Metro Ideas Project

Metro Ideas Project

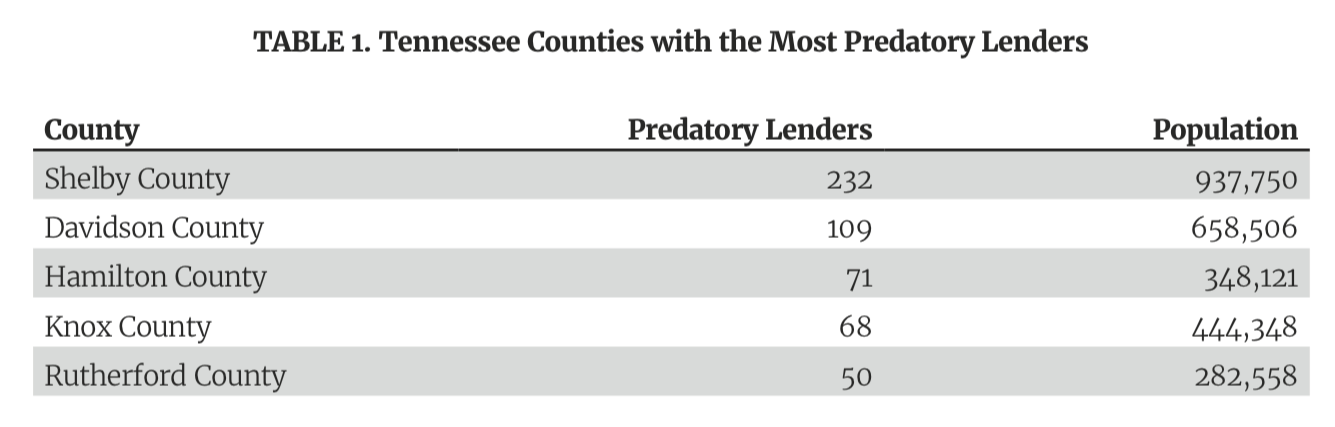

Shelby County has more payday lenders (by far) than any other county in the state, according to a new report from a Chattanooga-based think tank.

The county has 232 payday lending locations, more than double of second-ranked Davidson County (Nashville), which has 109.

Metro Ideas Project

Metro Ideas Project

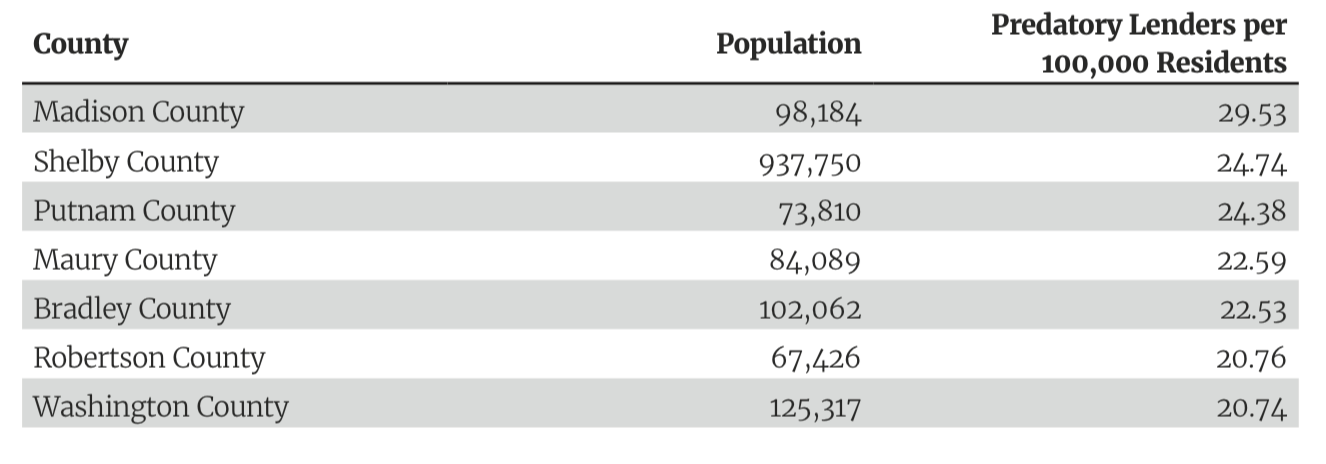

Shelby ranks second out of all Tennessee counties for the number of such lenders per capita. For every 100,000 Shelby County residents, there are nearly 25 payday lenders. Only Madison County (Jackson) beats Shelby with nearly 30 payday lenders per capita.

