To leave a legacy means more than the dollars you leave in the pockets of your children. A legacy is an opportunity to love someone from the grave. It’s forever tying a memory to a smell, taste, or sound. It’s asking yourself how you want to be remembered and what your core values are — then putting those answers into action. Here are four ways to leave a legacy for those you love.

Give back to your community.

If generosity and acts of service are among your core values, consider participating in at least one volunteer activity per year with friends or family. You can take part in a fundraiser or donate your time or talent to a local nonprofit you’re passionate about. If you have an affinity for a particular cause, creating a charitable foundation can be a meaningful way to provide your loved ones with employment or board membership opportunities directly related to the cause you support. While a private foundation is certain to leave a powerful financial legacy, it also promotes collaboration, creativity, and continuity of your philanthropic vision. A foundation can be structured to operate indefinitely so that the lessons you leave to your heirs can be taught for generations to come.

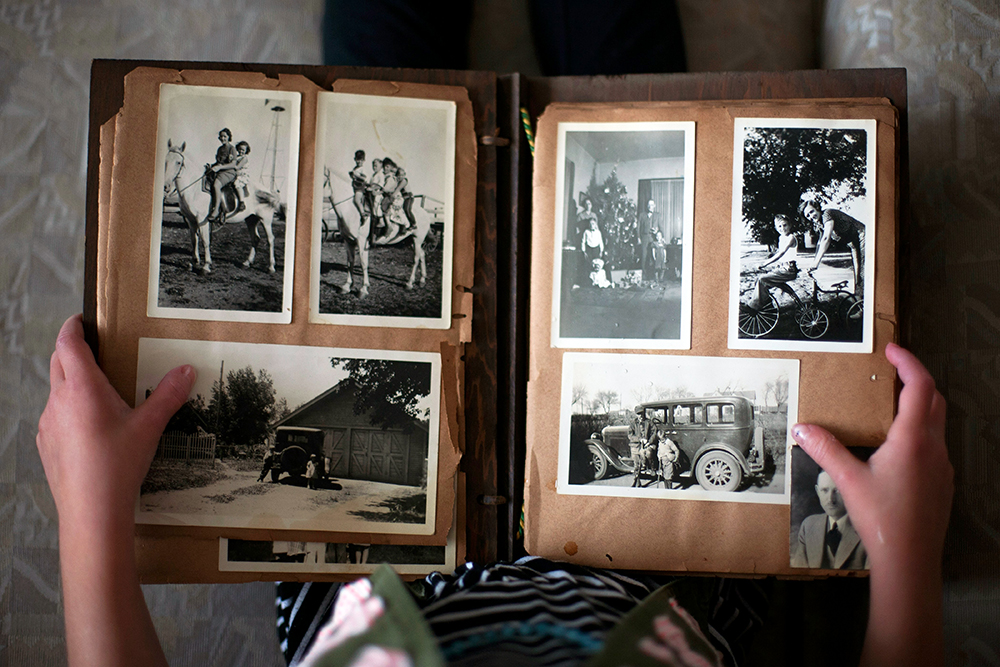

Keep a record.

Record a video message or keep a journal. When a loved one passes away, it’s common to hear sentiments such as, “I wish I could see their face or hear their voice again.” Recording a video message is an opportunity to express your love, share your life experiences and values, and offer guidance to your loved ones.

If a video feels too formal or induces stage fright, consider keeping a journal. Put it someplace you’ll see it often so that you can jot down daily observations, funny memories, random thoughts, and pieces of wisdom you want to pass along. There’s no need to copy edit or write multiple pages at once. Keeping a journal can be a low-pressure way of putting your personality to paper — a gift your loved ones will cherish when you’re gone.

Create a will and/or a trust.

The act of creating a will and/or trust gives the absence of chaos to your heirs following your death. These documents outline who will inherit your assets as well as how and by whom they’ll be distributed. Putting your wishes in writing helps to prevent disputes and legal battles among your heirs. Additionally, a trust may be able to protect your assets from creditors, reduce estate taxes, and provide financial support to your beneficiaries. A trust can also prevent your heirs from having to participate in probate, a lengthy and often expensive formal court administration processes that “proves” the legitimacy of your will after death. While far from glamorous, creating a will and/or trust is a generous and loving act of housekeeping that may spare your children from unnecessary additional suffering after your passing.

Start a family tradition.

Whether it be the dependable smell of homemade birthday cake, the sound of Frank Sinatra coming from the kitchen on Saturday mornings, or counting constellations from a tent under the open sky every summer, a tradition reinforces your family’s values and creates a sense of belonging. Establishing positive family traditions has proven to increase a child’s ability to form a strong sense of identity — an identity you have the opportunity to forever influence.

Katie Stephenson, JD, CFP, is a Private Wealth Manager and Partner with Creative Planning. Creative Planning is one of the nation’s largest registered investment advisory firms providing comprehensive wealth management services to ensure all elements of a client’s financial life are working together, including investments, taxes, estate planning, and risk management. For more information or to request a free, no-obligation consultation, visit CreativePlanning.com.