JB

JB

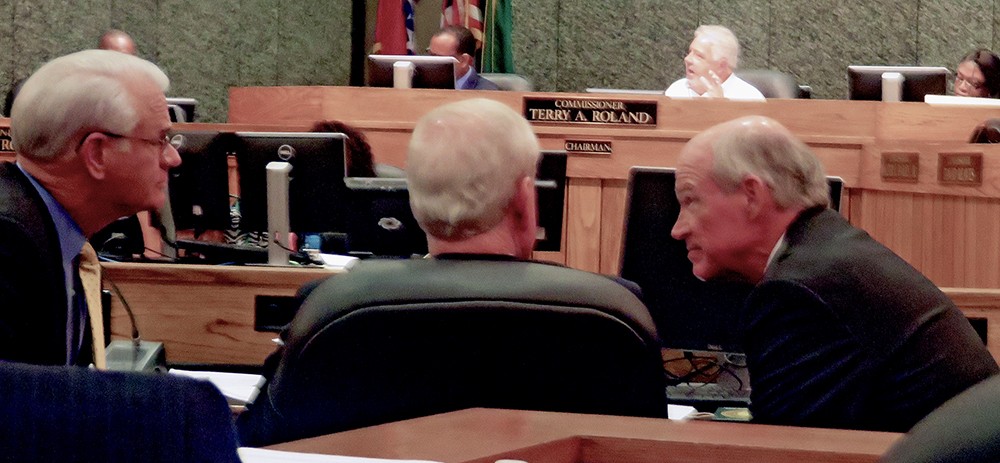

Administration figures Luttrell, Kennedy, and Swift huddle as the bargaining gets intense.

On Wednesday, the Shelby County Commission met for seven hours —nonstop except for brief “recesses” — and finally voted for a solution to the county’s budget dilemma that could probably have been arrived at within the first several minutes.

But the longer time period was doubtless necessary to iron out wrinkles and wear down some stubbornness and misgivings among the principals, both on the Commission and within the administration. The only given, as the day started, was that the persistent issue of school funding would be resolved via a $3.5 million add-on allocation to Shelby County Schools. (SCS’s total allocation is $22 million, and the county’s municipal-district schools will receive a pro-rated $6.2 millionl.)

The school-funding increase was one matter that Chairman Terry Roland (and most other participants) was insistent about. Every other possible increase was a variable in what turned out to be a $1.4 billion operating budget.

At roughly 3 p.m., the Commission resorted to a procedure that the administration of Mayor Mark Luttrell had persistently warned against and voted resoundingly to tap the county’s fund balance for $5 million to round out a budget deal that included some $13.5 million of add-on expenditures.

At various times in the proceedings, which began with committee meetings at 8 a.m. and continued with a special full-commission meeting that started at 11 a.m., Luttrell and two aides — CAO Harvey Kennedy and CFO Mike Swift — had seemingly convinced the Commission to pare down or eliminate some of the add-ons, which were earmarked for a variety of county departments, but in the end only a pair of add-on allocations were modestly trimmed.

The beneficiaries of the Commission’s largesse were Shelby County Schools ($3.5 million); the Sheriff’s Department ($3.1 million, with another $1.3 million possible down the road); Juvenile Court ($1 million); Shelby County Department of Corrections ($1 million); Regional One Health ($1 million) the District Attorney General’s office ($1,300,000); the Shelby County Election Commission ($8,216); General Sessions Criminal Court ($228,238); General Sessions Enviro

JB

JB

Commissioner Eddie Jones

nmental Court ($8,233); $169,000 for JIFF (Juvenile Intervention & Faith-based Fellowship); and $64,590 for the Commission’s own budget.

To offset these increases, the Commission availed itself of several cost-cutting remedies, some suggested by Kennedy for the administration, some of its own devising.

Among the former were a cap on life insurance payouts for county retirees, for a savings of $2 million; the inclusion of an estimated $1 million windfall addition to the county wheel tax, which will be routed exclusively to the schools for fiscal 2016-17; and a pledge from Kennedy to “find” another $1.2 million in random funds. Among the latter were a re-allocation to the fiscal 2016-17 budget of surplus Sheriff’s Department budget funds from fiscal 2015-16, and the aforementioned $5 million transfer from the fund balance.

Before the final budget formula was reached, various other alternatives were considered and discarded, including a proposal by David Reaves to eliminate blight-reduction funding so as to shift funds elsewhere; and a comprehensive amendment by Steve Basar that would have freed up several millions by re-classifying a number of pay-as-you-go capital-construction projects as debt-incurring cases.

Acceptance of Basar’s amendment, which was rejected after a recess, would have funded all the intended projects but would have left the county budget out of balance, with a need for the Commission to make later revisions in either the budget, which had to be passed by July 1, or the county tax rate, which got the second of three readings Wednesday, remaining at $4.37 per $100 of assessed value. The tax rate, which as of now balances with the budget, will get its third and final reading on July 27.

Although several of the votes along the way of Wednesday’s elongated bargaining sessions were contested, the margins of acceptance seemed to grow as the day wore on, with several commissioners accepting procedures they had earlier balked at (e.g., David Reaves on several expenditure increases he eventually accepted, or at least tolerated; and Reginald Milton on the retirees’ insurance caps).

The administration’s acceptance of the Commission’s tapping the county balance was passive and grudging, at best, with Kennedy acknowledging, “We didn’t like it, but we couldn’t stop it, and at least we managed to mitigate it.” As Heidi Shafer noted, the delving into the fund balance may have reduced the intensiveness of the county’s debt-retirement policy somewhat, but it still left it in acceptable order.

Implicit in Wednesday’s bargaining was the continuation of a power struggle

JB

JB

Commissioners Walter Bailey and David Reaves

between the Commission and the administration on matters of governance. Shafer voiced the issue during the day’s deliberations as a matter of whether the Commission’s responsibility was limited to approving a tax rate to cover the administration’s budget allocations or involved a more active license to collaborate on determining those allocations.

By definition, Wednesday’s negotiations, as well as the final outcome, resolved the issue in favor of a broader interpretation of the Commission’s mission.