy Economic, Inc, concluded that several factors could require TVA to increase its rates, which would ultimately lead to higher bills for customers.

From 2006 to 2018, TVA increased rates for MGLW by 30 percent, according to the report. Last year the utility purchased a little over $1 billion worth of electricity from TVA.

“The TVA’s rates have increased substantially over the last decade and this new report illustrates they are likely to increase substantially over the next decade, even if TVA claims they won’t,” said Herman Morris, former MLGW president and advisor to FOE. “The TVA will pay the price for its outdated, dirty power and pass the cost on to Memphis families and small businesses if we don’t make a chance to alternative power sources.”

The study highlights five risk factors that could cause TVA to raise its rates for local power companies like MLGW. Those factors include coal ash remediation, fossil full price increases, carbon prices, early plant retirement, and load departures.

[pullquote-1] Coal Ash Remediation

The remediation of coal ash or Coal Combustion Residuals (CCR) represents a larger potential cost for TVA, the reports says. TVA is committed to elimination the wet storage of CCRs in its service area. The utility is expected to spend $1.2 billion to do this over the next three years, yielding a possible rate increase of up to 2.3 percent.

Fossil Fuel Prices

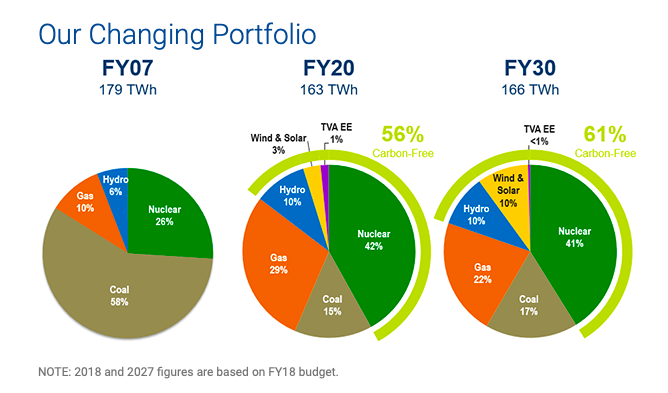

The price of fossil fuels are expected to rise “significantly” over the next two decades, the report predicts. The price of coal, from which TVA generates 19 percent of its energy in 2018, is expected to increase by over 50 percent by 2038, while the price of natural gas, used to generate 20 percent of TVA’s energy, could double. As a result, rates could increase by 1 percent to 6 percent.

Carbon Prices

The report suggests that as efforts increase to combat global warming, there will be increasing costs associated with carbon emission. The study estimates that cost to be between $5 and $22 per ton of carbon dioxide in 2028, costing TVA anywhere from $125 million to $1.1 billion, and customers 1.25 to 11 percent more. The study also notes that it’s likely these prices would continue to increase in the future.

Plant Retirements

If TVA coal power plants are retired early because of failure to meet future carbon dioxide regulations, TVA would lose assets. For example, if 2,000 megawatts of coal is retired early, it would cause a loss of $1.4 billion over 10 years. This equates to a 1.4 percent increase in rates. These calculations are “purely hypothetical,” the report notes, “but coal plants are under various pressures and additional retirement of TVA coal plants in the next 10 years is a possibility.”

Load Reduction

If TVA’s sales decline, it’s rates will decrease. A decline in sales could come as a result of industries departing the region, customers adoption of energy efficient technologies, or adoption of distributed energy resources. For example, an 8 percent load reduction in 2028 could reduce TVA revenue by 4 percent and lead to a rate increase of 4.3 percent.

Taking these factors into account, the study concludes that by 2031 the cost of power for MLGW could increase by as much as $343 million, while rate increases for customers could increase anywhere from 9 to 34 percent.

TVA spokesperson Scott Brooks said the following in response to the report:

“Our most recent long-term financial plan, approved by the TVA Board, includes keeping rates flat over the next decade, and the proposal for 20-year agreement with local power companies also includes a reduction in the wholesale rate.

“TVA has not reviewed the report, but we are working directly with MLGW and members of the community to provide accurate information as the utility makes decisions on its relationship with TVA. We are confident that, after a thorough and accurate review, TVA is still the best option for the people of Memphis and Shelby County.”

Brooks notes that the risk factors laid out in the report are “generally part of our capital expenditures and are included in the long-term financial plan. Those costs are not necessarily passed on in rates, but often absorbed in the annual budget.

“TVA makes decisions on assets and costs, including the future of coal combustion residuals, based on potential impacts to the 10 million customers we serve.”

TVA

TVA

TVA

TVA  TVA

TVA