When planning for retirement, people often focus on how much money they need to save, when they’ll retire, and how to spend their free time. An often-overlooked retirement planning consideration is where to retire — and the decision can have a significant impact on your finances. Here are some factors to consider when deciding where to retire:

• Income tax implications

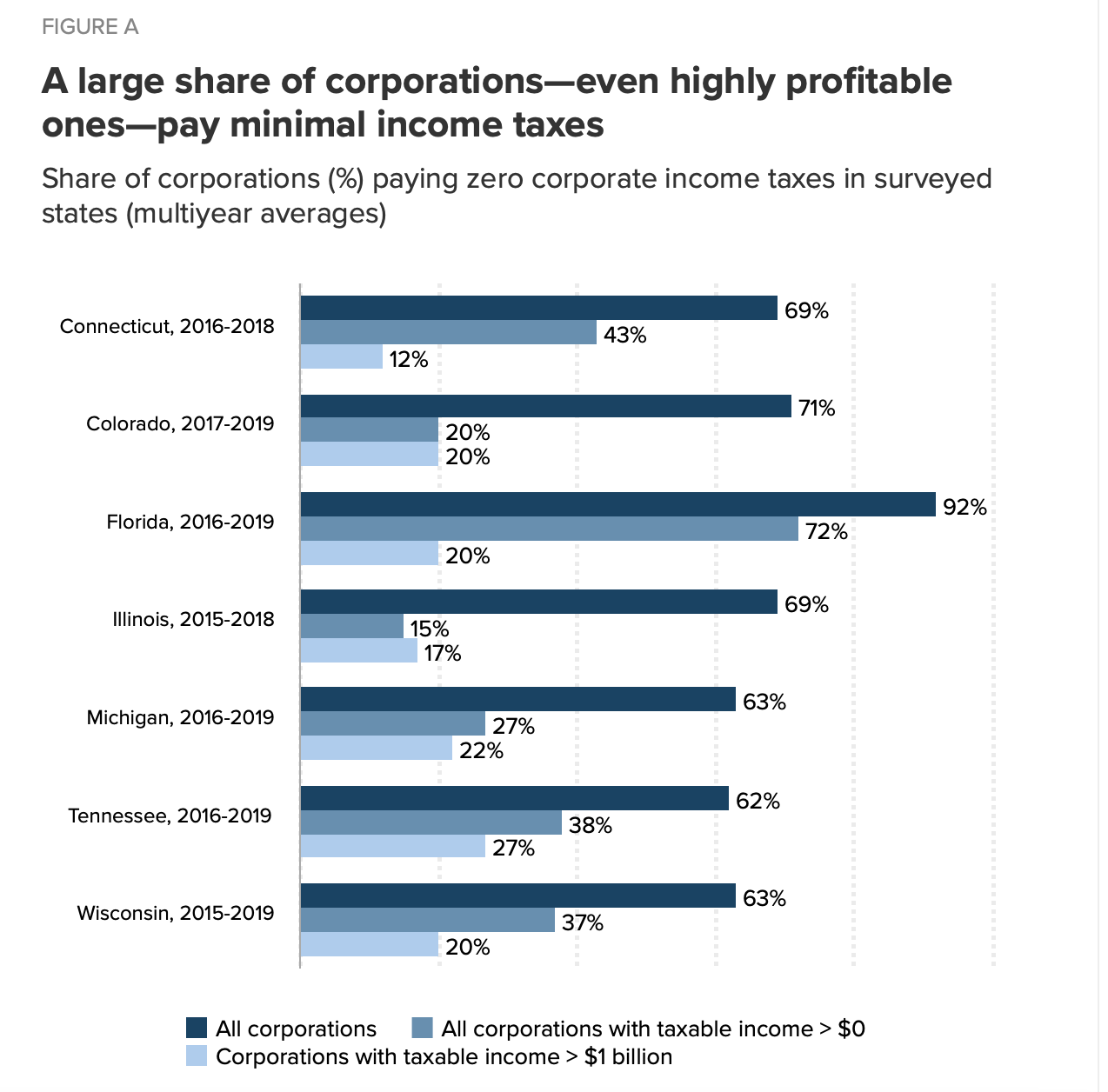

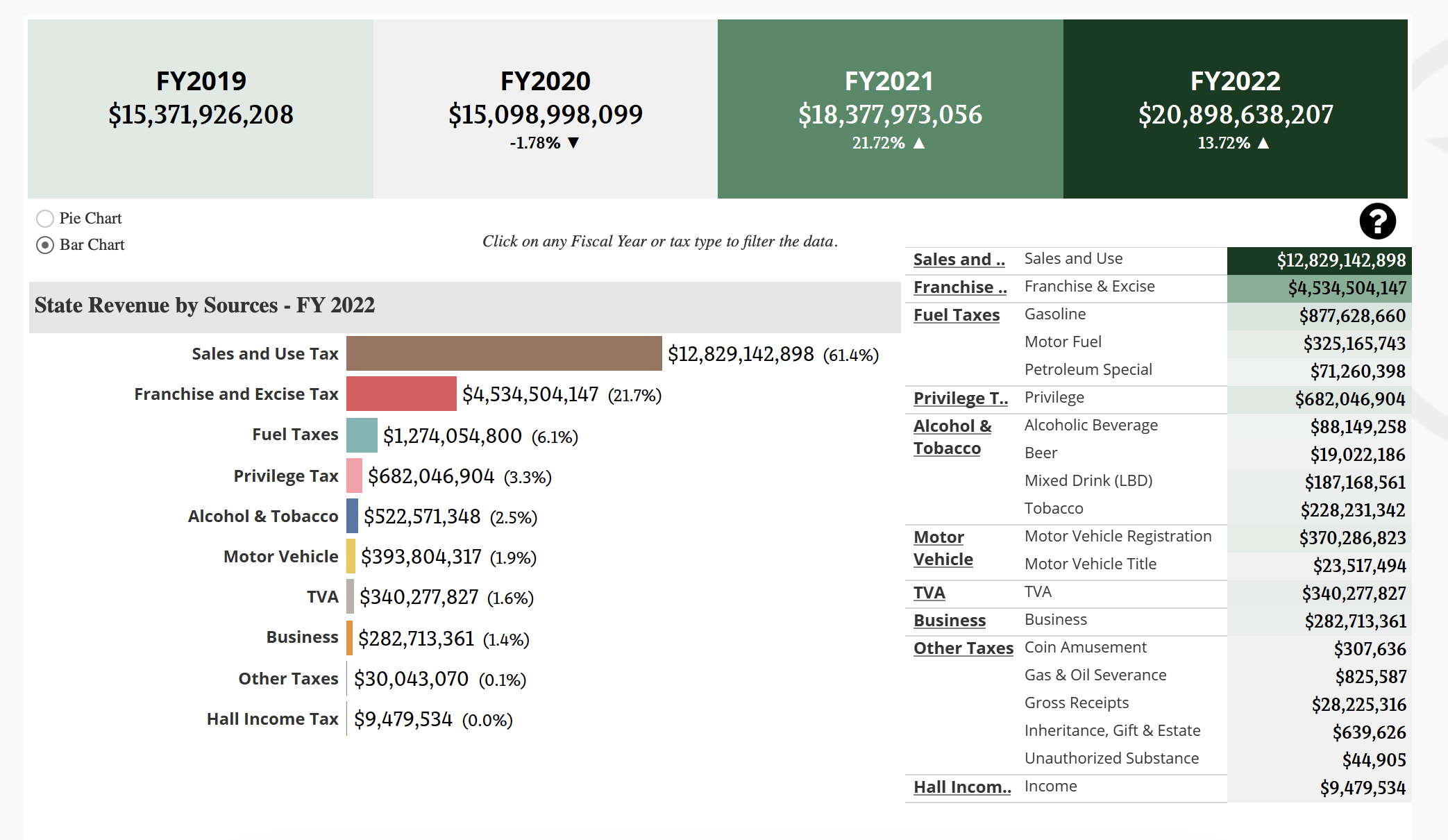

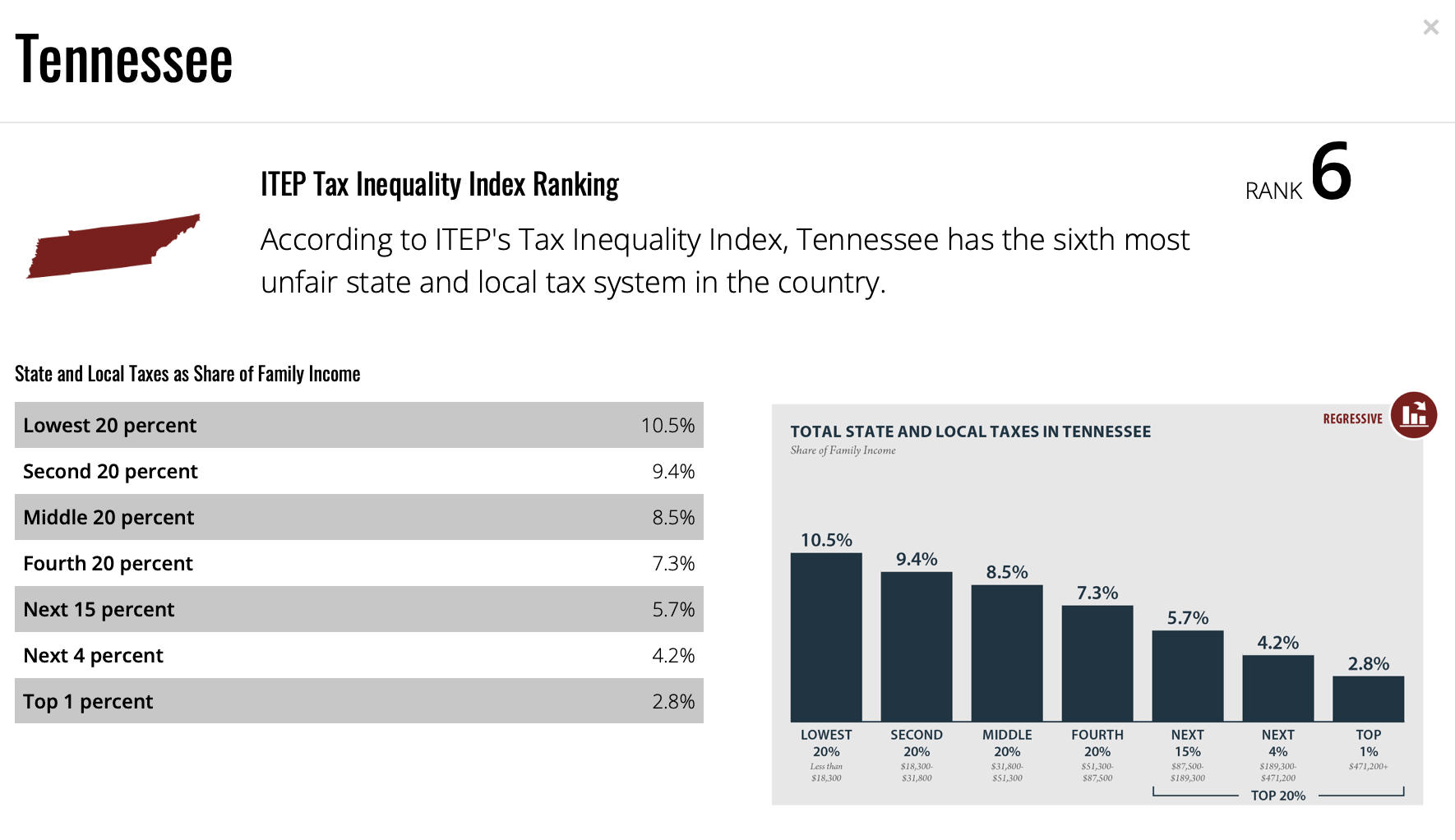

Let’s go ahead and start with the elephant in the room. Sadly, even after you finish working, you’ll still owe taxes. Taxes can have a significant impact on your retirement, and different states have different tax rates for retirement income. Some states have more favorable tax policies than others, which can allow retirees to keep more of their retirement income. In addition, some states don’t tax Social Security benefits or other types of retirement income, which can help you further maximize your retirement savings.

• Retirement income

Social Security benefits — While most states don’t tax Social Security benefits, there are a few states that impose some form of taxes on them. Regardless of where in the U.S. you live, up to 85 percent of your Social Security income may be subject to federal income tax.

Retirement plan distributions — Many people hold most of their retirement savings in tax-deferred accounts, such as IRAs and 401(k)s. While these vehicles provide a great way to save in a tax-deferred manner, retirement distributions from these types of accounts are subject to ordinary income tax at the federal level. However, some states don’t tax retirement plan distributions, which can help you maximize your funds available for retirement.

