State Senator Brian Kelsey is a sponsor of Amendment 3. Like Senator Kelsey, I am opposed to a state income tax. Unlike him, though, I am opposed to Amendment 3, which would establish a constitutional prohibition of a state income tax.

Kelsey offers a number of arguments against Tennessee adopting an income tax, and I agree with them. I think the costs outweigh the benefits, and I have reasonable fears that a new source of revenue will be a great temptation to politicians, Republican and Democrat, to spend more in order to buy our votes.

But these are policy arguments, about which reasonable people can differ. Everyone would like to have their policy preferences embedded in a constitution, but to settle a policy question by using the state Constitution to prohibit all future reconsiderations is, at best, imprudent.

We can never know the future, and we surely cannot control it.

The federal government can — and often does — impose new costs on states. It will almost surely provide less money to states as it finally begins to deal with massive annual deficits, a massive national debt, and unsustainable social programs like Medicare and Social Security.

And the federal government sends Tennessee a lot of money. Intergovernmental transfers make up 38 percent of Tennessee’s current revenue, and much of that is federal money. One large chunk of that money, for example, is for highway construction and repair. The Federal Highway Trust Fund is, however, teetering on insolvency. Something needs to give. I doubt that Congress will increase the gas tax again, and it cannot make up the difference through general revenues without increasing the national deficit and debt, which I assume the supporters of Amendment 3 would oppose, as I would.

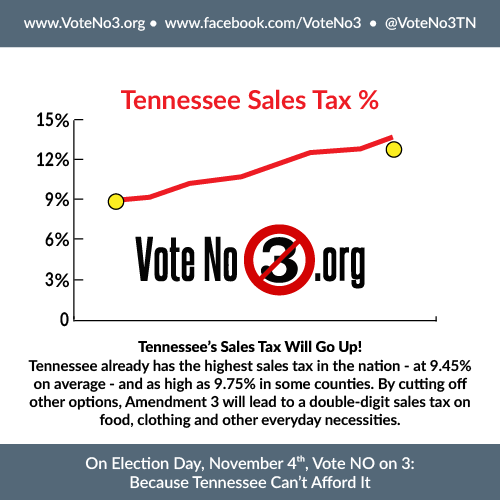

What funds will Tennessee use to cover new costs and decreasing national largesse? There is only so much that a sales tax can bear; sales taxes already produce more than 50 percent of our state’s revenue. Kelsey notes that Illinois had to increase its income tax by 67 percent. Can he know that Tennessee will not have to increase its sales tax by as much or more?

In other words, fiscal conditions, due to circumstances beyond our control, could get to the point where an income tax is actually more just — and less harmful — than the alternatives.

Again, I am not for an income tax now, but I do not know, and neither can Senator Kelsey, whether new circumstances will change these practical calculations and judgments.

Kelsey argues that the absence of an income tax attracts new residents and employers. Policy questions, however, involve many variables and considerations. Consequently, they ought to be left, as much as possible, to the legislature, which has the flexibility to adapt to changing conditions and public opinion. That is what legislatures are for.

The purpose of constitutions, on the other hand, is to establish the structure of the government that will make and implement policy decisions. A specific constitutional ban on income taxes makes the policy completely inflexible. No matter how dire the circumstances, the legislature could not even consider an income tax without first successfully removing the prohibition through the cumbersome amendment process. Kelsey is probably right when he says passing this amendment will, in effect, be banning an income tax “forever.”

Supporters of Amendment 1 argue that abortion policy ought to be determined by the elected and representative legislature, rather than by judges (interpreting the state Constitution). If a policy involving questions of individual rights should be left to the legislature, then a strictly practical matter, such as how the state raises revenue, surely ought to be.

Instead, Kelsey urges Republicans to use their democratically elected majority to deny all future democratically elected majorities the right to deliberate and legislate on the question of income taxes. Neither Republicans nor Democrats should take this astonishingly anti-democratic bait.