So April 15th has come and gone. Did you get a refund? Or did you have to send a check to Uncle Sam? It turns out that millions of Americans who are used to getting a refund from the IRS are having to pay up this year. That’s because of the 2017 Tax Cuts and Jobs Act, passed by a high-fiving Republican Congress and signed off on by President Trump.

So, if your taxes were cut, why are you having to pay more at tax time this year? Last summer, the Government Accounting Office issued a warning to employed taxpayers to check their withholding status, which for most wage-earners went down under the new law. The reason for the warning being that the less the government withholds from your paycheck, the more you owe at the end of the year. Hence all the surprised — and ticked off — folks who are suddenly having to pay the IRS instead of getting a check.

The bottom line is that, for most people, taxes haven’t gone up (though they will in coming years); it’s just a restructuring of how they’re collected. But the real pay-off in the Republicans’ “tax reform” went to the wealthiest Americans and big corporations, who got a trillion-and-a-half dollar tax cut. Inheritance taxes were also cut way back, and those who own stocks got a nice break, as well.

The national debt is higher than ever, and will continue grow under these cuts, but hey, all that dough will trickle down eventually, say the Republicans. And if doesn’t, well, we’ll just have to cut “entitlements,” like Medicare, Medicaid, and Social Security.

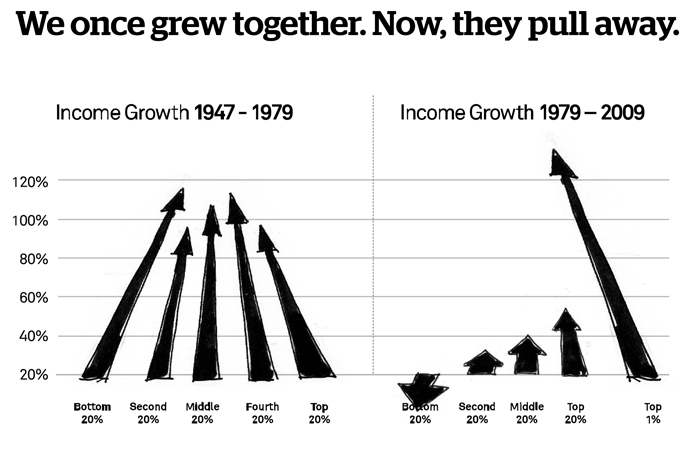

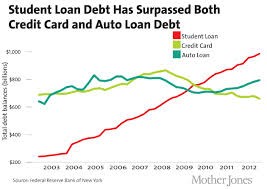

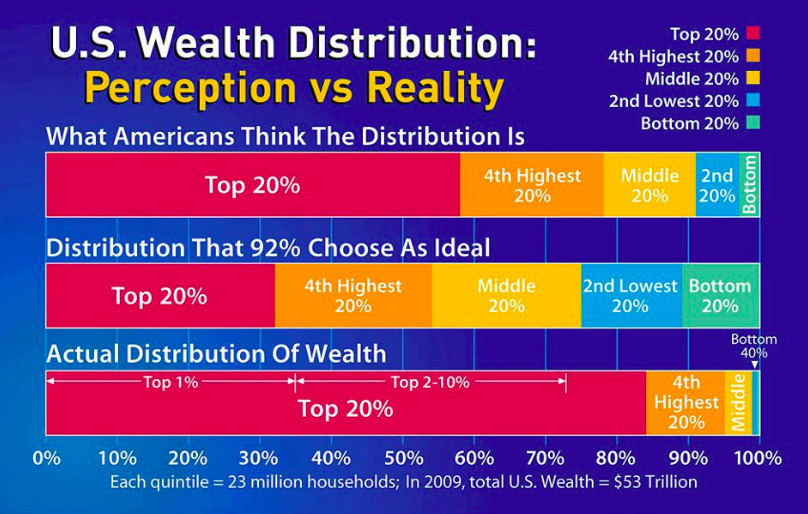

This has to stop. This GOP obeisance to a debunked Reagan-era economic policy has driven income inequality in this country to an unsustainable place. Here are a few numbers: 69 percent of Americans have less than $1,000 in savings! More than 93 percent of the stock market is owned by 20 percent of Americans (80 percent of Americans own little or no stock). Ten percent of Americans own 83 percent of the country’s wealth. The other 17 percent goes mostly to the shrinking middle class, with less than two percent owned by the bottom 40 percent of Americans. Toss in the pressures of unaffordable medical care, soaring education costs, and rent increases brought on by gentrification and it’s no wonder the American middle class is a vanishing species.

My wife and I didn’t get hit too badly, but we did have to write a four-figure check to the government. That said, we paid $1,000 and change (plus the taxes withheld from our paychecks) more than Amazon, which made $11 billion in profits in 2018 and got a one-percent refund! We also paid more in taxes than Delta Airlines, Chevron, General Motors, John Deere, Halliburton, Netflix, IBM, Goodyear, and more than 30 other major American corporations who paid no tax or got a refund from the IRS.

The top four Big Pharma companies pocketed $4 billion in tax savings. J.P. Morgan landed a sweet $3.7 billion tax cut. The list goes on and on.

The rationale for the corporate cuts was that big companies would use the savings to invest in new factories and employ more Americans. Nope. In reality, what happened was nearly $1.1 trillion in stock buybacks by America’s large corporations. They didn’t reinvest the tax dividend in the economy; they reinvested it in their own stock and gave huge raises to their corporate officers. Many of these companies actually laid off workers.

And here’s another kick in the pants: While the GOP made the tax cuts for corporations permanent, the nominal cuts they gave to most Americans are set to expire over the next eight years. By 2027, most Americans will be paying a higher percentage of their income in taxes than they are now.

We are becoming a nation of the very wealthy and the working poor. If we don’t reverse course, the American middle class will shrink to a non-factor. And if we don’t put spending money in the hands of more Americans, the economy will collapse again, just as it did in 2008 — and in 1929.

It’s not socialism to create a minimum wage that allows people to save and invest and buy cars and homes. It’s not socialism to try to ensure that all Americans have access to affordable health care so that the next medical emergency won’t send them into bankruptcy or cost them their home. It’s not socialism to tax corporations at a reasonable rate. It’s common sense. Amazon needs customers; so do all of those other corporations who pay less in taxes than you do. We’ve been trickled down on long enough. It’s time to rebuild — from the bottom up.