Bonds have had a challenging year, and many people are wondering whether to extend their average bond maturity/duration now that yields have risen. This might be tempting, but there are a few reasons that it might be best to stay the course rather than make dramatic changes in your bond allocations:

• Stocks and bonds are more correlated than ever, so if we experience another year like 2022 when stocks and bonds are down meaningfully in the same year you would probably want to have the protection of a relatively short/low duration bond portfolio. If you’re unfamiliar with the term “duration,” it essentially means the average amount of time until you get your payments for a bond. For example, bonds with longer maturity have longer duration than bonds with shorter maturities, and bonds with higher coupon payments have lower duration than bonds of similar maturity with lower coupon payments.

• We are benefiting from higher yields already. Yield calculations can be confusing and there are many different ways to look at yields, but everything comes back to the coupon payments from individual bonds or the distributions from bond mutual funds. Regardless of when you bought in, the price of the bond/fund, or whether you have a loss or gain, those payments represent the income on your bonds. These distributions are starting to creep up in many bond mutual funds and this trend is likely to continue as long as yields remain elevated. This means that even without trading in your current portfolio for longer bonds, you’ll still get exposure to those higher yields.

• In fact, the yield curve is inverted currently, meaning that longer bonds actually yield less than shorter duration bonds. While there’s more opportunity for price appreciation if you buy longer bonds, there’s also more risk if there is a downturn in the bond market, and you simply aren’t getting paid to go out long on the yield curve right now. The highest yields are in the two- to three-year range and bonds 10 years and beyond yield meaningfully less.

Looking at history, longer bonds almost always outperform shorter duration bonds, so you might be surprised that we don’t suggest a very long duration in our bond portfolios. At my firm, we believe in taking risks in stocks and keeping the risk on the bond side relatively low. In fact, we believe our bond portfolio is the security that allows for the risk we take in the stock market. It’s possible that longer bonds could dramatically outperform shorter bonds in the near term, but it’s also possible the worst isn’t over for bonds in 2022.

Nobody knows exactly what the Fed will do in the coming months or the impact those actions will have on the markets, but there is still hope. It’s remarkable that even in one of the worst years ever for bonds they still are providing support to portfolios in a year where stocks are mostly down even more. As always, we believe a measured, consistent, short- to intermediate-bond approach will probably serve you well in bad times for bonds as well as the good years that are inevitably on the horizon.

Gene Gard is Chief Investment Officer at Telarray, a Memphis-based wealth management firm that helps families navigate investment, tax, estate, and retirement decisions. Ask him your questions or schedule an objective, no-pressure portfolio review at letstalk@telarrayadvisors.com. Sign up for the next free online seminar on the Events tab at telarrayadvisors.com.

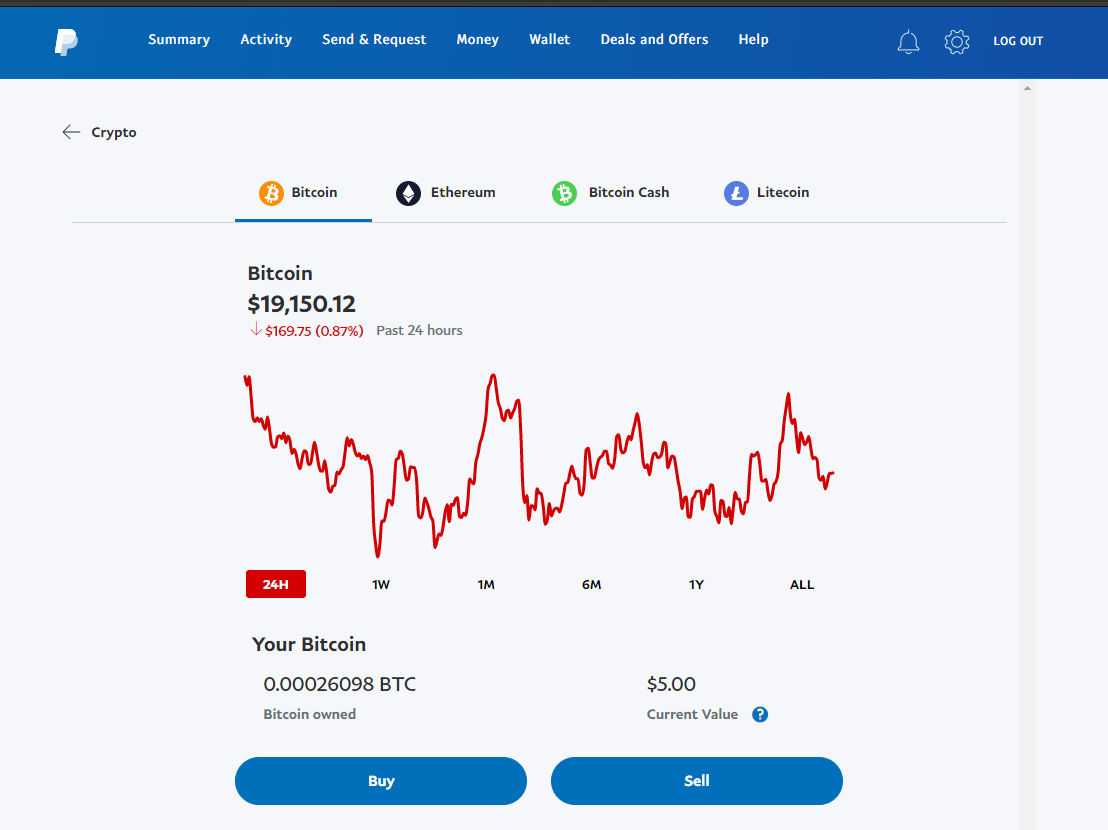

Photo by Bitcoin BCH

Photo by Bitcoin BCH