Election Day — Tuesday, November 3rd — is almost upon us! After a long, unique campaign during the COVID pandemic, Americans who exercise their right to vote are choosing a president, senators, congresspersons, and a whole host of local politicians. Let’s hope we know the results on November 4th!

How will the election impact your long-term investments? Much speculation has been bandied about how the U.S. stock market will react. Pundits on the various business television channels (and Cheddar) are gaining PR exposure by making their own predictions of coming stock market gains or losses post-Election Day. Of course, many of these prognosticators are primarily seeking attention, so the more extreme their views, the more likely their comments will be promoted and shared.

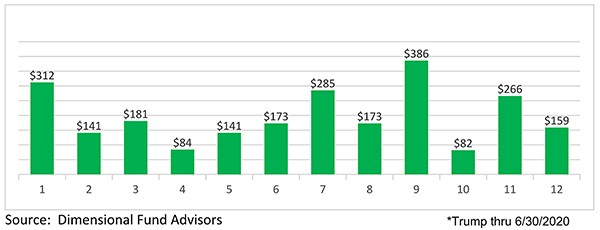

This chart quantifies how much $100 invested in the total U.S. market on the Election Day would have grown during the terms of the last 12 past presidents.

Should long-term investors worry about this chatter? Many of us have passionate opinions about our political choices, but should we act on our convictions when it comes to election-influenced short-term volatility in the stock market?

It may come as a surprise to know, according to Forbes magazine research, stock market returns for the six Democratic presidents since 1952 have averaged 10.6 percent/year versus 4.8 percent/year for seven Republican presidents.

Richard Nixon and George W. Bush really brought the Republican average down with cumulative losses of 20 percent and 40 percent, respectively. In the Nixon years, stagflation took hold — high inflation, slow growth, and high unemployment. The stock market fell 50 percent from the beginning of 1973 to two months after his resignation due to the Watergate scandal. Bush’s term started with the dot-com bust and ended with the financial crisis — the “lost decade” for the U.S. stock market.

Investors profited during the eight-year terms of Bill Clinton, Barack Obama, Dwight Eisenhower, and Ronald Reagan (from best to fourth best) as economic recoveries and expansions took hold.

Back to our question. Should long-term investors care about short-term volatility that often surrounds a presidential election? Stock markets over the long term reflect the growth and profitability of public corporations. Corporations have a long, successful history of adjusting to changing tax, regulatory, and global trade policies. This will continue to be the case for the 2020 presidential election and those to come.

Therefore, vote for the values and leadership for which you are passionate. Whatever the outcome, according to Forbes research, take comfort that the “buy and hold” investment strategy is the best policy for the long-term investor.

Carol Lee Royer, CFP, CFA, CDFA, is senior vice president and senior wealth strategist for Waddell & Associates.