Metro Ideas Project

Metro Ideas Project

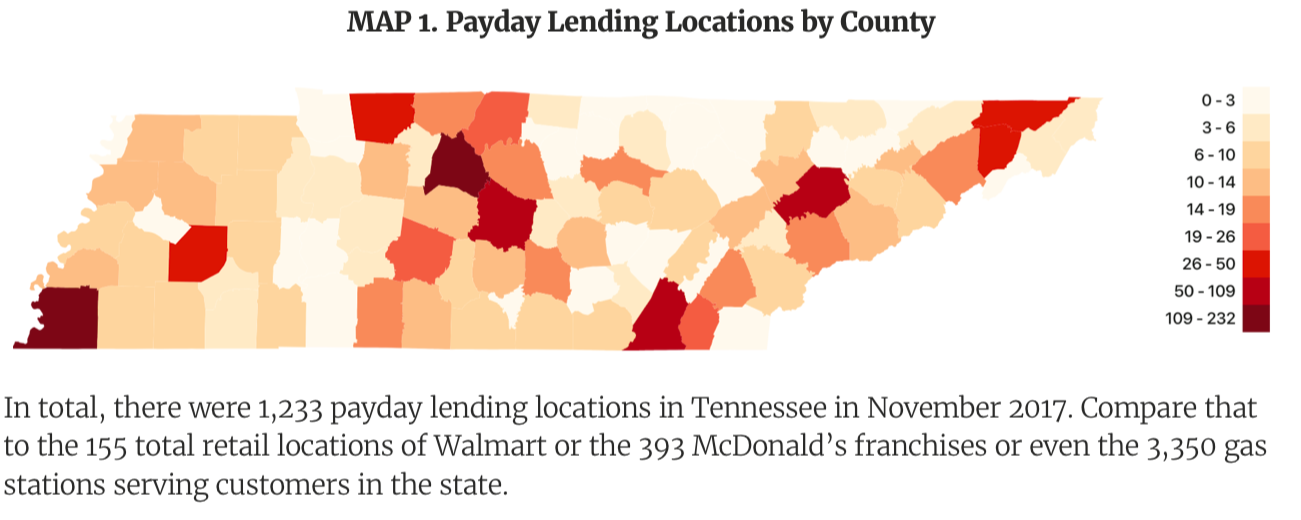

In total, there are more 1,233 payday lending locations in 89 of the state’s 95 counties.

“The high totals of predatory lender locations in Tennessee are indicative of a loose regulatory environment,” reads “Fighting Predatory Lending in Tennessee,” issued this month from the Metro Ideas Project.

The report calls these organizations “predatory lenders” and say they are most widely used by home renters, African Americans, those without a four-year college degree, and those earning less than $40,000 a year.

“And, contrary to payday lender advertising, seven in 10 borrowers use them for regular, recurring expenses as opposed to unexpected or emergency costs,” said the report.

[pullquote-1]The report said Tennessee had more payday lending locations than any other state “and that these institutions are pervasive in communities of poverty, color, and low educational attainment.”

The Metro Ideas Project said state law pre-empts local authority on the terms of the payday loans. Lenders here can charge up to 459 percent annual percentage rate (APR) on loans, for example, and city leaders cannot change that.

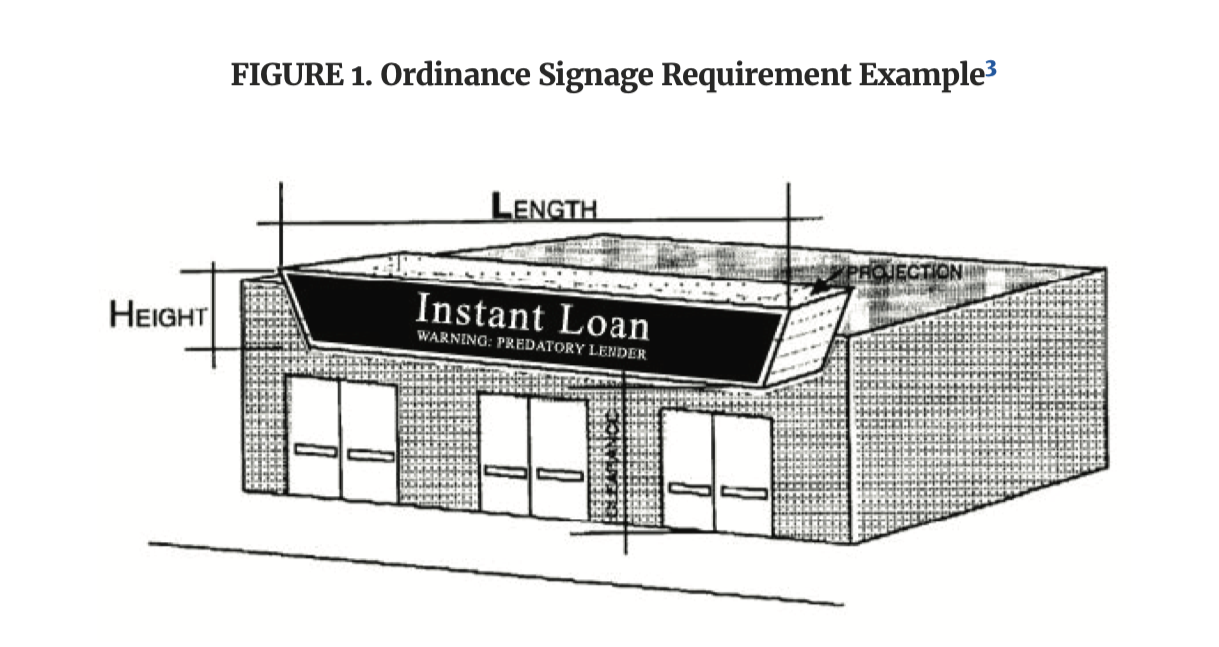

However, the group said local governments can force payday lenders to give space on all outdoor signage that reads “warning: predatory lender.”

Metro Ideas Project

Metro Ideas Project

Cities can also require such lenders to get a local permit. This would prevent the creation of clusters of lenders. However, this strategy would not affect established businesses, “limiting the usefulness of such regulation.”

Finally, the report favors establishing a nonprofit, “non-predatory” lender “for residents with poor or nonexistent credit histories.” The organizations could be established with funds from banks, credit unions, and philanthropies and would only charge interest on loans enough to manage the risk in lending to a “subprime borrower.”

Changing state law on payday lenders would be the easiest route, the report said, but that isn’t likely in Tennessee.

“The Tennessee General Assembly, however, has failed to act and instead has chosen to give away the store to the payday industry,” the report says. “To date, it seems that statewide reform of APRs, fees, or enforcement of aggregate loan limits is off the table until state legislators are willing to act.

“In lieu of state action, cities must take the issue into their own hands.”