One of the most fervent hopes, post the Shelby County general election of 2018, was that the siege warfare that had existed between outgoing Mayor Mark Luttrell and the Shelby County Commission would cease to be once new Mayor Lee Harris and a practically all-new set of commissioners took over the show in the Vasco Smith County Administrative Building.  Justin Fox Burks

Justin Fox Burks

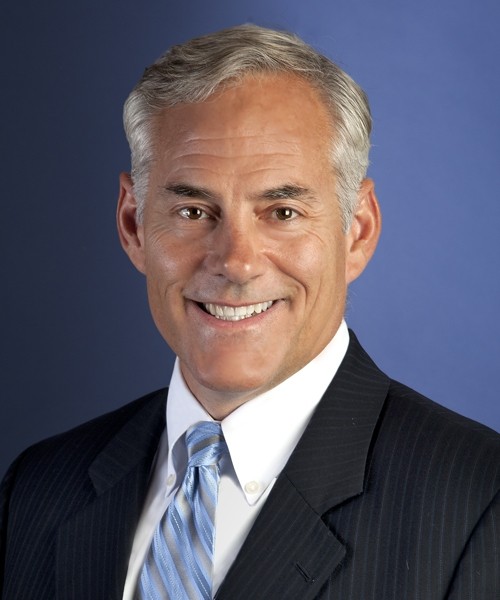

Shelby County Mayor Lee Harris

Harris made a point of declaring, early on in his administration, that he would not be at odds with his commissioners but would work with them at every turn. Making allowances for a certain bold innocence the new mayor brought to his task, it was always likely to be roughed up and sanded down by the grit and cross-purposes of others on the commission with differing agendas of their own.

Still, the mayor exuded enough zeal and progressivism in his first months — insisting on pay equities, overdue attention to criminal justice needs, and novel good health initiatives — as to earn himself a lingering honeymoon. It began to wear off when a project or two brought in from the outside, like the Downtown Memphis Commission’s Union Row project, caught him unawares and rendered passive, and when, in the eyes of a majority of commissioners, he overstepped himself by playing hardball with University of Memphis president David Rudd, threatening to veto funding for the university’s planned natatorium, unless Rudd came through on pay raises for the school’s employees.

The standoff with Rudd, though it had support here and there in the community and seemed consistent with Harris’ Captain America image, earned him an override of his veto by the commission and drastically reconfigured his in-house relationships. Henceforth, he would be increasingly — and publicly — regarded by some commissioners as a would-be future congressman biding his time in a lesser office until he could get to Washington. Indeed, at one point, he seemed virtually to concede as much.

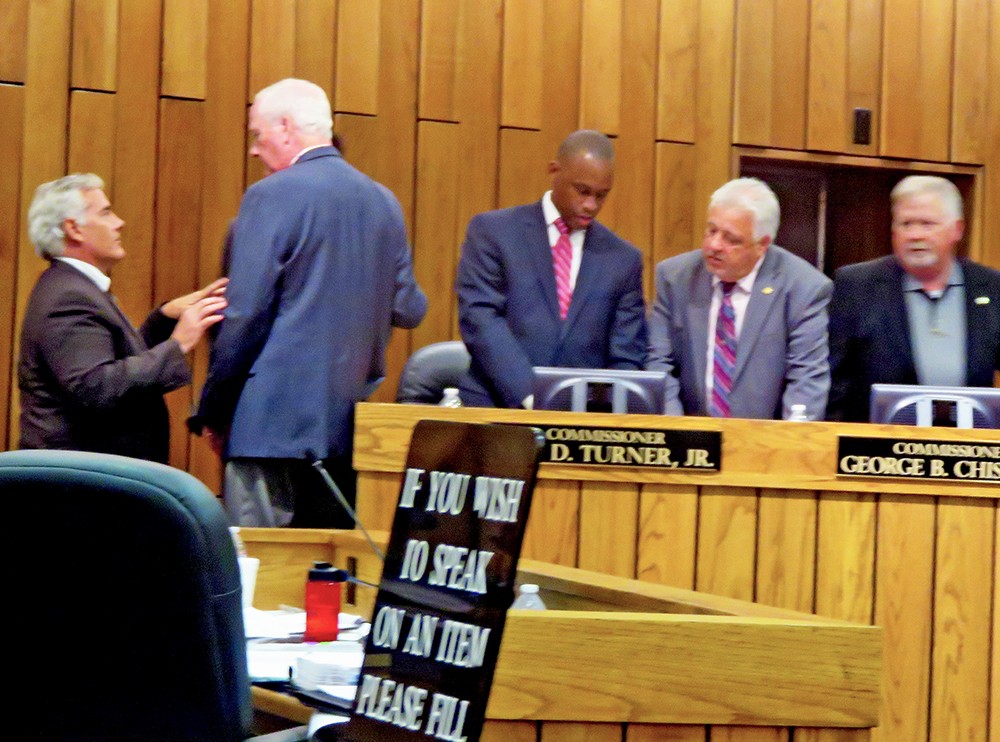

Thus it was that Harris came into his second budget season this year with some baggage. And for whatever reason, he had earned a determined adversary on the commission, Edmund Ford Jr., who’d come over from several terms on the Memphis City Council with arguably higher-office ambitions of his own.