Pension income — Some states differentiate between public and private pensions and may tax only public pensions. Other states tax both, while some states tax neither. Again, the amount of state tax you pay on this retirement income source can have a big impact on your lifestyle.

• Estate taxes

In 2025, the federal government allows individuals to pass on up to $13,990,000 without any federal estate tax ($27,980,000 for married couples filing jointly). However, depending on where you live, you may need to pay state estate taxes. It’s important to understand the estate tax requirements of your current state as you’re planning your legacy, especially since some states’ estate tax limits may be lower than you would expect.

• Capital gains

Long-term capital gains are taxed by the federal government at more favorable rates than ordinary income. However, this is often not the case for states that charge state income tax. Many states don’t differentiate between earned income and capital gains, which means depending on the state in which you live, you may have significant tax liabilities on investment income.

• Cost of living

Cost of living can differ widely between various cities and states, making it essential to choose a retirement location you can afford. Some cities have a much lower cost of living than others, which allows you to do more with your retirement savings. By choosing a location with a lower cost of living, you may be able to afford a larger home, travel more often, or pursue hobbies and interests that may be out of reach if you were paying more for daily living expenses.

• Healthcare costs

When choosing where to retire, it’s important to find a location that offers access to high-quality healthcare facilities. Having convenient access to healthcare can help keep your costs down.

• Housing costs

Housing costs can vary widely between different cities and states, which is why it’s important to choose a retirement location that aligns with your housing budget. It’s also important to consider what property taxes you’ll be responsible for paying, as these too can vary widely.

As you begin planning for your retirement, keep in mind it’s important to understand how where you live can impact your retirement finances. This knowledge allows you to choose a location that fits within your retirement budget and can help you live the lifestyle you want.

Katie Stephenson, JD, CFP, is a Private Wealth Manager and Partner with Creative Planning. Creative Planning is one of the nation’s largest registered investment advisory firms providing comprehensive wealth management services to ensure all elements of a client’s financial life are working together, including investments, taxes, estate planning, and risk management. For more information or to request a free, no-obligation consultation, visit CreativePlanning.com.