The Black Coalition for Housing will be hosting the 2023 Black Developers Housing Summit in Memphis on March 9-11 at the Hilton Hotel located at 939 Ridge Lake Boulevard. The theme for this year’s summit is “shifting the paradigm through equity and access.”

According to Tennessee managing director Rasheedah Jones, the Black Coalition for Housing is a national organization headquartered out of Chicago, Illinois.

Jones is a native “North Memphian” who wanted to bring this summit to her hometown after noticing inequities in the development industry.

“Memphis was the first launch city for the outreach work, as a market that needed the kind of impact that we wanted to make across this country,” said Jones.

Jones has worked in the real estate industry in various capacities for 18 years. She said that her primary focus is on community development and rehabilitation around neighborhood development that supports affordable housing models.

Memphis is the first-choice city for what is to be a five-city tour for the summit. According to Jones, there are challenges on the ground that continue to impact Black home ownership, and the inability to close the wealth gap.

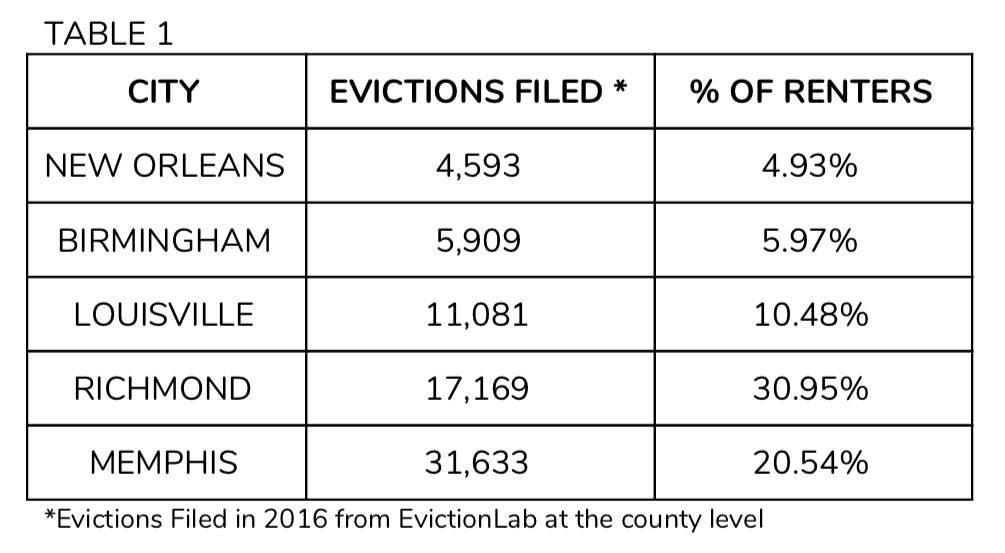

According to information compiled from the U.S. Census Bureau, as of 2022, stacker.com said that the Black homeownership gap is 30.4 percent. The Black homeownership rate for Memphis is 58.8 percent, with the white homeownership rate being 74.3 percent.

“The disparity for homeownership continues to grow here,” said Jones. “Even with the deployment of dollars, even with the deployment of opportunities, what I have continued to hear is that there is a lack of skillset for Black developers to access opportunities.”

Jones also said that there is a large housing stock crisis, and that due to the dynamic market of interest rates, people are either falling out of the ability to obtain homeownership. She also said that people are unaware that they can enter into this as a wealth-building strategy.

“It was important for me to fight that Memphis be mapped in a way that those resources, opportunities, and conversations happen here,” said Jones.

In a statement released regarding the summit, it is stated that the purpose is to “synergize Black and minority developers at every stage of their real estate development, business journey by offering collective technical support, education, and the sharing of lived experience to scale, grow, and expose others to the next level.”

Jones said that the summit will consist of “foundations of development training.” She said that they receive inquiries about where to start in development. This is in hopes of exposing the foundation of development to developers who have zero to three years of experience, in addition to students who are looking to start work in development.

There will also be overarching conversations with “mixed levels of development.” There will be a panel of seasoned developers who Jones said have impacted their respective communities with onboarding properties, which she said were not “generating tax revenue up to the millions.”

Jones also said that these conversations will be heard by organizations such as the Black Legislative Caucus of Shelby County Commission, the City of Memphis Division of Housing and Community Development, and the Downtown Memphis Commission.

“We have a huge support system where we can lean into understanding as to what they’re looking for when they’re thinking of opportunities for Black developers,” said Jones. “The goal is to empower the participants, but to also list out the concerns and challenges that exist from both sides of the coin, so that we may be able to come together on some solution.”

Toby Sells

Toby Sells

Google Maps

Google Maps

United Housing/Facebook

United Housing/Facebook

United Housing/Facebook

United Housing/Facebook