Edmund Ford Jr.

Harris threw out his second budget, for fiscal 2020-21, with the same take-it-or-leave-it attitude as had accompanied his first, which the commission had made sure to chew on as a corrective. This year’s Harris budget, delivered in virtual form online amid the first surging of the pandemic, was characterized by the mayor as a “lean and balanced” $1.4 billion.

The Harris budget included a warmed-over version of the wheel-tax increase he’d proposed weeks earlier in another context, and involved some $13.6 million in cuts, along with increases for pre-K and school construction and for the Shelby County Sheriff’s Department, which would be taking over policing responsibility for de-annexed areas of the city of Memphis.

It was promptly disparaged by Commissioner Ford, who compared Harris’ projected plans to some adopted in 2014 by the city council on which both he and Harris served. Those financial arrangements lowered the county’s bond rating and drew the attention of the state comptroller, Ford insisted.

In weeks to come, Ford, the budget committee vice chair, and Eddie Jones, the chairman of that committee (both Democrats, like Harris) would attempt to take over the reins and fashion an alternate budget of their own. Harris was now in a difficult position, analogous to that of his predecessor. Just as Luttrell, a Republican, had been faced off consistently by two active Republican commissioners, Terry Roland and Heidi Shafer, now Harris, a Democrat, was embroiled in continuing controversy with two members of his own party, Ford and Jones.

Republican members like Mick Wright and Brandon Morrison had reordering plans of their own to offer, more or less in the interests of greater austerity, and another Republican, commission Chairman Mark Billingsley, began scheduling marathon special meetings to deal with the budget. Some of these were held online, via webinar, others were arranged at large locations, like the Peabody ballroom or the FedEx Events Center at Shelby Farms.

All these meetings have been lengthy and wearing, and they all have resembled, installment by installment and collectively, a kind of Blair Witch Project, a desperate search for a way out of a lost and forbidding wilderness that ever, inevitably, leaves the participants, anguished hours later, right back at their starting point.

From time to time, Harris himself has intervened in the commission’s deliberations in a vain effort to offer guidance, more often so has county CAO Dwan Gilliom, but the administration’s real warrior has been the normally self-contained County Financial Officer Mathilde Crosby, whose duty it has been to spar with Jones/Ford and try to maintain such administrative priorities as she can against the revisionist mathematics of the budget duo.

Meanwhile, Mayor Harris has been releasing periodic broadsides taking the commission to task. The most recent one came on Monday, June 15th, even as commissioners were girding for the latest specially called budget webinar.

“Unfortunately,” wrote Harris, “the commission has taken a buzz saw to the county’s budget, cutting vital programs, and putting jobs at risk.” He predicted looming layoffs and irrevocable damage to “Homeland Security, the Health Department, Juvenile Court, the Office of the Public Defender, Finance, Human Resources, County Attorney, Information Technology Services, and our Low-Income Commodities Food Program, among others.”

Previous broadsides by the mayor asserted such declarations as, “Unfortunately … the Shelby County Commission has voted to approve several budget cuts that will put in jeopardy our ability to meet our community’s need,” and “dozens of Shelby County employees could see their jobs vanish amid the current public health emergency. This is the wrong approach and the wrong time to put jobs in jeopardy.”

Keeping to the theme, CFO Crosby has consistently maintained that most of the reductions proposed by Jones/Ford, who have effectively become the commission’s official scalpel, are taken at the expense of administrative personnel and projects.

Before Monday’s meeting, it had seemed that the commission, by diligent scrutiny and trimming among the weeds of county finance, had come to within $5,7435,00 of balancing the budget. The state Senate, closing out the state government’s budget in Nashville, had meanwhile liberated some $200 million of previously allocated infrastructure aid to localities, eliminating restrictions on the money’s use.

The state’s action potentially freed up Shelby County’s share, $7.7 million — enough to balance the budget. That fact would be duly considered on Monday by the commission, but only after yet another lengthy wrangle between Jones/Ford and Crosby over a new configuration presented by Jones.

Ultimately the commission would once again suspend its work on the budget. Before adjourning on Monday, however, it voted, by the minimum seven votes necessary, to deposit the $7.7 million manna from the state, when and if it is delivered after July 1st, into the county’s fund balance, which is due to be tapped significantly in any possible venture to balance the budget.

Even that engenders controversy, however, in that the commission, led by Democrats Van Turner and Reginald Milton, are determined to find money in the budget for rehabilitating The Med (aka Regional One Health). The commission’s previous allocation of $5.4 million for the purpose was vetoed by Harris, who wishes to use the money for construction of his proposed new Juvenile Justice Center.

Turner indicated Monday that the commission will attempt to recover that funding for The Med via an override vote. And the $7.7 million due from the state, originally earmarked for the Juvenile Justice Center, may well be sliced up, ultimately divided into several parts for several purposes.

The commission will have met in committee on Wednesday, June 17th, before what may well be its climactic meeting on the budget, next Monday, June 22nd.

JB

JB  JB

JB